In the high-stakes world of stock market investing, discerning a genuine opportunity from a potential value trap is paramount. The case of SolDefense Co., Ltd. presents a complex puzzle for investors, marked by a prolonged trading halt, a steady decline in its corporate fundamentals, and recent insider share sales. A recent corporate disclosure provides a critical window into the company’s precarious situation, forcing us to ask: what is really happening at SolDefense, and how should investors navigate these turbulent waters?

This comprehensive SolDefense investor analysis will dissect the latest shareholder report, evaluate the company’s deteriorating financial health, and provide a clear, actionable strategy for current and potential investors. Understanding the layers of risk is the first step toward making an informed decision.

The Catalyst: A Major Shareholder Sells Down

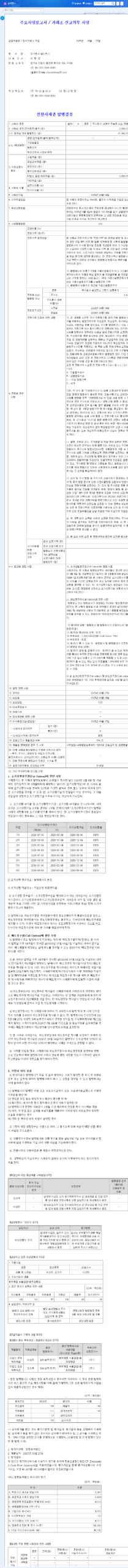

On November 10, 2025, a significant development emerged. SolDefense Co., Ltd. filed a “Report on the Status of Large-Scale Holdings of Stocks, etc. (Simplified)”, which can be viewed in this Official Disclosure. The filing revealed that major shareholder Ji Yoon Jeon and affiliated parties reduced their collective stake by 1.37%, bringing their total ownership down from 6.86% to 5.49%. The stated reasons were stock consolidation and open market sales.

While a 1.37% change may seem minor, sales by insiders and special affiliates are often interpreted as a signal of waning confidence in a company’s future prospects. Given the existing challenges, this move amplifies concerns about management’s own assessment of the path forward.

Analyzing the Red Flags: SolDefense Co., Ltd.’s Financial Health

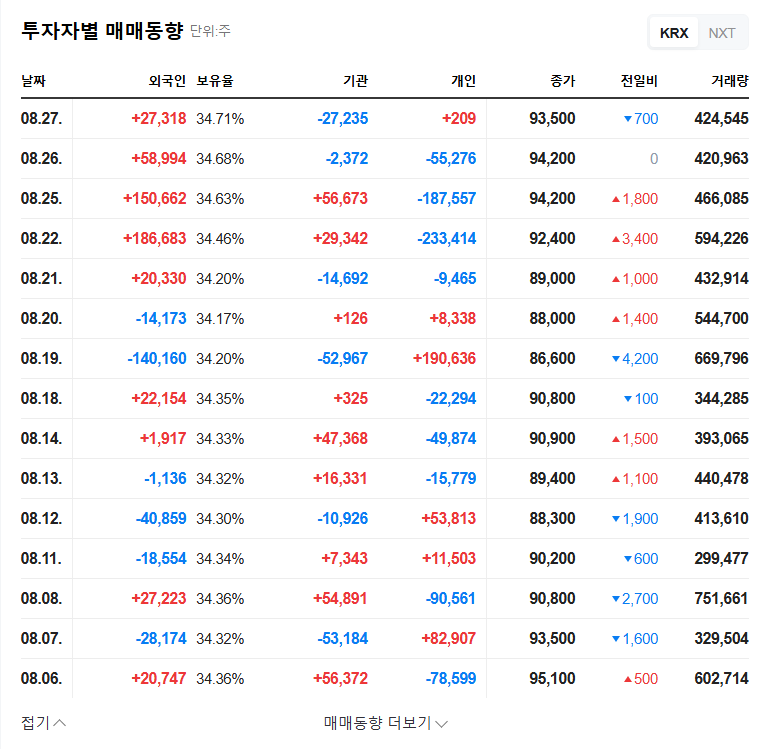

The shareholder sale doesn’t exist in a vacuum. It’s set against a backdrop of deeply concerning corporate fundamentals and operational paralysis. Two factors stand out as critical risks.

1. The Crippling Trading Halt

The most significant risk factor is the persistent SolDefense trading halt, which has been in effect since January 2022. A prolonged halt freezes investor capital, creates immense information asymmetry, and makes rational company valuation nearly impossible. Without a clear timeline for the resumption of trading, any investment remains highly speculative and illiquid.

