The future of Doosan Fuel Cell hangs in the balance as it prepares for its critical Q3 2025 Investor Relations (IR) event. For investors and market analysts, this event is more than a routine earnings call; it’s a pivotal moment that will reveal the company’s strategy for navigating recent financial headwinds and its roadmap for capitalizing on next-generation SOFC technology. This comprehensive analysis unpacks the company’s current state, the opportunities and risks tied to the IR, and the key metrics every stakeholder should be watching.

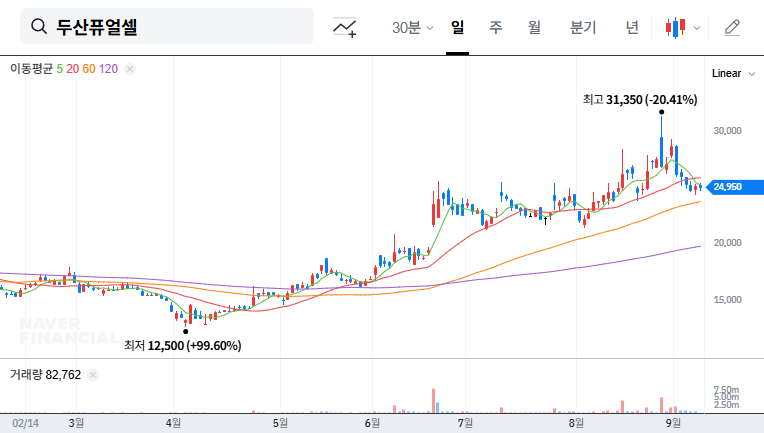

Amid declining revenues and operational losses, Doosan Fuel Cell is betting on future growth engines, including Solid Oxide Fuel Cell (SOFC) development and a strategic entry into the eco-friendly vehicle market. The question remains: can the company’s leadership present a convincing case for a turnaround and sustainable growth, thereby restoring market confidence in the Doosan Fuel Cell stock?

The Upcoming Doosan Fuel Cell IR Event: What to Expect

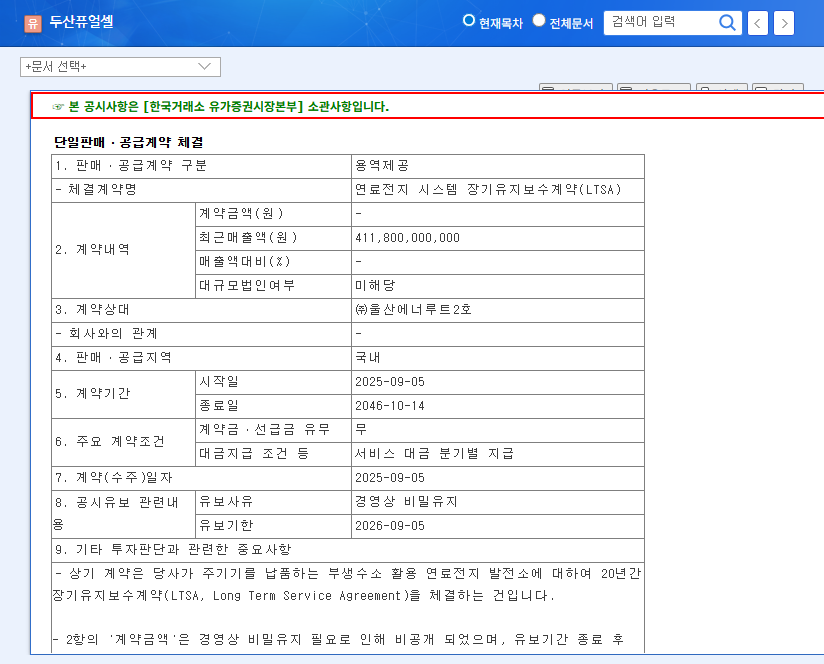

Doosan Fuel Cell Co., Ltd. has officially scheduled its Doosan Fuel Cell IR event for domestic institutional investors on November 10, 2025, at 1:00 PM. The primary agenda is to present the Q3 2025 management performance and provide a detailed business status update. This event is a crucial platform for the company to address the underperformance seen in the first half of the year and to articulate a clear, actionable plan for recovery and future expansion. The official announcement can be reviewed in the company’s disclosure. (Source: Official Disclosure).

