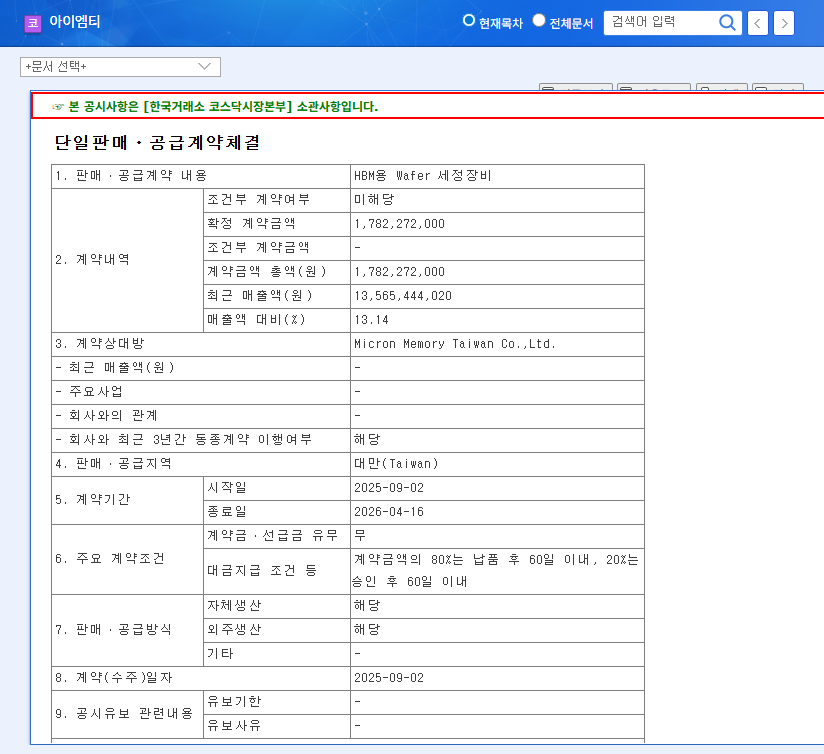

IMT Lands $1.8 Billion HBM Equipment Deal with Micron

On September 3, 2025, IMT announced a $1.8 billion contract with Micron Memory Taiwan Co.,Ltd. to supply HBM wafer cleaning equipment. The contract extends until April 16, 2026, representing 13.14% of IMT’s recent revenue.

Implications of the Deal: Riding the HBM Wave?

This contract holds significant implications for IMT, aligning with the growing HBM market. Increased HBM demand is expected to positively impact IMT’s performance. Their advanced technological capabilities in supplying crucial HBM manufacturing equipment position IMT for potential future growth.

Investment Considerations: Financial Health and Profitability

Despite the positive outlook, investors should consider certain factors. IMT is currently experiencing operating losses and requires financial restructuring. Their high dependence on specific clients and the competitive landscape of the semiconductor equipment market should also be taken into account. Closely monitoring IMT’s profitability and financial health following this contract is crucial.

Action Plan for Investors

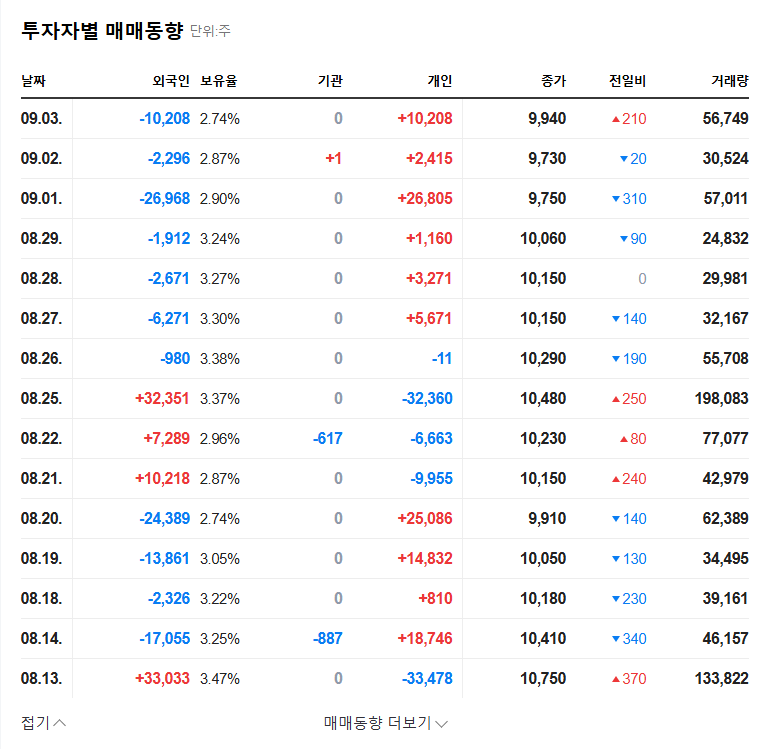

- Monitor Contract Implementation and Revenue Recognition: Tracking the contract’s progress and revenue recognition timing is essential to assess its tangible impact.

- Watch for Additional Contracts: Securing further contracts with clients beyond Micron would significantly solidify IMT’s growth trajectory.

- Analyze Financial Statements: Review upcoming financial statements to evaluate improvements in operating profit, debt ratios, and overall financial health.

This contract signals IMT’s growth potential. However, a thorough assessment of their financial standing and the competitive market is crucial before making investment decisions.

Frequently Asked Questions (FAQ)

What is HBM?

HBM (High Bandwidth Memory) is used in high-performance computing requiring high data throughput.

How will this contract affect IMT’s stock price?

It may provide a short-term boost, but long-term impact depends on profitability improvements.

What is IMT’s core business?

IMT develops, manufactures, and sells cleaning equipment used in various industries like semiconductors, displays, and secondary batteries.