The market is closely watching TY Holdings Co., Ltd. (363280) following its decisive move to participate in a major capital increase for its subsidiary, Taeyoung Engineering & Construction. This strategic financial injection is a cornerstone of the ongoing Taeyoung E&C workout program, signaling a critical effort to stabilize the construction giant and, by extension, the entire TY Holdings group. This analysis explores the nuances of the TY Holdings capital increase, its potential effects on group fundamentals, and the outlook for the TY Holdings stock price.

The Core Details of the Capital Increase

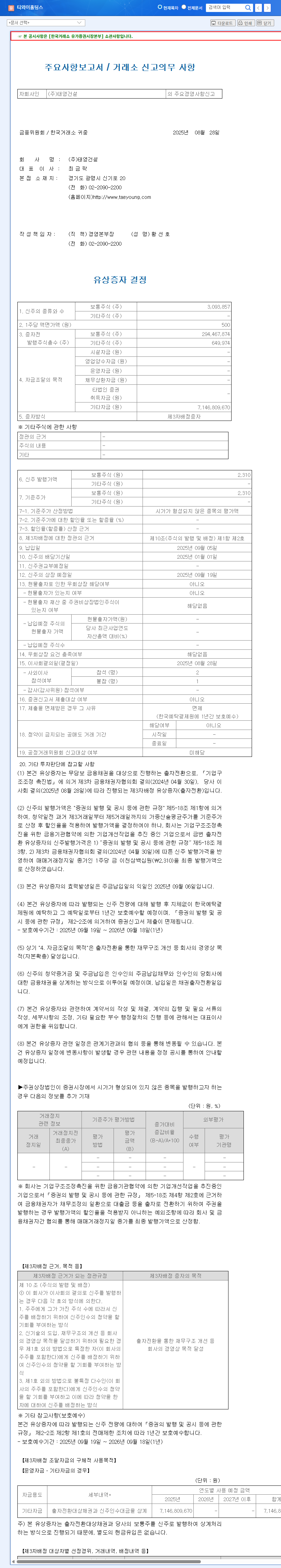

According to an official disclosure filed on October 28, 2025, TY Holdings has committed to a significant capital injection into Taeyoung E&C. This move is not just a line item on a balance sheet; it’s a foundational step in Taeyoung E&C’s restructuring journey. You can view the Official Disclosure (Source) for complete details. The key figures are as follows:

- •Shares Acquired: 28,347 common shares of Taeyoung E&C.

- •Investment Amount: Approximately 65.5 billion KRW (approx. $65.5 million USD) at 2,310 KRW per share.

- •Participants: 28 investors from the 68th public corporate bond offering.

- •Key Dates: Payment on November 5, 2025, with shares listed on November 21, 2025.

Strategic Rationale: Why Now?

The primary motivation for this capital increase is to fortify Taeyoung E&C’s financial structure and sharpen its competitive edge. Since applying for a corporate workout in December 2023, Taeyoung E&C has been navigating a turbulent economic landscape. The construction industry faces a perfect storm of rising material costs, persistent high-interest rates, and a cooling real estate market, as documented by sources like global economic reports. For a company in workout, securing this funding is paramount for survival and future growth, providing essential capital for debt service, operational stability, and pursuing new projects.

This capital injection is less a simple bailout and more a strategic pivot to de-risk the parent company and stabilize the entire group’s long-term financial health, demonstrating a firm commitment to the Taeyoung E&C workout plan.

Impact on TY Holdings’ Financials and Stock Price

Potential Upsides for Investors

The successful execution of the TY Holdings capital increase could trigger a cascade of positive outcomes:

- •Improved Group Financials: As Taeyoung E&C’s debt ratios fall and liquidity improves, it positively impacts TY Holdings’ consolidated financial statements, bolstering overall stability.

- •Enhanced Corporate Value: The normalization of its key subsidiary is expected to increase Taeyoung E&C’s enterprise value, directly boosting the investment value for TY Holdings as the parent entity.

- •Restored Market Confidence: Proactive steps toward financial health fulfill market expectations and can help rebuild trust among investors and creditors for both companies.

Key Risks and Considerations

Despite the positive intent, investors must remain aware of the inherent risks:

- •Short-Term Financial Burden: The 65.5 billion KRW is a significant cash outflow. If Taeyoung E&C’s recovery falters, it could become a drag on TY Holdings’ resources.

- •Macroeconomic Headwinds: The broader construction market’s health is a major dependency. Ongoing stagnation or further rate hikes could hinder Taeyoung E&C’s normalization efforts.

- •Uncertain ROI Timeline: The timing and magnitude of a return on this investment are tied to Taeyoung E&C’s future performance, which remains uncertain.

Investor Outlook & Strategic Recommendations

Overall, this capital increase is a necessary and strategic move to ensure long-term value creation. For investors, the focus now shifts to monitoring execution and key performance indicators. For those new to this type of event, it may be helpful to read our guide on Understanding Corporate Workouts in Korea.

In the short term, the TY Holdings stock price may see some volatility as the market digests the cash outflow against the long-term benefits. A significant, immediate rally is unlikely given industry-wide uncertainty. However, the mid-to-long-term outlook is more constructive. If Taeyoung E&C’s workout progresses successfully, TY Holdings’ corporate value is positioned for substantial growth.

Investors should demand transparency on the use of funds, scrutinize TY Holdings’ risk management strategies against market volatility, and look for clear plans to generate synergy once Taeyoung E&C has stabilized. While this event is a positive signal, a cautious and informed approach is essential as the recovery story unfolds.