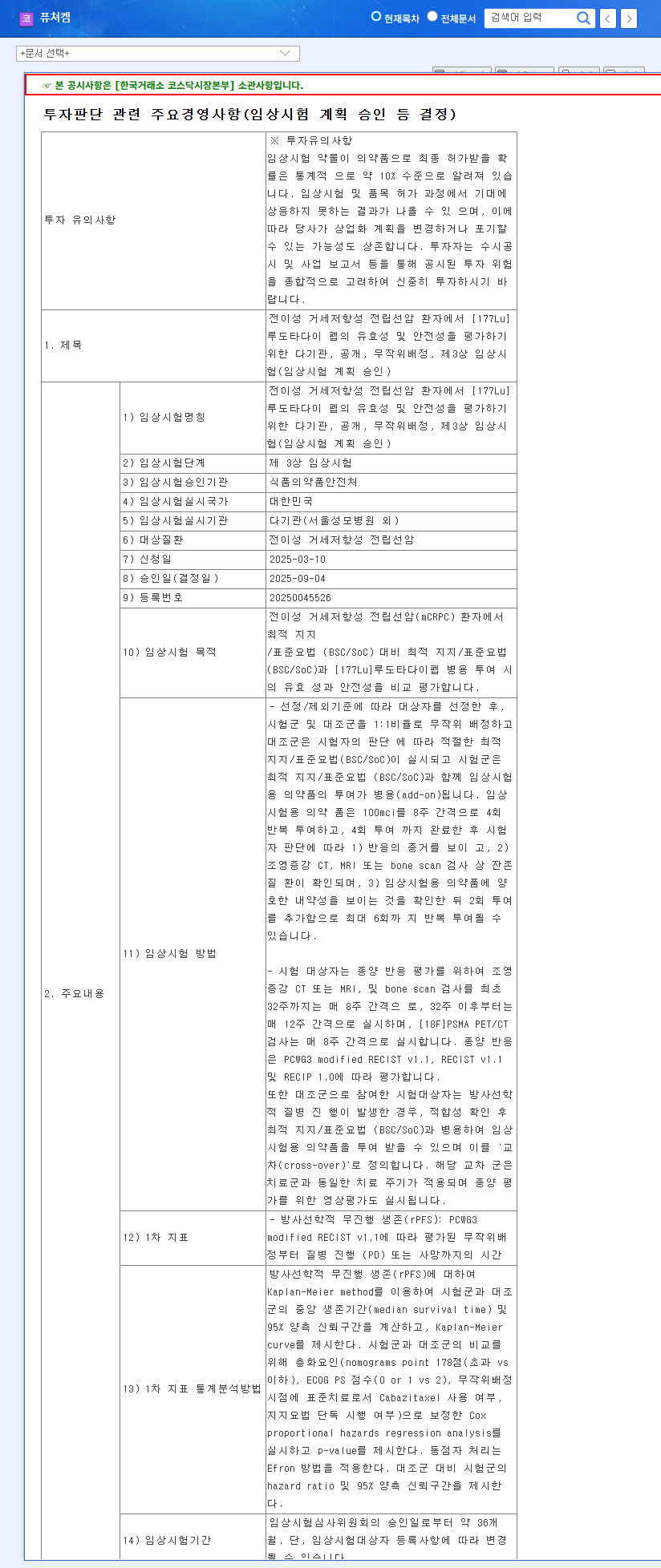

1. What Happened? ([177Lu]Ludotadipep Phase 3 Trial Approval)

On September 4, 2025, FutureChem announced the approval of its Phase 3 clinical trial plan for [177Lu]Ludotadipep targeting metastatic castration-resistant prostate cancer (mCRPC) patients. This trial will be conducted in South Korea and will compare the efficacy and safety of [177Lu]Ludotadipep combined with best supportive care/standard of care (BSC/SoC) against BSC/SoC alone. The primary endpoint is radiological progression-free survival (rPFS).

2. Why Does It Matter? (Impact on Corporate Value and Stock Price)

The entry of [177Lu]Ludotadipep, FutureChem’s key pipeline, into Phase 3 clinical trials significantly increases the likelihood of commercialization. Successful clinical results are expected to boost investor confidence and reaffirm FutureChem’s R&D capabilities and market competitiveness. Considering the high growth potential of the prostate cancer treatment market, this approval is projected to have a substantial positive impact on FutureChem’s corporate value. However, potential risks such as clinical trial uncertainties, high R&D costs, and intensifying market competition should also be considered.

3. What Should Investors Do? (Action Plan)

While a positive short-term stock price trend is anticipated, long-term investors should closely monitor the Phase 3 clinical trial results and the subsequent commercialization process. Key factors to monitor include:

- • Progress and interim results of the Phase 3 clinical trial

- • Application and approval status for [177Lu]Ludotadipep

- • Clinical progress of other pipelines (Alzheimer’s, Parkinson’s disease, etc.)

- • News regarding technology transfer or partnership agreements

- • Changes in FutureChem’s financial health indicators

- • Analysis of global radiopharmaceutical market trends and competitors

Q: What type of cancer does FutureChem’s [177Lu]Ludotadipep treat?

A: It treats metastatic castration-resistant prostate cancer (mCRPC).

Q: What stage is this clinical trial currently in?

A: It is in Phase 3, the final stage before potential commercialization. Success in this phase is crucial for market approval.

Q: How will this trial approval impact FutureChem’s stock price?

A: It is likely to have a positive short-term impact. However, the long-term stock price will depend on the trial results and market conditions.