Recent market movements have put a spotlight on INCAR FINANCIAL SERVICE Co.,Ltd. stock (KOSDAQ: 238500.KQ), prompting investors to look closer. A disclosure filed on November 6, 2025, revealed intriguing shifts in shareholder positions. This report wasn’t just a routine update; it provides critical clues about the company’s internal confidence, management stability, and future value. This comprehensive INCAR FINANCIAL SERVICE analysis will dissect these changes, evaluate the company’s core financial health, and provide a clear investment outlook to help you navigate the opportunities and risks ahead.

While revenue growth remains strong, underlying profitability metrics and a high debt ratio require careful consideration. The key is balancing external growth with internal financial stability.

The Shareholder Shake-Up: What Exactly Happened?

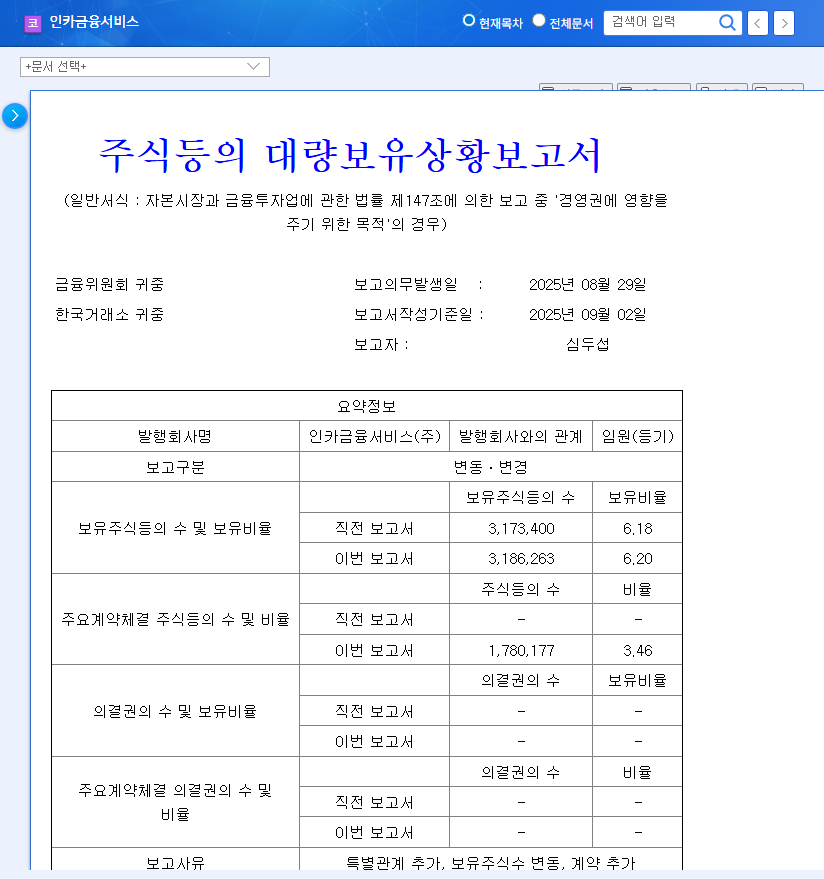

The catalyst for this analysis is the ‘Report on the Status of Large Holdings of Stocks, etc.’ filed by Mr. Byung-Chae Choi, a major shareholder. While his personal stake saw a marginal decrease from 41.56% to 41.55%, the more telling story lies in the concurrent activities of other key insiders. The full details can be verified in the Official Disclosure on the DART system.

Key Insider Transactions

- •Mr. Doo-Seop Shim: Executed the most significant move, purchasing 140,676 shares on the open market between Oct 30 and Nov 5, 2025. This is a substantial vote of confidence.

- •Mr. Tae-Yeol Kim: Acquired 3,000 shares on the market over two days in early November 2025.

- •Mr. Tae-Seop Shin: Added 800 shares via a market purchase in late October 2025.

- •Mr. Dae-Kwon Chun: Transferred 174,500 shares as a gift to his spouse and children, an internal family asset transfer with no immediate impact on management control.

These simultaneous transactions, especially the significant on-market buying, suggest a coordinated belief among insiders in the company’s undervalued potential, making it a critical event for any INCAR FINANCIAL SERVICE investment strategy.

Fundamental Health: A Tale of Growth and Caution

To understand the context of these insider moves, we must examine the company’s underlying financial performance based on its 2025 semi-annual report.

The Bright Spots: Revenue and Innovation

INCAR FINANCIAL SERVICE demonstrated impressive top-line growth, with consolidated semi-annual revenue hitting 468.9 billion KRW, an 18.3% increase year-over-year. This was fueled by strong sales in both non-life and life insurance products. Furthermore, the company is actively investing in its future through business diversification post-KOSDAQ listing and technological advancements like AI agents and integrated financial platforms. This forward-looking strategy is a positive long-term signal.

Areas for Concern: Profitability and Debt

Despite surging revenues, semi-annual operating profit (44.85 billion KRW) and net profit (33 billion KRW) lagged behind the full-year 2024 results, suggesting a potential slowdown in profit growth. The most significant red flag is the high debt-to-equity ratio, which stood at 356% as of June 2025. A high ratio like this indicates significant leverage, which can amplify risk during economic downturns. For more information on this key metric, you can read this guide on the debt-to-equity ratio from a leading financial education site. On a positive note, operating cash flow improved significantly, providing necessary liquidity.

Investor Action Plan: Weighing the Pros and Cons

Given this mixed financial picture, the recent insider buying becomes even more significant. It signals that those with the most information believe the stock’s future is bright despite the challenges. Here’s how to frame your INCAR FINANCIAL SERVICE investment decision.

The Bull Case (Positive Factors)

- •Strong Insider Confidence: Substantial on-market purchases are one of the strongest bullish signals an investor can get.

- •Sustained Revenue Growth: The company continues to successfully expand its market share and top-line revenue.

- •Future-Proofing with Technology: Investments in AI and digital platforms could create significant competitive advantages and new revenue streams.

The Bear Case (Risk Factors)

- •High Financial Leverage: The 356% debt-to-equity ratio is a considerable risk that requires diligent monitoring.

- •Slowing Profitability: Investors need to see that the company can translate its revenue growth into bottom-line profit growth more effectively.

- •Macroeconomic Headwinds: Broader economic uncertainty, including fluctuating interest and exchange rates, could impact investor sentiment across the market. For more on this, see our guide to analyzing financial sector stocks.

In conclusion, the analysis of INCAR FINANCIAL SERVICE Co.,Ltd. stock presents a compelling but complex picture. The strong vote of confidence from insiders is a powerful argument, but it must be weighed against tangible financial risks. A prudent approach would involve initiating a small position and closely monitoring the company’s next few quarterly reports for improvements in profitability and a reduction in the debt ratio before committing further capital.

Disclaimer: This report is prepared based on publicly available information and is for informational purposes only. It is not intended as investment advice. All responsibility for investment decisions rests solely with the investor.