A Deep Dive into Doosan Fuel Cell’s Current State

Business Model & Competitive Edge

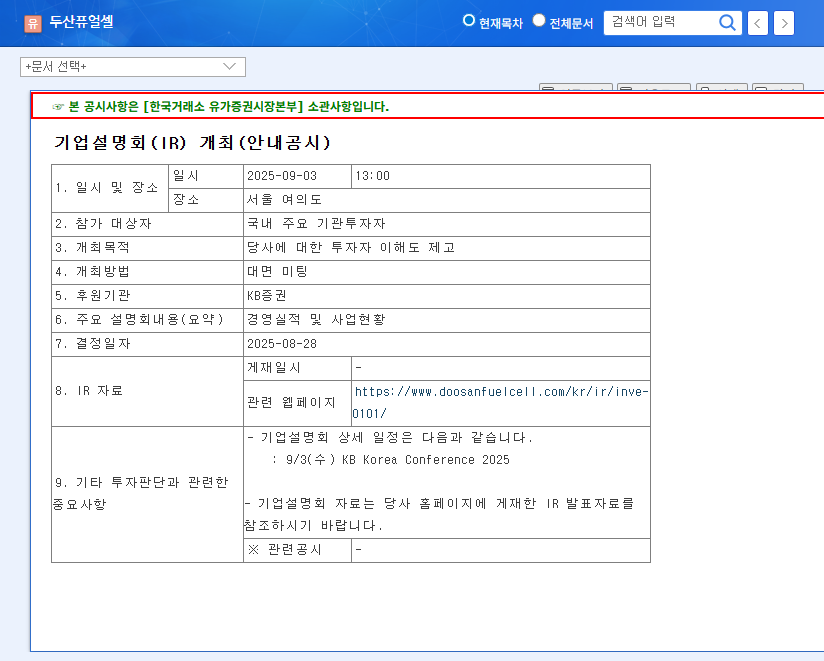

Doosan Fuel Cell has long been a leader in the Korean power generation hydrogen fuel cell market, specializing in Phosphoric Acid Fuel Cell (PAFC) technology. This established technology provides stability and versatile fuel utilization, giving the company a strong foothold. However, recognizing the market’s evolution, the company is making strategic pivots:

- •Portfolio Diversification: An equity investment in HyAxios Motors signals a serious commitment to entering the burgeoning eco-friendly commercial vehicle market, reducing reliance on stationary power generation.

- •Future-Proofing with SOFC Technology: The acquisition of next-generation Solid Oxide Fuel Cell (SOFC) technology and the construction of a 50MW production facility are critical for long-term growth and competing on a global scale. You can learn more about this technology in our guide, A Deep Dive into SOFC vs. PAFC Technology.

Financial Health Under Scrutiny

The H1 2025 financial report painted a challenging picture. Revenue plummeted to 228.2 billion KRW (a 44.7% decrease YoY), while the operating loss widened to -13.5 billion KRW. This performance raises significant questions about inventory management (358.7 billion KRW in assets) and debt, with the debt-to-equity ratio climbing to 153.8%. A clear strategy to improve financial discipline will be non-negotiable for investors at the IR event.

Investors will be looking past the promises of future technology and scrutinizing the balance sheet. A credible plan to manage debt and improve operational efficiency is just as important as the roadmap for SOFC technology.

Macro-Environment and Policy Tailwinds

It’s not all headwinds. The broader market offers several opportunities. Government policies like the Clean Hydrogen Portfolio Standard (CHPS) are creating a favorable domestic market. Globally, the push towards a hydrogen economy, as outlined by organizations like the International Energy Agency (IEA), provides a long-term tailwind. Furthermore, stabilizing interest rates could ease borrowing costs, providing some financial relief.

Potential IR Impact on Doosan Fuel Cell Stock

The upcoming Doosan Fuel Cell IR event is a double-edged sword, presenting both significant opportunities and risks.

Opportunities (Potential Upside)

- •Restoring Investor Confidence: A transparent explanation for recent struggles coupled with a robust improvement plan could significantly boost sentiment.

- •Highlighting Future Value: A detailed roadmap for the commercialization of SOFC technology and the new vehicle venture can shift the narrative from current losses to future potential.

- •Synergy with Policy: Demonstrating alignment with national and global hydrogen policies can unlock perceived value and de-risk the business model.

Risks (Potential Downside)

- •Magnifying Poor Performance: If Q3 results show a continuation of the negative trend without a clear path to profitability, investor concerns will intensify.

- •Vague Strategic Vision: A lack of concrete details on financial management or competitive strategy could be interpreted as a lack of direction, further damaging the stock.

Investor Checklist: Key Watch Points

Investors should meticulously evaluate the information presented at the IR, focusing on these five critical areas:

- 1.Q3 Performance & Outlook: Are there tangible signs of a turnaround in the core business?

- 2.Financial Improvement Plan: What are the specific steps and timelines for reducing inventory and improving the debt ratio?

- 3.SOFC Commercialization Roadmap: What is the realistic timeline for revenue generation from the new SOFC technology?

- 4.Competitive Strategy: How will Doosan differentiate itself as global competition in the hydrogen fuel cell space heats up?

- 5.Capital Allocation: How will the company balance investment in future growth with the need for current financial stability?

In conclusion, the Doosan Fuel Cell IR event is a watershed moment. The company’s ability to deliver a clear, credible, and convincing message that addresses its current challenges while painting a compelling vision for the future will be paramount in determining the trajectory of its stock and its place in the rapidly evolving energy landscape.