Kolon Investment Divests Neurophet Shares: What Happened?

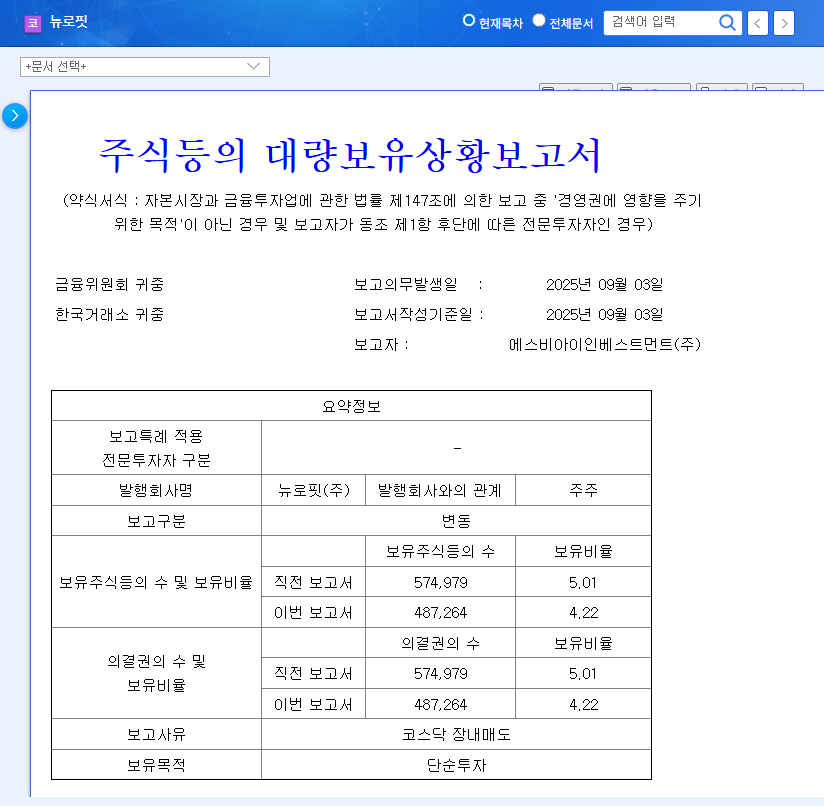

On September 4, 2025, Kolon Investment, a major shareholder of Neurophet, sold 183,085 shares on the market. This reduced Kolon Investment’s stake in Neurophet from 5.36% to 3.58%.

Divestment Background and Short-Term Impact Analysis: Why the Sale?

Kolon Investment stated that the sale was for simple investment purposes. They clarified that there was no intention to participate in management or change the purpose of their holdings. However, the divestment by a major shareholder can put downward pressure on the stock price in the short term. This is especially true for Neurophet, whose stock price has been rising since its recent IPO.

Long-Term Outlook and Investment Strategy: What’s Next?

It is unlikely that this divestment will directly impact the company’s fundamentals. It can be interpreted as a typical process of investment recovery for a financial investor (FI). The key is Neurophet’s long-term growth potential. The brain disease AI solution market has high growth potential, and Neurophet possesses unique technology and patents.

Investor Action Plan

- Monitor short-term stock volatility: Stock volatility may increase as the market absorbs the sold shares.

- Reaffirm company fundamentals: Carefully review the continued operating losses and capital impairment status. However, the capital impairment is expected to be resolved with the IPO funds.

- Monitor IPO fund utilization and performance: Check whether the raised funds are being used efficiently for R&D and business expansion, and whether this translates into increased sales and improved profitability. The performance of new solutions like Neurophet AQUA AD is particularly crucial.

- Focus on long-term growth potential: It’s important to base investment decisions on long-term growth potential rather than short-term stock fluctuations.

- Monitor other shareholders for potential sales: Consider the possibility of further divestments by other shareholders when making investment decisions.

FAQ

Is Kolon Investment’s divestment a negative signal for Neurophet’s future?

While it might put downward pressure on the stock price in the short term, it’s not expected to significantly impact the company’s fundamentals. It can be seen as a standard investment recovery process for a financial investor. It’s crucial to evaluate the company’s long-term growth potential.

Should I invest in Neurophet?

Investment decisions should be made by considering the growth potential of the brain disease AI solution market, Neurophet’s technology, and the company’s plans for utilizing the IPO funds. It’s important to focus on long-term growth prospects rather than short-term stock fluctuations, and to keep in mind that investments always carry risk.

What is Neurophet’s financial status?

Currently, the company is experiencing operating losses and capital impairment, but the capital impairment is expected to be resolved with the funds raised through the IPO. Investors should closely monitor the company’s future profitability.