What Happened with CIS?

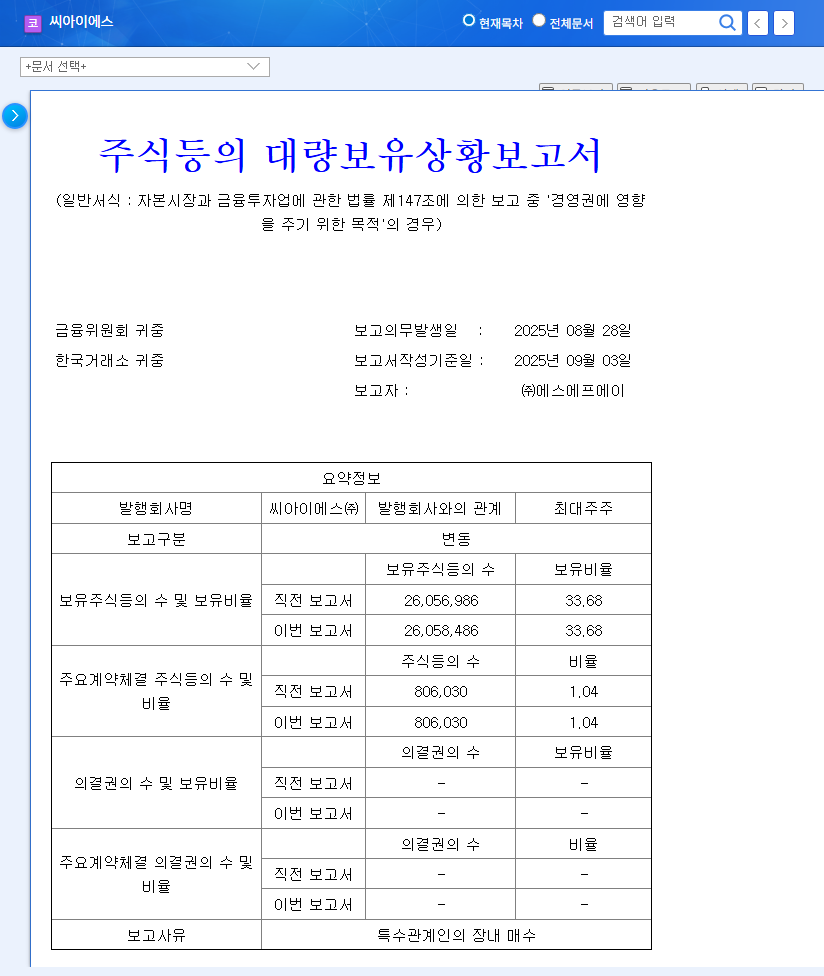

On September 3, 2025, CIS announced that its largest shareholder, SFA, maintained its stake at 33.68%. This followed an insider purchase, with no impact on management control.

Why is This Announcement Important?

This announcement demonstrates the largest shareholder’s firm control over management. Positively, it suggests management stability. However, it can also be interpreted as acceptance of the current poor performance. CIS is facing challenges, with sales and operating profit down 8.2% and 58.2%, respectively, in the first half of 2025.

So, What Should Investors Do?

Focus on CIS’s fundamental improvements rather than short-term stock price fluctuations. A solid order backlog and investment in next-generation technologies are positive, but risks remain, including poor performance, high inventory levels, and financial burdens.

- Key Checkpoints:

- • Quarterly earnings improvement

- • Commercialization and profitability of next-generation technologies

- • Expansion and execution of overseas orders

- • Changes in the macroeconomic environment

Investor Action Plan

If you are considering investing in CIS, it is crucial to make investment decisions from a long-term perspective, continuously monitoring the key checkpoints mentioned above, rather than reacting to short-term stock price fluctuations.

FAQ

Who is the largest shareholder of CIS?

The largest shareholder of CIS is SFA.

What is the impact of this announcement on CIS’s stock price?

No significant impact is expected in the short term, but the company’s fundamental improvements will affect the stock price in the long run.

What is the outlook for CIS?

While CIS has long-term growth potential, it needs to improve its performance and stabilize its financial structure in the short term.