1. What Happened?: Over 4 Million New Shares Listed Due to Convertible Bond Exercise

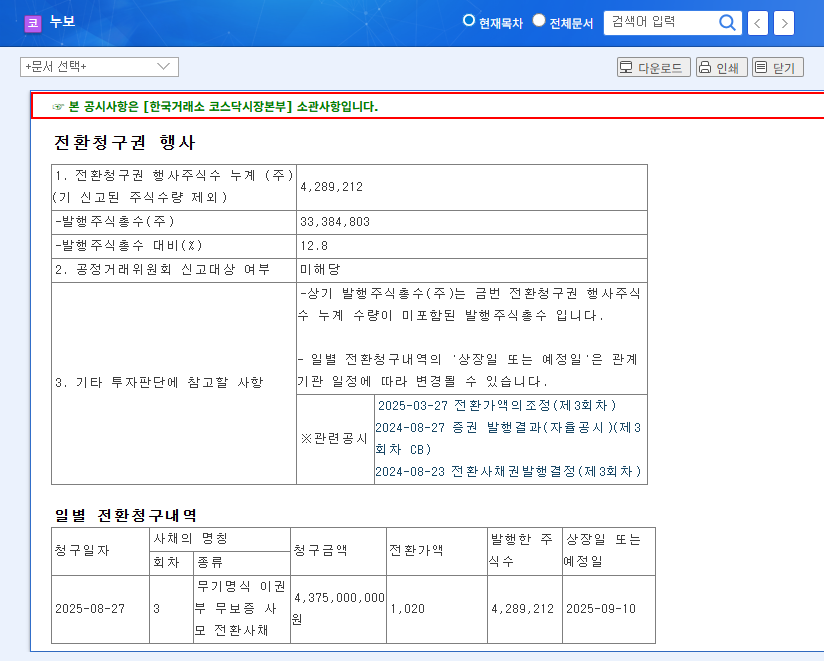

On August 27, 2025, NUBO announced the exercise of conversion rights for 4,289,212 convertible bonds. This represents 12.8% of the market capitalization and is scheduled to be listed on September 10.

2. Why is it Important?: Potential for Stock Price Decline and Changes in Corporate Value

The listing of a large number of new shares can lead to downward pressure on the stock price due to increased supply. The fact that the current stock price is higher than the conversion price also increases the likelihood of profit-taking sales.

3. So What’s Next?: Potential Short-term Decline, Long-term Fundamental Improvement Needed

- Short-term Impact: Downward pressure on stock price, possibility of profit-taking. Financial structure may improve partially with reduced debt and increased capital, but the effect will be limited if profitability issues persist.

- Long-term Impact: Potential for investor sentiment deterioration. However, liquidity supply effects are also expected. Ultimately, the improvement of the company’s fundamentals will determine the stock price direction.

4. Investor Action Plan: Cautious Approach, Fundamental Monitoring Essential

Investors should be aware of short-term stock price volatility. In the mid- to long-term, it is crucial to closely monitor NUBO’s efforts to improve profitability and strengthen financial soundness, as well as the performance of new businesses.

Frequently Asked Questions

What are convertible bonds?

Convertible bonds are a type of bond that gives the holder the right to convert them into shares of the issuing company’s stock under certain conditions.

Why does the exercise of convertible bonds negatively affect the stock price?

The exercise of convertible bonds results in the issuance of new shares, which increases the supply of stock and can put downward pressure on the price.

What is the outlook for NUBO?

Improving profitability and strengthening financial soundness are key tasks. The stock price direction will be determined by the performance of new businesses and whether fundamentals improve.