Xi S&D Inc. (자이에스앤디), a key player in specialized construction and services, has made a bold move, capturing the market’s attention with its latest announcement. The company has publicized an ambitious Xi S&D Inc. revenue forecast aiming for ₩1.4 trillion in 2025. Coming at a time of declining revenues and a recent shift to operating loss, this projection raises a critical question for investors: Is this a credible signal of a powerful rebound or an overly optimistic goal amidst a challenging economic landscape?

This comprehensive analysis will dissect the layers behind this forecast. We will explore the company’s current financial health, break down its core business segments, and weigh the potential catalysts and risks that could define its path forward. This deep dive aims to provide investors with the critical insights needed to navigate the outlook for the Xi S&D Inc. stock.

The ₩1.4 Trillion Announcement: A Declaration of Intent

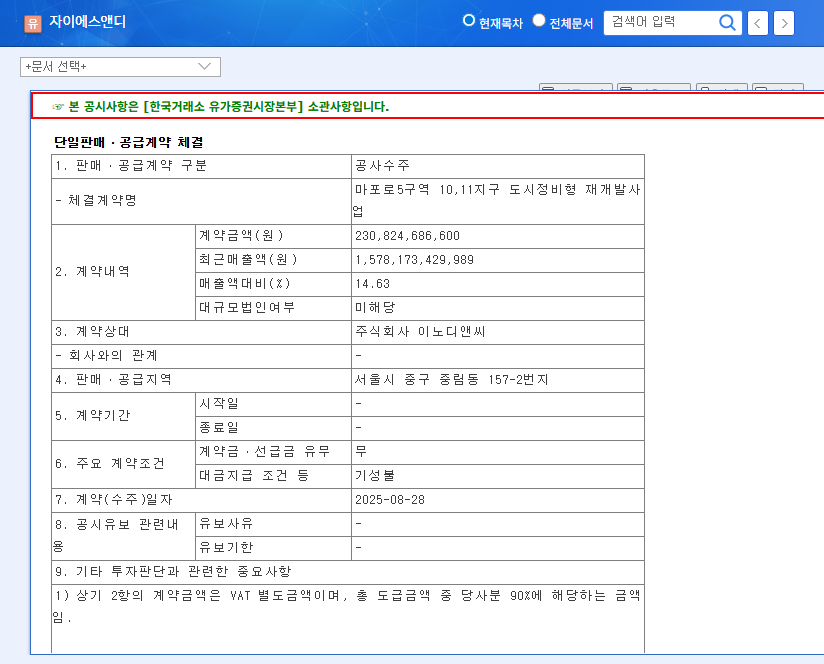

On November 11, 2025, Xi S&D Inc. formally disclosed its consolidated annual revenue forecast, setting a 2025 revenue target of ₩1.4 trillion for the fiscal year. This announcement, detailed in the company’s official filing (Official Disclosure), is a clear statement of its commitment to reversing recent sluggish performance. However, the company notably omitted forecasts for operating profit and net income, an element that adds a layer of uncertainty for the market.

Current Financial Landscape: A Mix of Strength and Concern

A Challenging First Half

The backdrop for this ambitious forecast is a difficult recent performance. The company’s 26th semi-annual report revealed a revenue of ₩649.6 billion, a year-over-year decrease, and more concerningly, a shift to an operating loss of ₩13.3 billion. This downturn is primarily driven by deteriorating profitability in the core construction business and mounting losses in the housing segment, reflecting broader pressures in the construction industry analysis.

While the consolidated debt-to-equity ratio of 81.38% appears financially sound and manageable, a negative shift in operating cash flow is a significant red flag that warrants close monitoring. It suggests that the company’s core operations are currently consuming more cash than they are generating.

For investors, the central tension is clear: a forward-looking, growth-oriented forecast set against a backdrop of current operational and financial headwinds. Execution will be the ultimate arbiter of success.

Deep Dive into Business Segments

Understanding Xi S&D Inc. requires looking at its three distinct business pillars:

- •Construction (63% of revenue): The company’s strength lies in high-tech industrial construction, including data centers and clean rooms. However, this segment is highly sensitive to corporate investment cycles and faces stiff competition.

- •Housing (11% of revenue): Leveraging the prestigious ‘Xi’ brand, this division focuses on small-scale urban regeneration. It is, however, extremely vulnerable to real estate market fluctuations, high interest rates, and the risk of unsold inventory.

- •Home Solution (26% of revenue): This diversified and growing segment includes smart home systems, property management, and leasing services. It offers a more stable and consistent source of revenue with significant growth potential.

Investor Guidance: Navigating the Path Forward

The Xi S&D Inc. revenue forecast is a bold statement, but the stock’s future trajectory hinges entirely on the company’s ability to execute and improve profitability. Investors should adopt a cautious yet watchful approach.

Key Factors to Monitor

- •Profitability Metrics: Look beyond the revenue target. Scrutinize upcoming quarterly reports for improvements in gross profit margins and a return to positive operating income.

- •New Orders and Backlog: The health of the construction business depends on a steady stream of new, high-value orders. A growing backlog provides future revenue visibility.

- •Macroeconomic Conditions: Keep an eye on interest rate trends, raw material costs, and overall economic health, as these external factors will heavily influence all business segments. For a deeper understanding, review our guide on key metrics for evaluating construction stocks.

- •Market Communication: Proactive and transparent communication from management, including future profit forecasts, will be essential to rebuilding market confidence.

In conclusion, while the ₩1.4 trillion revenue target provides a beacon of hope, it does not by itself guarantee a fundamental turnaround. A prudent investment strategy involves meticulous monitoring of the company’s operational performance and its ability to translate top-line growth into bottom-line profitability. The coming quarters will be pivotal in determining whether Xi S&D Inc. can successfully build a new foundation for sustainable growth. As noted by industry experts at sources like the Korea Research Institute for Construction Policy, the path ahead remains complex.