The recent announcement regarding the HD Hyundai quarterly dividend has generated significant buzz among investors. As a major holding company with a vast and diverse business portfolio, HD HYUNDAI CO.,LTD.’s decision carries weight beyond a simple payout. It signals a strategic commitment to its shareholder return policy and offers a window into the company’s financial health and future outlook. But what does this mean for your investment strategy?

This comprehensive guide provides an expert-level analysis of HD Hyundai’s dividend decision, a deep dive into its corporate fundamentals, and a clear-eyed look at the potential impact on its stock price. We will unpack the critical details you need to make informed investment decisions.

Understanding the HD Hyundai Quarterly Dividend Announcement

HD Hyundai has officially confirmed its latest cash and in-kind dividend decision. According to the Official Disclosure filed with DART, the company will issue a quarterly cash dividend of 900 KRW per common share. The record date is set for September 30, 2025, with the payment scheduled for November 14, 2025.

Based on the share price of 31,191 KRW (as of November 3, 2025), this translates to a dividend yield of 0.58%. This move continues the quarterly dividend policy that the company initiated in the second quarter of 2024, reinforcing its commitment to providing consistent HD Hyundai shareholder return.

HD Hyundai has announced an aggressive shareholder return policy, targeting a dividend payout ratio of 70% or more for the next three years. This is a significant commitment to its investors.

Corporate Analysis: Strong Fundamentals Backing Shareholder Value

HD Hyundai operates as a holding company with a powerful presence across several key industries. Its financial foundation appears robust, providing the necessary stability to support its dividend policy. As of its H1 2025 report, the company’s total assets stand at 75.3 trillion KRW against total liabilities of 47.1 trillion KRW, resulting in total equity of 28.1 trillion KRW. Importantly, key indicators of financial health, such as the debt-to-equity ratio and net borrowing ratio, have shown improvement. This stability is further underscored by a stable A+ credit rating, signaling low default risk to creditors and investors.

Deep Dive into Key Business Segments

A proper HD Hyundai stock analysis requires understanding its diverse revenue streams:

- •Shipbuilding & Offshore (41% of Revenue): While demand for eco-friendly vessels like LNG carriers remains strong, overall order volumes have seen a decrease. The company is wisely investing in R&D to maintain its competitive edge against rising steel prices. For more context, you can read our analysis of the global shipbuilding market.

- •Oil Refining (39% of Revenue): This segment is inherently exposed to crude oil price volatility. To mitigate this risk, HD Hyundai is diversifying into high-growth areas like bioenergy and Sustainable Aviation Fuel (SAF).

- •Electric & Electronics: This division is well-positioned to capitalize on the global shift towards renewable energy, with growing markets for power equipment, Energy Storage Systems (ESS), and smart grids.

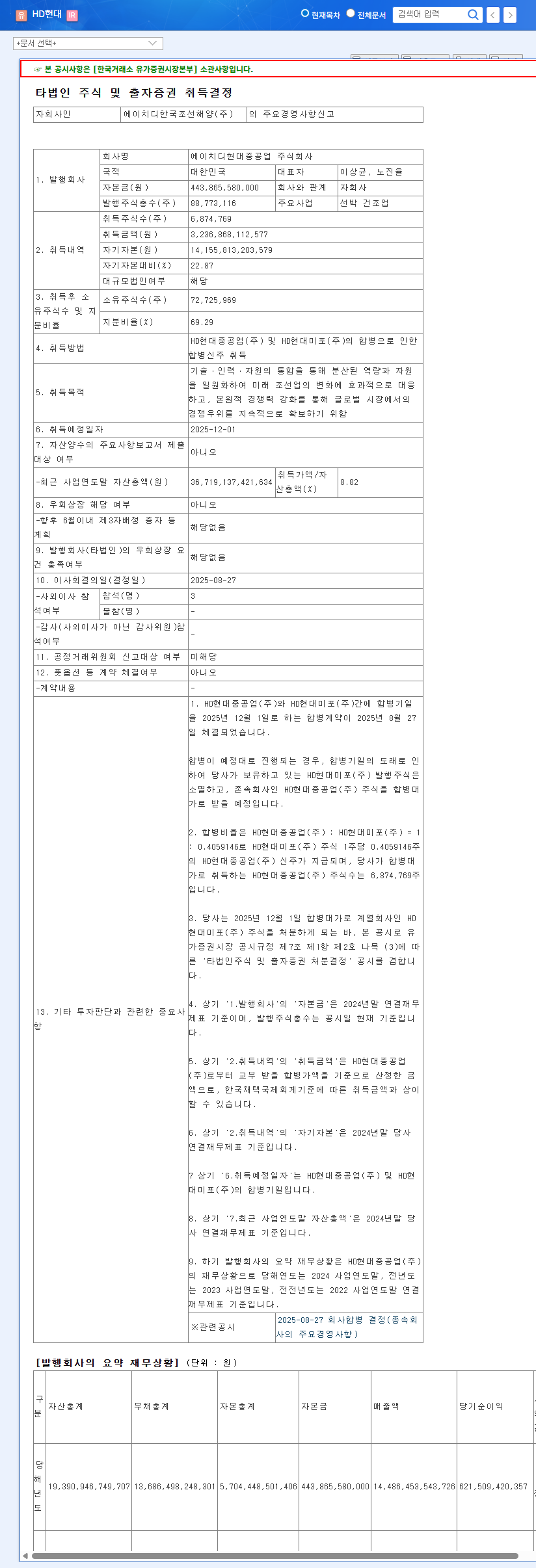

- •Construction Machinery: The strategic merger of HD Hyundai Construction Equipment and HD Hyundai Infracore is expected to create significant synergies and enhance global competitiveness.

Event Impact Analysis: Stock Price and Investor Sentiment

The confirmation of the HD Hyundai quarterly dividend is a clear positive signal. It reaffirms the company’s confidence in its financial stability and its dedication to shareholder returns. For long-term investors, a consistent dividend policy can foster price stability and create expectations for gradual capital appreciation.

However, investors should also consider potential headwinds. The current dividend yield of 0.58% is relatively low and may not provide a strong enough catalyst for a short-term price surge. Furthermore, the H1 2025 report showed a year-on-year decrease in revenue (down 49%) and operating profit (down 18.7%), largely due to downturns in front-line industries and a loss in the oil refining segment. Sustaining a high payout ratio could become challenging if this trend continues. Investors should monitor for a performance rebound, as discussed in many reputable financial publications.

Actionable Investment Strategy & Outlook

While the dividend is a positive development, a successful HD Hyundai investment requires looking beyond the payout. Prudent investors should focus on several key areas to make an informed decision:

Key Monitoring Points for Investors

- •Financial Performance Recovery: Watch for a rebound in revenue and operating profit in upcoming quarterly reports. Growth in new business areas is crucial.

- •Segment Profitability: Pay close attention to order intake and profit margins in the critical shipbuilding and oil refining segments.

- •Execution of Shareholder Policy: Can the company consistently meet its ambitious 70%+ dividend payout ratio target without compromising its financial health?

- •Macroeconomic Factors: Keep an eye on global oil prices, interest rates, and currency exchange rates, as these can significantly impact HD Hyundai’s diverse operations.

In conclusion, HD Hyundai presents a compelling case with its solid financial structure and commitment to shareholders. However, achieving sustained growth in shareholder value will depend on both the stability of the global market and the company’s ability to navigate industry challenges and deliver a strong financial turnaround.

Disclaimer: This report is based on the information provided, and the ultimate responsibility for investment decisions lies with the investor. This material is for informational purposes only and should not be construed as investment advice or recommendation.