The world of biotech investment is closely watching IntoCell, Inc., a pioneering company in Antibody-Drug Conjugate (ADC) platform technology. The firm recently announced a major milestone: the successful submission of its Investigational New Drug (IND) application to the U.S. Food and Drug Administration (FDA) for its proprietary anti-cancer drug candidate, ITC-6146RO. This critical step prepares the ground for Phase 1 clinical trials and signals a significant move towards global market entry for IntoCell’s innovative oncology treatment.

This FDA IND submission is far more than a regulatory formality; it is a powerful validation of IntoCell’s advanced ADC technology by one of the world’s most rigorous regulatory agencies. This analysis delves into the specifics of ITC-6146RO, the implications of this achievement for IntoCell’s business outlook, and the potential risks and rewards for investors.

Understanding ITC-6146RO and the FDA IND Submission

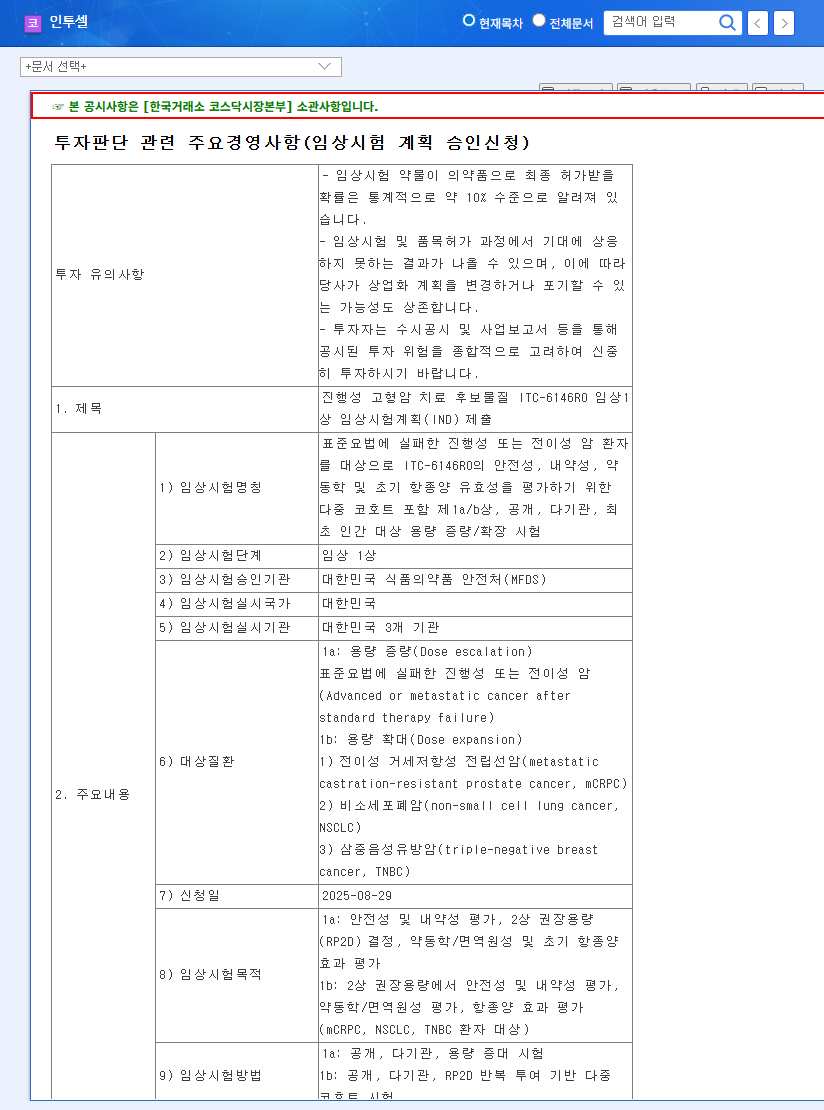

On October 31, 2025, IntoCell officially completed its IND application for ITC-6146RO, marking the achievement of a key corporate goal. An IND application is the first crucial step required to administer a new drug candidate to humans, representing the culmination of extensive non-clinical safety and efficacy studies. For a biotech company, securing an FDA IND clearance is a monumental achievement that opens the door to the largest biopharmaceutical market in the world.

Details of the Phase 1 Clinical Trial

The upcoming Phase 1a/b clinical trial for ITC-6146RO is an open-label, multi-center, first-in-human dose escalation and expansion study. Its primary objectives are:

- •To evaluate the safety and tolerability of the drug in patients with advanced or metastatic cancer who have exhausted standard therapies.

- •To study its pharmacokinetics (how the drug moves through the body).

- •To assess preliminary anti-tumor efficacy.

The Phase 1b expansion will specifically target challenging cancers, including Metastatic Castration-Resistant Prostate Cancer (mCRPC), Non-Small Cell Lung Cancer (NSCLC), and Triple-Negative Breast Cancer (TNBC).

IntoCell’s Core Competency: Advanced ADC Technology

At the heart of IntoCell’s innovation is its proprietary Antibody-Drug Conjugate platform. ADCs are a powerful class of drugs designed to act like guided missiles, delivering potent chemotherapy agents directly to cancer cells while sparing healthy tissue. You can learn more about the fundamentals of ADC technology on our blog. IntoCell’s key technological advantages include:

- •OHPAS™ Linker Platform: This technology enhances the stability of the ADC in the bloodstream, preventing the premature release of the toxic payload. It ensures the drug is selectively cleaved and activated only inside the target cancer cells.

- •PMT™ Platform: This platform minimizes the non-selective uptake of the drug by normal, healthy cells. This precision targeting is crucial for reducing side effects and improving the therapeutic window.

This differentiated technology suite forms the basis of IntoCell’s business model, which is focused on generating revenue through early-stage clinical pipeline out-licensing and strategic partnerships with global pharmaceutical companies.

Investment Analysis: Opportunities and Risks

Positive Catalysts from the FDA IND Submission

The IND submission for ITC-6146RO is a significant de-risking event that enhances investor confidence. The progression of a key pipeline into the clinical stage validates the company’s scientific approach and business model. It also accelerates opportunities for technology out-licensing discussions with major pharmaceutical players, which could dramatically improve IntoCell’s financial structure. As is common in the biotech sector, this news is expected to provide positive stock price momentum, driven by heightened expectations for future growth.

Overall, the U.S. FDA IND submission for ITC-6146RO is a profoundly positive event for IntoCell, signaling a crucial turning point in its medium-to-long-term growth trajectory. Combined with substantial cash assets from its IPO and the robust growth of the global ADC market, IntoCell’s future outlook is bright.

Potential Risks and Considerations for Investors

Despite the optimism, investing in biotech carries inherent risks. The FDA IND submission is only the beginning of a long and expensive journey. Clinical trial success is never guaranteed; data from Phase 1 trials, which primarily focus on safety, can lead to success, delays, or outright failure. According to the National Cancer Institute, the path through clinical development is fraught with uncertainty.

Furthermore, clinical trials require substantial capital, and R&D expenditures are expected to rise, increasing the short-term financial burden. This is compounded by the recent termination of a license agreement with ABL Bio, which affects short-term profitability and makes securing new partnerships even more critical. Finally, the ADC technology market is intensely competitive, and ITC-6146RO must demonstrate a clear competitive advantage in its clinical results to succeed.

Investors should carefully monitor the progress and results of the Phase 1 clinical trial for ITC-6146RO and watch for new technology out-licensing agreements. While the IND submission is a major step forward, long-term value will be determined by clinical data and commercial execution. For full transparency, refer to the company’s Official Disclosure filed with regulatory authorities.