The latest HYBE Q3 earnings report for 2025 has sent shockwaves through the investment community. While the K-POP powerhouse maintained impressive top-line revenue growth, the reveal of a massive operating and net loss has raised serious red flags. This unexpected deficit signals potential foundational cracks, forcing a critical re-evaluation of the company’s trajectory and HYBE stock valuation.

This comprehensive analysis delves into the deteriorating HYBE financial performance, exploring the root causes of the Q3 deficit and its profound implications for corporate value and future investment strategies. For any investor seeking to understand HYBE’s current standing beyond the surface-level numbers, this article provides essential insights.

HYBE Q3 2025 Performance: The Alarming Financials

According to the preliminary earnings disclosed on November 10, 2025, HYBE’s results significantly missed market consensus on profitability. While revenue grew to 727.2 billion KRW, a 37.8% increase year-over-year, the bottom line told a starkly different story. The transition to a deficit of this magnitude is unprecedented in the company’s recent history.

Key Q3 2025 Figures:

• Revenue: 727.2 billion KRW (Exceeded Forecast)

• Operating Profit: -42.2 billion KRW (Forecast was +36.5 billion KRW)

• Net Profit: -50.3 billion KRW (Forecast was +16.6 billion KRW)

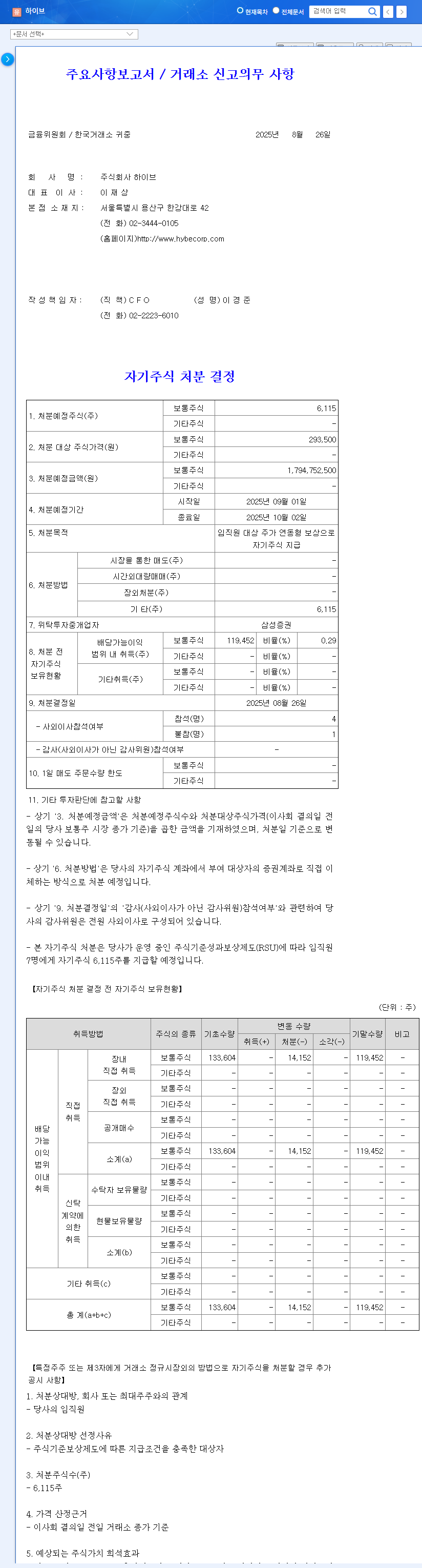

This sharp reversal from profitability to a significant loss, despite strong revenue, points to severe underlying issues with cost management and operational efficiency. You can view the complete filing in the Official Disclosure on DART.

Analyzing the Massive Deficit: Where Did the Money Go?

The operating loss of 42.2 billion KRW suggests a fundamental breakdown in HYBE’s financial structure. The trend of worsening profitability seen in the first half of 2025 has not only continued but has accelerated dramatically. Several factors are likely at play.

1. Escalating Costs and Business Underperformance

The most probable cause is an explosion in cost of goods sold (COGS) or selling, general, and administrative (SG&A) expenses that outpaced revenue growth. This could be due to:

- •Core Segment Slump: Potential underperformance in high-margin areas like album sales, digital music, and concerts. Artist hiatuses or less successful global tours could have a disproportionate impact on the bottom line.

- •Platform Profitability Lag: The Weverse platform may be expanding its user base but failing to translate that growth into profit, instead incurring higher operational and development costs.

- •New Venture Investments: Aggressive investments in new technologies, M&A activities, and future growth drivers may be front-loaded with heavy costs while contributing minimal revenue in the short term, creating a significant HYBE deficit.

2. Macroeconomic Pressures

The global economic climate cannot be ignored. While a weaker Korean Won can help overseas revenue figures, other factors create significant headwinds. High interest rates increase the cost of borrowing for expansion, while rising oil prices and logistical challenges inflate shipping and production costs for merchandise, a key revenue stream. For a broader market context, expert analysis from platforms like Bloomberg can provide valuable perspective.

Implications for HYBE Stock and Investors

This HYBE Q3 earnings report is a critical inflection point. The massive miss on profitability will almost certainly erode investor confidence and trigger a negative reaction in the HYBE stock price in the immediate term. The results expose potential structural weaknesses that were previously masked by rapid growth.

- •Erosion of Trust: Such a significant deviation from market expectations damages management’s credibility and raises questions about financial forecasting and control.

- •Artist Dependency Risk: The report magnifies the risks associated with a business model heavily reliant on a few key artists. Any disruption to their activities can have a severe impact on the entire company’s profitability.

- •Re-evaluation of Strategy: Investors will now demand a clear and transparent plan from HYBE’s leadership on how they intend to restore profitability and ensure their expansion strategies are financially viable.

Conclusion: An Urgent Call for a Cautious Approach

The Q3 2025 earnings are a clear sign that HYBE’s fundamentals are facing a severe crisis. The core challenge is no longer just about growth, but about sustainable profitability. The path forward is uncertain, and the high volatility surrounding the HYBE financial performance necessitates a conservative stance.

Given the significant risks and the high uncertainty clouding profitability recovery, a “Sell” or “Hold” recommendation is strongly advised. Investors should avoid significant new positions in HYBE stock until management provides a convincing and actionable turnaround strategy. Careful monitoring of subsequent earnings reports and strategic announcements is paramount. To understand the broader industry context, consider reading our analysis on The Future of the K-POP Industry.