A significant HVM CO.,LTD. block deal has sent ripples through the investment community, raising questions about the company’s future stock performance and management stability. On October 27, 2025, a major shareholder executed a large share sale explicitly for ‘management influence,’ a move that warrants careful examination. While this event may introduce short-term volatility for HVM stock, a deeper look reveals a company with robust fundamentals poised for long-term growth.

This comprehensive HVM stock analysis will dissect the block deal, evaluate the company’s intrinsic value, and provide a clear HVM investment strategy to help you navigate the market noise and make informed decisions.

Decoding the HVM CO.,LTD. Block Deal

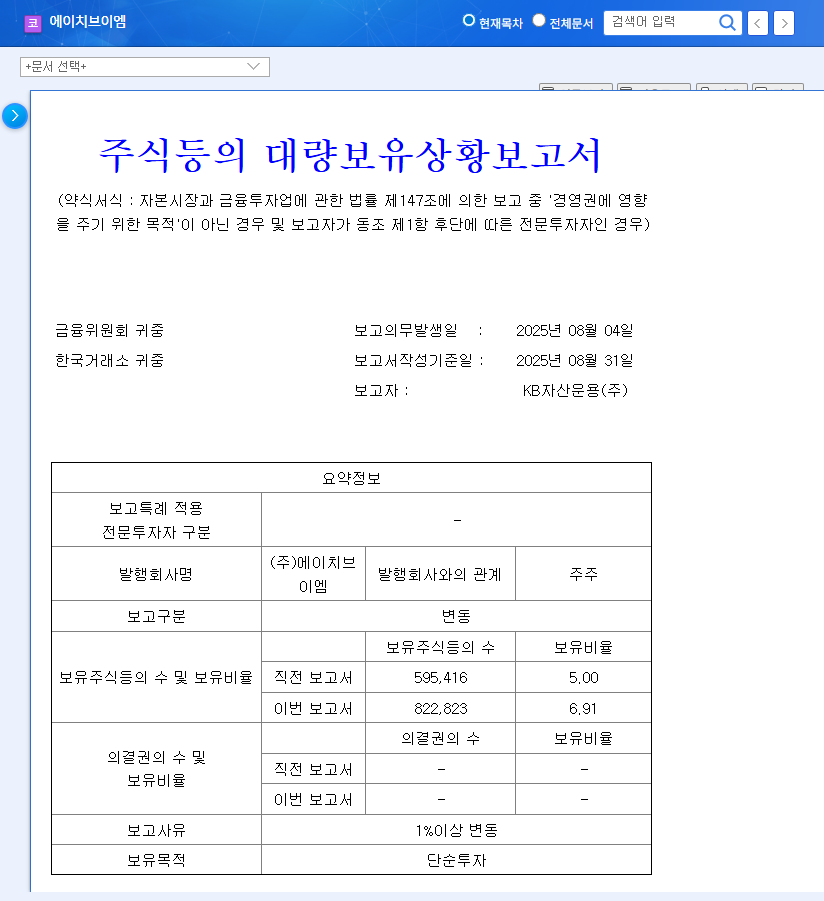

On October 27, 2025, the market took note of a disclosure regarding a change in large-scale shareholding for HVM CO.,LTD. (에이치브이엠). The shareholder, Choi Jae-young, executed an after-hours block trade, selling a substantial portion of his holdings.

Transaction Snapshot:

Seller: Choi Jae-young

Shares Sold: 230,000 common shares

Stake Change: Reduced from 10.00% to 8.07%

Stated Purpose: ‘Management influence’

Source: Official Disclosure (DART)

The term ‘management influence’ is what sets this transaction apart from a typical sale for profit-taking. It suggests a strategic motive related to corporate control or direction, which can create uncertainty among investors. This ambiguity often leads to short-term price pressure as the market digests the potential implications for HVM’s leadership and strategic stability.

Fundamental Analysis: HVM’s Unwavering Growth Drivers

Beyond the immediate noise of the HVM CO.,LTD. block deal, the company’s core fundamentals remain exceptionally strong. HVM is a specialist in advanced metals, leveraging proprietary high-purity vacuum melting technology to produce materials critical for high-growth industries.

Core Technological Competitiveness

HVM’s competitive edge is rooted in its unique technology. The company’s proprietary vacuum melting facilities allow it to produce high-purity metals and sputtering targets that are essential for manufacturing semiconductors, displays, and aerospace components. This technological moat, protected by patents and continuous R&D, ensures its relevance in a demanding market.

Financial Health and Strategic Expansion

As of the first half of 2025, HVM’s financial reports show a company in a strong growth phase. Consistent revenue increases and a successful turnaround to profitability underscore its operational efficiency. While an increase in inventory assets warrants monitoring, it’s largely tied to strategic investments in production capacity, including a new factory and advanced melting furnaces. This signals management’s confidence in future demand within the advanced metals market.

Market Outlook & Stock Impact

Short-Term Volatility vs. Long-Term Value

The immediate aftermath of a block deal like this often involves heightened stock volatility. The large volume of shares creates a temporary supply overhang, and the ambiguous ‘management influence’ motive can spook risk-averse investors, leading to short-term price dips. However, these movements are often detached from the company’s operational reality.

From a mid-to-long-term perspective, the narrative shifts back to fundamentals. HVM operates in a sector with explosive growth potential. The global demand for advanced materials is surging, and HVM is well-positioned to capture a larger share, both domestically and through overseas expansion. Paradoxically, the shareholder’s reduced stake could even lead to greater management stability by consolidating the control of the existing leadership team. Ultimately, the company’s intrinsic value, driven by earnings and innovation, will be the primary determinant of its long-term stock trajectory.

A Smart HVM Investment Strategy for 2025

Given the circumstances, a prudent HVM investment strategy requires looking beyond the short-term market drama. Here are key points to consider:

- •Focus on the Fundamentals: Prioritize analysis of HVM’s technological leadership, market position, and financial health over reactionary news. The company’s ability to innovate and execute is what will create shareholder value.

- •Adopt a Long-Term Horizon: Short-term volatility can present buying opportunities for investors who believe in the company’s long-term growth story. Avoid emotional decisions based on daily price swings.

- •Monitor Key Metrics: Keep an eye on major shareholder trends, but also track macroeconomic factors like exchange rates, which can impact HVM’s import/export business. Follow the company’s progress on its capacity expansion plans.

In conclusion, while the recent HVM CO.,LTD. block deal has created temporary uncertainty, the company’s underlying strengths—its proprietary technology, expanding production capacity, and alignment with high-growth industries—present a compelling case for long-term investors.

Frequently Asked Questions (FAQ)

Why was the HVM block deal significant?

The deal was significant due to its stated purpose of ‘management influence.’ This implies strategic motivations beyond simple profit-taking, which can create uncertainty about corporate governance and future direction, often impacting investor sentiment.

How might this block deal affect HVM’s stock price?

In the short term, it could lead to increased stock volatility and downward pressure due to the large supply of shares and market uncertainty. In the long term, the stock price is more likely to be driven by HVM’s fundamental performance, profitability, and market growth.

What is the long-term investment outlook for HVM CO.,LTD.?

The outlook remains positive. HVM has strong fundamentals, unique technology in the growing advanced metals industry, and is expanding its production capacity. These factors suggest that its intrinsic business value is positioned for growth, irrespective of short-term shareholder movements.