COWINTECH Co., Ltd. has captured significant market attention following its recent joint Investor Relations (IR) session on October 20, 2025. This event represents a pivotal moment for the company and its affiliates, offering a rare, consolidated view of their collective strategy. For investors, understanding the nuances of the COWINTECH Joint IR is more than just processing news; it’s about deciphering the future trajectory of the company’s corporate value and making informed decisions. This comprehensive analysis will break down the event’s core message, evaluate potential market impacts, and provide a clear action plan.

Event Overview: The COWINTECH Joint IR Announcement

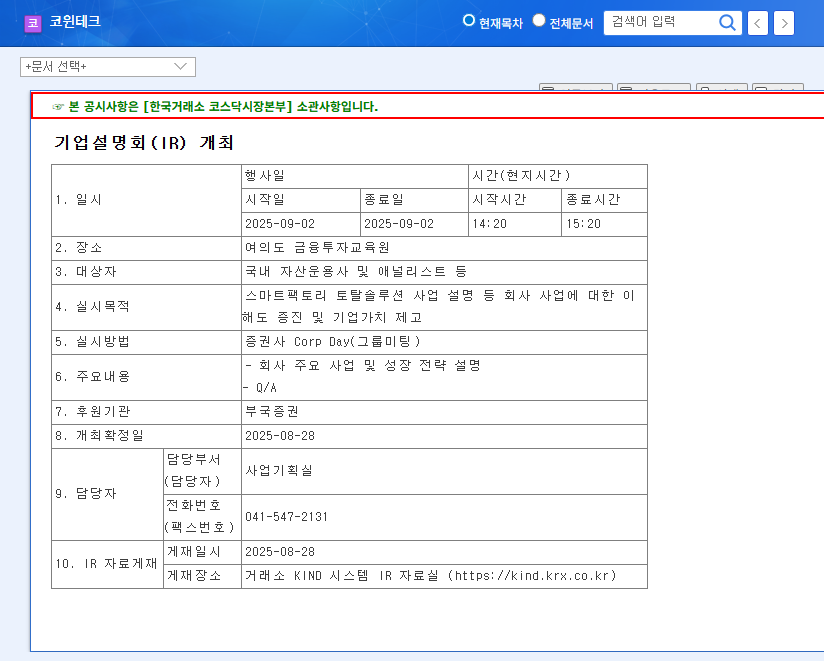

On October 15, 2025, COWINTECH officially announced its plan to hold a ‘Joint Affiliate IR Session’. The announcement, made available via an Official Disclosure (Source: DART), set the stage for the conference held on October 20. The primary goal was to enhance investor understanding by presenting a unified front, detailing key business strategies, financial outlooks, and hosting an interactive Q&A session. Such joint events are critical as they can reveal inter-company synergies that are not apparent from individual financial reports.

However, a significant challenge for analysts and investors is the current scarcity of detailed securities firm reports on COWINTECH. This information vacuum makes it difficult to objectively gauge pre-event market expectations, thereby complicating any predictive investor outlook on how the IR’s content would affect the company’s fundamentals.

“A joint IR is a high-stakes move. When executed well, it paints a powerful picture of synergistic growth. When it falters, it can expose foundational cracks between affiliates. The market’s reaction to the COWINTECH Joint IR will be a telling indicator of management’s ability to sell their unified vision.”

Potential Impacts: The Bull vs. Bear Case

Every investor relations event carries both promise and peril. Based on the information presented, we can outline the potential positive and negative scenarios that could influence COWINTECH stock analysis moving forward.

The Bull Case: Positive Catalysts

- •Deepened Investor Insight: The IR could successfully illustrate how COWINTECH and its affiliates create a whole greater than the sum of its parts, clarifying complex business portfolios and boosting confidence in the group’s long-term strategy.

- •Enhanced Corporate Value: Clear, confident communication from leadership about growth drivers and market advantages can directly lead to a positive re-rating of the company’s stock and a tangible increase in corporate value.

- •Increased Transparency: By openly discussing business operations and future plans, the company can build significant trust with the investment community, fostering a loyal long-term shareholder base. For more on this, see how transparency impacts valuations on sites like Investopedia.

The Bear Case: Potential Risks

- •Unmet Expectations: If the presentation lacks new, substantive information or fails to deliver a compelling growth narrative, it could lead to widespread investor disappointment and a potential sell-off.

- •Revelation of Negative Information: The unscripted nature of a Q&A session could inadvertently expose unforeseen business risks, financial weaknesses, or strategic disagreements among affiliates, damaging investor sentiment.

- •Questionable Synergies: If the promised synergies between affiliated companies appear weak or poorly defined upon scrutiny, investors may question the very premise of the joint structure, negatively impacting the group’s perceived value.

Strategic Action Plan for Investors

Given the high stakes of the COWINTECH Joint IR, a passive approach is insufficient. Proactive analysis is required. Here are the crucial next steps for investors to gain a clearer picture and make strategic moves:

- •Scrutinize the IR Transcript: Once available, dissect the presentation and, most importantly, the Q&A session. Look for specifics, data-backed claims, and the conviction behind management’s answers.

- •Monitor Market and Analyst Reactions: Observe the stock’s price and volume in the days following the IR. Watch for the first wave of analyst reports from securities firms, as they will provide a professional consensus on the event’s impact.

- •Cross-Reference with Financials: Connect the strategic narrative from the IR with the company’s actual financial statements. Do the growth plans align with the balance sheet and cash flow? For more detail, review our internal guide on analyzing quarterly financial reports.

In conclusion, the COWINTECH Joint IR is a significant event that provides a wealth of information for the diligent investor. While this report offers an initial framework for analysis based on the announcement, the true insights will emerge from a thorough examination of the event’s content and the market’s subsequent reaction.