DRTECH’s ₩5 Billion Rights Offering: What Happened?

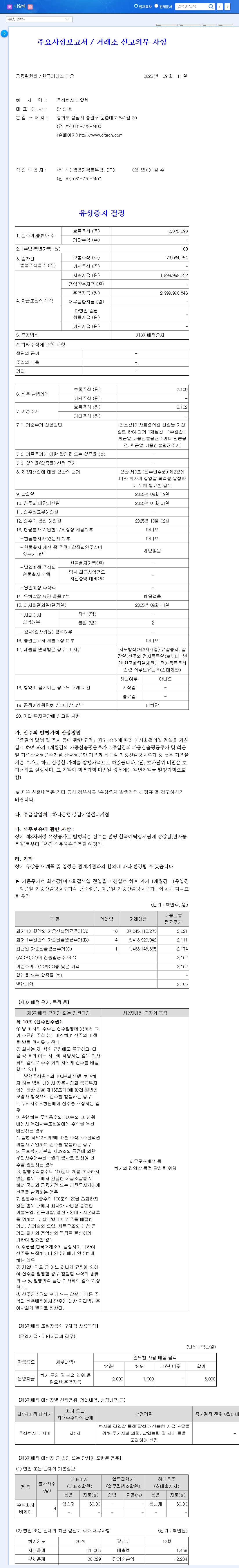

DRTECH announced a rights offering on September 11th to raise ₩5,002,007,920. New shares will be issued to BJ through a third-party allocation. The offering price is set at ₩2,105 per share, with the new shares expected to be listed on October 2nd. The number of shares to be issued is 2,375,296, representing a 3% dilution.

Purpose and Background of the Rights Offering: Why Raise ₩5 Billion?

DRTECH plans to use the proceeds from this rights offering for new product development, R&D investment, and operating expenses. While the company achieved a turnaround to profitability in the first half of 2025, it still faces high debt-to-equity ratios and a net loss on a consolidated basis, highlighting the urgent need for financial improvement. This rights offering is interpreted as a strategic move to strengthen its financial health and secure future growth momentum.

Impact of the Rights Offering on Stock Price

A rights offering can have both positive and negative impacts on stock prices.

Positive Impacts: Improved Financial Structure and Growth Momentum

- Expected improvement in financial structure, including a decrease in debt-to-equity ratio, through raising ₩5 billion

- Securing future growth momentum through new product development and R&D investment

Negative Impacts: Potential Stock Dilution

- Potential dilution of existing share value due to new share issuance

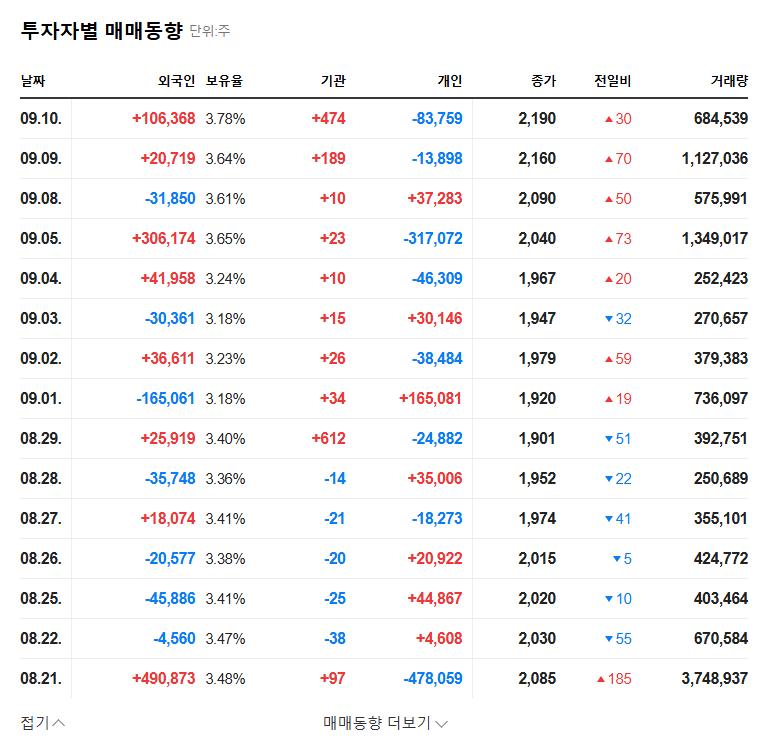

- Possibility of short-term downward pressure on the stock price as the offering price (₩2,105) is similar to the current stock price (₩2,080)

Investor Action Plan

Rather than being swayed by short-term stock price fluctuations, investors should carefully monitor the following factors and develop investment strategies from a mid-to-long-term perspective.

- Use of Proceeds: Investors need to verify whether the funds will be used efficiently and translate into tangible results.

- Future Earnings Improvement Trend: It’s crucial to observe whether the company can maintain its turnaround to profitability and sustain growth momentum.

- Market Reaction and Changes in the Competitive Landscape: Continuous monitoring of market response and competitor activities is essential.

The current investment opinion is ‘Neutral’. The investment outlook may change depending on the use of funds and earnings improvement.

FAQ

How will the DRTECH rights offering affect the stock price?

While there may be downward pressure on the stock price in the short-term due to dilution, there’s also the potential for a positive impact in the long-term through improved financial structure and securing growth momentum.

How will the funds from the rights offering be used?

The funds are planned to be used for new product development, R&D investment, and operating expenses.

Should I invest in DRTECH?

The current investment opinion is ‘Neutral’. It’s recommended to carefully monitor the use of the funds from the rights offering and earnings improvements before making investment decisions.