What Happened?

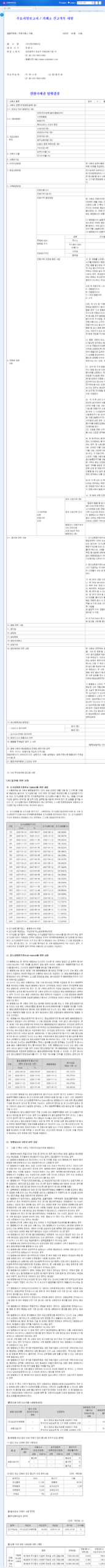

On September 19, 2025, Syntekabio secured a 9.44% equity investment through a convertible bond issuance to Ssangyong Savings Bank.

Why Does This Investment Matter?

Syntekabio has been facing financial difficulties due to continuous operating losses and increasing debt. This investment provides an opportunity to improve the company’s financial structure through short-term funding and secure capital necessary for business operations. Furthermore, investment from a financial institution can positively impact market confidence.

What’s Next?

- Positive Scenario: The influx of funds could improve the financial structure and accelerate the growth of the AI drug discovery platform and data center business.

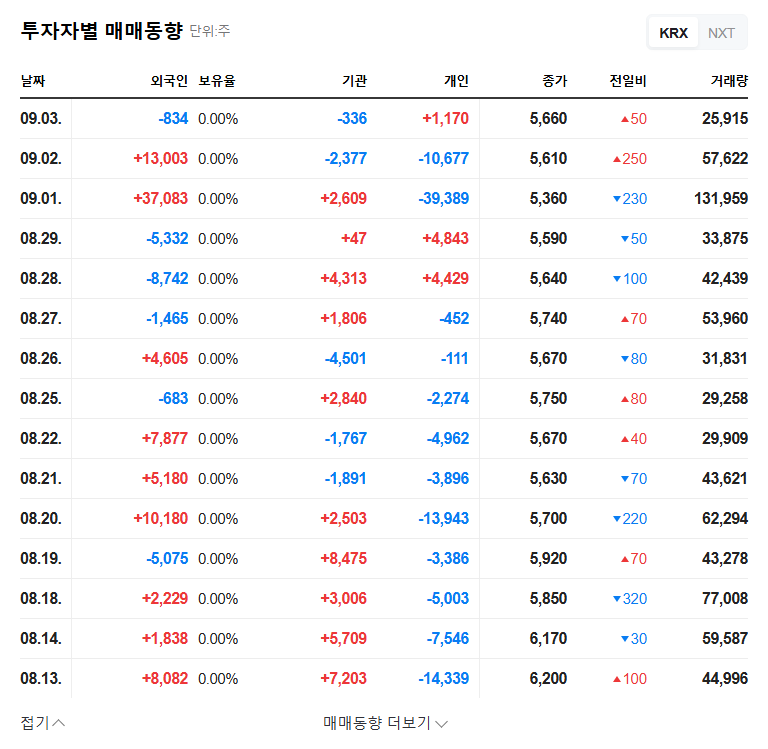

- Negative Scenario: There is a possibility of stock dilution due to the conversion of convertible bonds into shares, and potential short-term stock price volatility. Also, if fundamental profitability does not improve, long-term growth could be challenging.

What Should Investors Do?

Investors should look beyond short-term stock price fluctuations and closely monitor the company’s fundamental improvements. It’s crucial to observe the commercialization and revenue generation of the AI drug discovery platform, the performance of the data center business, and changes in key financial health indicators.

Frequently Asked Questions

What are convertible bonds?

Convertible bonds are a type of debt security that can be converted into shares of the issuing company’s stock after a certain period.

How will this investment affect Syntekabio’s stock price?

Short-term volatility may increase, but the long-term impact will depend on the company’s fundamental improvements.

What are Syntekabio’s main businesses?

Syntekabio focuses on AI drug discovery platform and data center business.