The recent announcement of the Doosan Bobcat dividend for Q4 2025 has captured significant attention from the investment community. For current and prospective shareholders of Doosan Bobcat Inc. (KRX: 241560), this decision raises crucial questions: Does this payout signal underlying strength despite a challenging first half of the year? And how should this factor into your long-term view of Doosan Bobcat stock? This comprehensive analysis will explore the specifics of the dividend, dissect the company’s financial health, and evaluate the macroeconomic environment to provide a clear, actionable perspective for investors.

Unpacking the Q4 2025 Doosan Bobcat Dividend Announcement

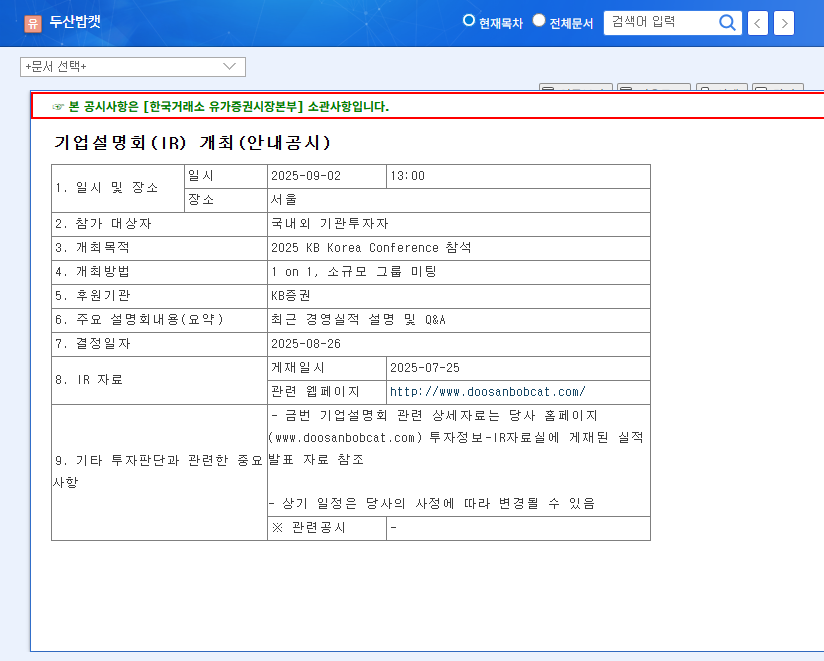

On October 30, 2025, Doosan Bobcat Inc. officially declared its quarterly cash dividend, reinforcing its commitment to its shareholder return policy. This move, detailed in their Official Disclosure (Source), is often seen as a sign of management’s confidence in future cash flow stability. Here are the critical details at a glance:

- •Event Type: Cash Dividend (Quarterly)

- •Dividend per Common Share: 400 KRW

- •Dividend Yield: Approximately 0.6% (based on a price of 81,048 KRW)

- •Record Date: November 14, 2025

- •Payment Date: November 28, 2025

Financial Health & Market Headwinds: The ‘Why’ Behind the Payout

To fully appreciate this dividend decision, we must place it in the context of the company’s recent performance and the broader economic climate. While the payout is a positive gesture, the underlying financials reveal a more complex picture.

A Challenging H1 2025 Performance

The first half of 2025 was marked by significant headwinds for Doosan Bobcat. A downturn in the global construction equipment and industrial vehicle markets led to a steep 52% year-over-year revenue decline. This slump compressed the operating profit margin from 9.4% to just 4.3%, signaling a sharp erosion in profitability. Despite this, the company’s operating cash flow saw a 21% increase, a testament to efficient working capital management. This cash flow strength is a critical factor enabling the company to sustain its shareholder return policies, including this 241560 dividend payment.

Navigating the Macroeconomic Landscape

The external environment remains a primary concern for any Doosan Bobcat investor analysis. Persistent high-interest rates in key markets like North America and Europe directly impact sales, as they increase the cost of financing for customers purchasing heavy equipment. While a weaker KRW can benefit exports, volatile energy prices and shipping costs present ongoing risks to the company’s cost structure. For more on market trends, investors often consult resources like Bloomberg’s construction industry reports.

The decision to issue a dividend amidst declining revenue and macroeconomic pressure suggests management’s confidence in a second-half recovery and the long-term strategic value of its recent acquisitions.

What This Dividend Means for Doosan Bobcat Stock Investors

How should investors interpret this event? The implications can be viewed from both a positive (bullish) and a cautious (bearish) perspective.

The Bull Case: Positive Signals for Long-Term Value

- •Commitment to Shareholders: A consistent dividend, even a modest one, attracts income-focused investors and signals a disciplined approach to capital allocation.

- •Fundamental Recovery on the Horizon: The payout can be seen as management telegraphing a belief in a profitable turnaround for the full year, boosting investor confidence in the Doosan Bobcat stock outlook.

- •Strategic Diversification: The recent acquisition of Doosan Motrol Co., Ltd. expands the company’s portfolio into hydraulic components, creating new revenue streams and growth potential that may not be fully priced into the stock yet. You can learn more by reading our guide on how to analyze industrial acquisitions.

The Bear Case: Potential Risks and Considerations

- •Profitability Concerns: The sharp drop in H1 2025 performance is a major red flag. If market conditions do not improve, the sustainability of future dividend payments could come into question.

- •Macroeconomic Uncertainty: A global economic slowdown remains a potent threat that could further suppress demand for construction and industrial equipment, impacting revenue and cash flow.

- •Modest Yield: At 0.6%, the current dividend yield is relatively low and may not be compelling enough to attract significant new capital or offset potential price volatility.

Strategic Outlook: Key Takeaways for Your Investment Thesis

The Q4 2025 Doosan Bobcat dividend is a positive gesture of shareholder commitment but should not be viewed in isolation. The company’s long-term investment appeal hinges on a demonstrable recovery in its core markets and the successful integration of its new hydraulics business. While the dividend provides a small return, investors should focus more on the upcoming earnings reports for signs of a sustained operational turnaround.

In conclusion, this dividend decision adds a layer of stability to the investment case but the primary driver for Doosan Bobcat stock will be its ability to navigate economic uncertainty and execute on its growth strategy. Cautious optimism is warranted, with a keen eye on performance metrics in the coming quarters.

Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. All investment decisions are the sole responsibility of the investor.