![Wontech Stock Update: Analyzing Recent Ownership Changes and Investment Strategies [September 2025] 대표 차트 이미지](https://note12345.mycafe24.com/wp-content/uploads/2025/09/336570-1.png)

What Happened? Analyzing Wontech’s Ownership Changes

Wontech’s CEO, Jong-won Kim, recently disclosed changes in shareholding through a large shareholding report. Following the report, Mr. Kim’s stake decreased slightly from 52.42% to 51.99%. This change resulted from a shift in special relationships (new appointment of executive Tae-bong Kim) and stock purchases/sales by Ae-kyung Kim and Jong-won Kim. The report states the purpose of this change as “influencing management control.”

Why are These Changes Important?

Changes in major shareholder ownership are crucial signals regarding a company’s management stability and future strategies. Changes aimed at “influencing management control” can suggest potential management disputes, mergers and acquisitions, or governance restructuring, warranting close attention from investors.

What’s Next for Wontech? Fundamental and Market Analysis

- Solid Profitability: Wontech maintained a high operating profit margin of 41.21% in the first half of 2025, demonstrating strong profitability management.

- Growing Market: The global aesthetic medical device market is projected to grow at an average annual rate of 10.32%, positively impacting Wontech’s core business.

- Declining Sales: Sales decreased year-on-year in the first half of 2025, attributed to temporary factors. Future sales trends need monitoring.

- Financial Stability: With a debt-to-equity ratio of 34.64%, Wontech’s financial structure is stable, but the size of convertible bond-related derivative liabilities could affect stock price volatility.

What Should Investors Do? Action Plan

- Short-Term Investors: Closely monitor the CEO’s ownership changes and market reactions, being mindful of short-term stock price volatility.

- Long-Term Investors: Base investment decisions on careful analysis of new product launches, overseas market expansion performance, and improvements in convertible bond-related financial structure.

Frequently Asked Questions

What is Wontech’s main business?

Wontech primarily manufactures aesthetic medical devices, with key products including Oligio, Picocare, and Lavieen. The aesthetic medical device business accounts for approximately 97.5% of its revenue.

How will these ownership changes affect the stock price?

The expectation of management stabilization and increased market attention could drive stock prices upward. However, the decrease in ownership and the possibility of management changes may increase stock price volatility.

What should investors be cautious about when investing in Wontech?

Investors should carefully monitor the continuation of the sales decline, trends in major shareholder ownership changes, and the possibility of changes in management strategies. Attention should also be paid to financial risks related to convertible bonds.

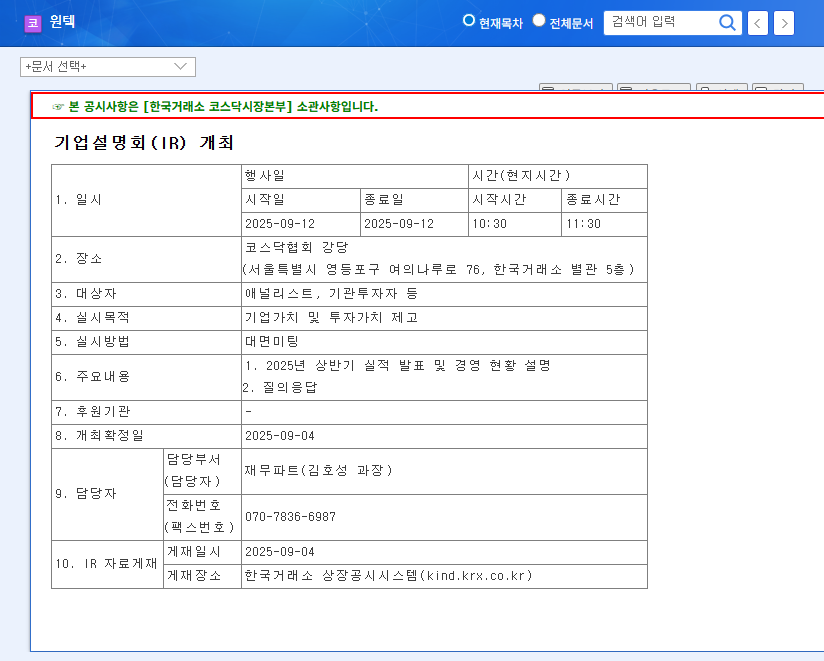

![Wontech Stock Update: Analyzing Recent Ownership Changes and Investment Strategies [September 2025] 관련 이미지](https://note12345.mycafe24.com/wp-content/uploads/2025/09/336570_공시-1.png)

![Wontech Stock Update: Analyzing Recent Ownership Changes and Investment Strategies [September 2025] 관련 이미지](https://note12345.mycafe24.com/wp-content/uploads/2025/09/336570_투자자동향-1.png)