1. Genieance’s Convertible Bond Issuance: What Happened?

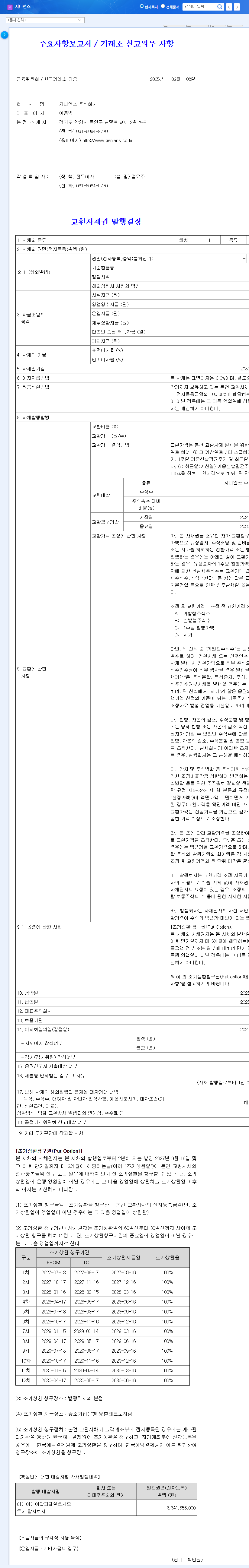

On September 8, 2025, Genieance announced its decision to issue ₩8.3 billion worth of convertible bonds. These bonds will be issued privately, with a conversion price of ₩22,423 and a 0% coupon rate. The payment date is September 16, 2025, the conversion start date is October 16, 2025, and the conversion end date is August 16, 2030.

2. Why Issue Convertible Bonds?

Genieance is accelerating its growth by expanding into ‘Security and Network Monitoring Services (MDR)’ and ‘Computer System Integration Consulting and Implementation Services (SI).’ This bond issuance aims to secure funding for these new business ventures and further research and development (R&D) investments. The low 0% coupon rate is a particularly effective strategy for minimizing interest expenses during a period of rising interest rates.

3. What Does This Mean for Investors?

- Positive Impacts:

- Securing growth drivers through funding

- Potential for improved financial structure due to low interest expenses

- Negative Impacts and Considerations:

- Significant gap between conversion price (₩22,423) and current stock price (₩385)

- Potential for share dilution upon conversion (currently low probability)

- Efficiency of fund utilization and visibility of results

4. Investor Action Plan

Investment Recommendation: BUY (Hold/Buy)

Genieance, with its solid fundamentals and growth strategy, presents a compelling long-term investment opportunity. Investors should focus on the long-term growth potential rather than short-term stock price fluctuations. However, continuous monitoring of conversion possibilities and the effectiveness of fund utilization is crucial.

FAQ

What are convertible bonds?

Convertible bonds are bonds that give the holder the right to convert them into shares of the issuing company’s stock after a certain period.

How will this bond issuance impact the stock price?

While the short-term impact may be minimal, there is a long-term risk of share dilution upon conversion. However, the probability of conversion is currently considered low.

What is the outlook for Genieance?

Genieance holds strong growth potential fueled by solid fundamentals and new business expansions. However, the efficient use of funds and tangible results from these new ventures will be key factors.