What Happened? Changes in GI Innovation’s Special Relationship Shareholder Stakes

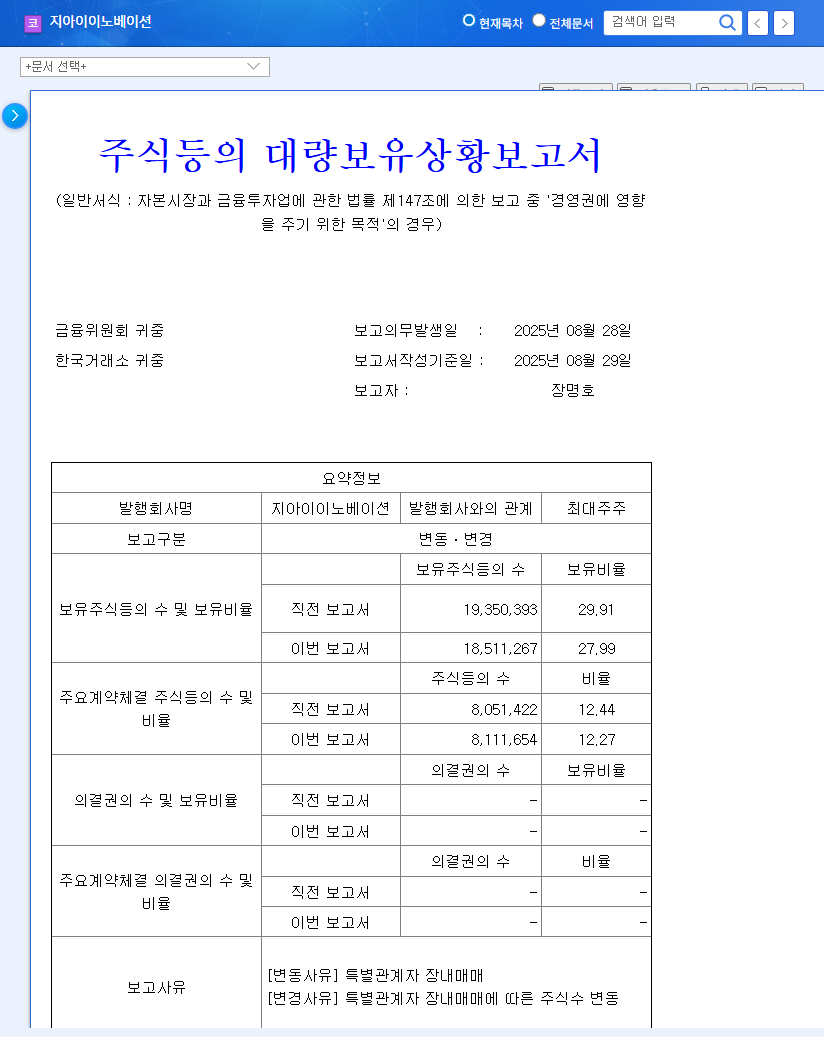

According to the ‘Report on the Status of Large-volume Holdings of Stocks, etc.’ released on September 4, 2025, the stake held by CEO Myung-Ho Jang and other special relationship shareholders decreased from 29.91% to 27.99%. DS Asset Management, Anda Asset Management, and others reduced their stakes through market sales, while Brain Asset Management’s stake changed due to the dissolution of a special relationship related to convertible preferred stock.

Why Are These Changes Important?

Changes in special relationship shareholder stakes can impact market confidence in a company’s management stability and future direction. While this stake decrease may put short-term pressure on the stock price, the remaining stake is sufficient for maintaining management control.

So, What Does the Future Hold for GI Innovation?

Positive Factors: A robust R&D pipeline, successful technology transfers, and improved financial structure underpin GI Innovation’s long-term growth potential. Diverse pipelines, including immuno-oncology drugs (GI-101/GI-102), allergy treatments (GI-301), and metabolic immuno-oncology drugs (GI-108), will serve as future growth drivers.

Negative Factors: The sale of shares by special relationship shareholders may cause short-term stock price volatility. The inherent high failure rate of new drug development, financial burden from continuous R&D investment, and intensifying market competition are also risk factors to consider.

What Should Investors Do? Action Plan

- Monitor Pipeline Clinical Trial Results: Clinical trial results significantly impact stock prices, requiring continuous attention.

- Check for New Technology Transfer Agreements: Additional technology transfer agreements are a crucial indicator of the company’s growth potential.

- Understand Funding Plans: Investors should assess the company’s funding plans and execution capabilities for R&D investments.

- Observe Shareholder Movement Trends: Changes in major shareholder stakes can influence market sentiment.

- Consider Macroeconomic Factors: Interest rates, exchange rates, and bio-industry trends should be factored into investment decisions.

GI Innovation holds high growth potential, but investment always carries risk. Consider the action plan above to make informed investment decisions.

FAQ

What are GI Innovation’s main pipelines?

GI Innovation has a diverse pipeline including immuno-oncology drugs (GI-101/GI-102), allergy treatments (GI-301), and metabolic immuno-oncology drugs (GI-108).

How do special relationship shareholder changes affect the stock price?

In the short term, it can act as selling pressure, leading to a decline in stock price. However, the long-term impact depends on the company’s fundamentals and future outlook.

What should investors be aware of when investing in GI Innovation?

Investors should consider the high failure rate of new drug development, the financial burden from continuous R&D investment, and intensifying market competition. It’s also crucial to monitor clinical trial results, technology transfer agreements, and funding plans.