2. A Pattern of Financial Decay (2022-2024)

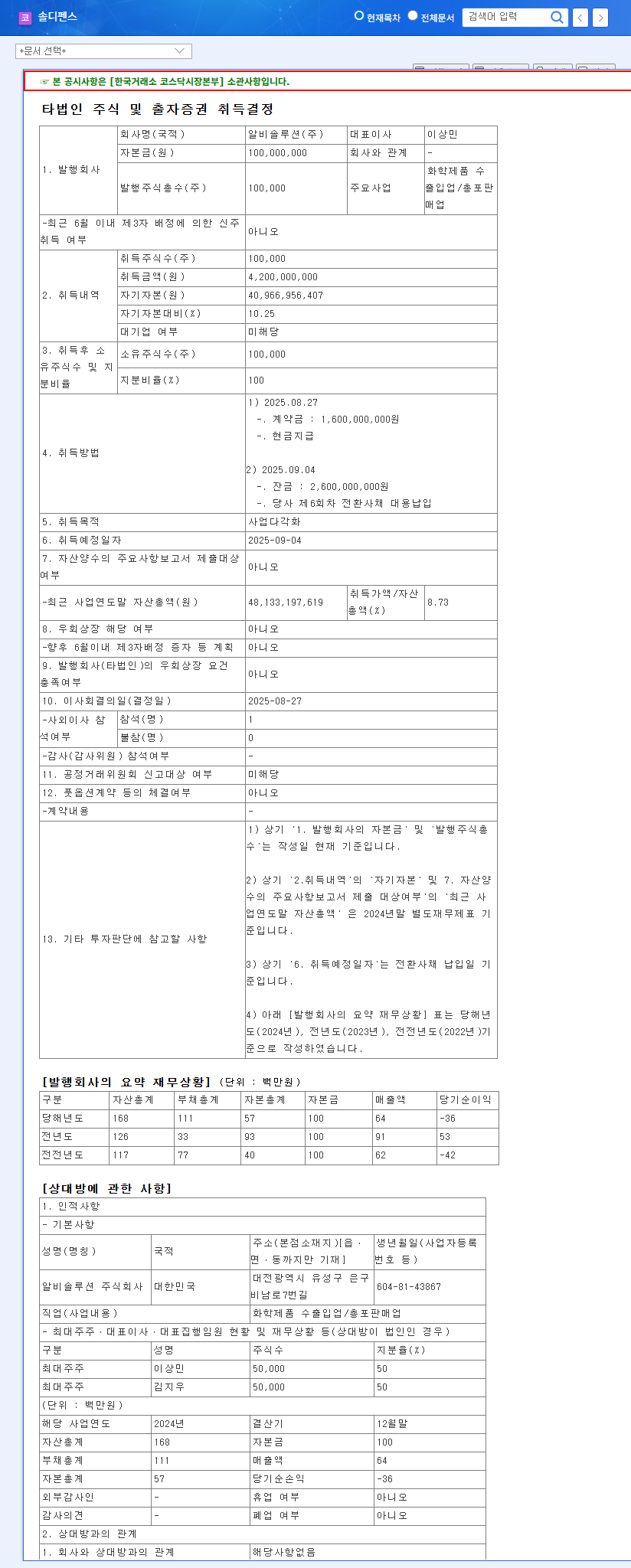

The company’s financial statements paint a grim picture of its operational performance:

- •Plummeting Revenue: After maintaining its top line through 2023, revenue saw a sharp decline to KRW 132.8 billion in 2024.

- •Evaporating Profits: Operating profit fell off a cliff, dropping from KRW 23.0 billion in 2022 to just KRW 6.5 billion in 2024. Consequently, the operating profit margin collapsed from a healthy 16.21% to a meager 4.87%.

- •High Leverage: The debt-to-equity ratio stood at a concerning 102.93% in 2024. A ratio this high indicates that the company relies heavily on debt to finance its assets, increasing financial risk. You can learn more about financial ratios on Investopedia.

The combination of a multi-year trading halt, declining revenue, collapsing profitability, and high debt creates a perfect storm of investment risk. The recent insider sales only serve to confirm the severity of the situation.

Strategic Action Plan for SolDefense Investors

Given the multitude of red flags, a clear and disciplined approach is essential. Here is a recommended action plan for anyone with exposure to or interest in SolDefense Co., Ltd.

Priority #1: Confirm Trading and Listing Status

Before any other analysis matters, the core uncertainty must be resolved. The absolute top priority is to monitor for official announcements from the company and regulatory bodies regarding the potential resumption of trading. Without this, the stock has no market value.

Priority #2: Demand a Credible Turnaround Plan

Should trading resume, investors must meticulously scrutinize the company’s plans to address its financial crisis. Look for concrete, measurable steps for improving financial health, reducing debt, and restoring profitability. Vague promises are not enough. For more on this, see our guide on how to analyze high-risk turnaround stocks.

Investment Outlook: Conservative Observation

At present, initiating a new position in SolDefense Co., Ltd. is fraught with unacceptable risk. The confluence of deteriorating fundamentals and the prolonged trading halt makes this a highly speculative situation. We strongly advise a ‘Conservative Observation’ stance. It is prudent to remain on the sidelines until there is tangible, verifiable evidence of a fundamental business turnaround and a confirmed date for trading resumption.

Frequently Asked Questions (FAQ)

Q1: What is the core issue with SolDefense’s recent shareholder report?

The report indicates a 1.37% decrease in ownership by a major shareholder and their affiliates. This is a negative signal, suggesting that insiders may lack confidence in the company’s ability to recover.

Q2: Is SolDefense Co., Ltd. stock currently tradable?

No. The stock has been under a trading halt since January 2022. This is the single most critical risk factor for investors.

Q3: What does SolDefense’s financial health look like?

The company’s corporate fundamentals are poor. Its 2024 performance showed sharp declines in revenue and profit, and its debt-to-equity ratio is over 100%, indicating high financial risk.

Disclaimer: This report is based on publicly available information, and the ultimate responsibility for investment decisions rests with the individual investor.