1. What Happened?: Background of the Injunction Withdrawal

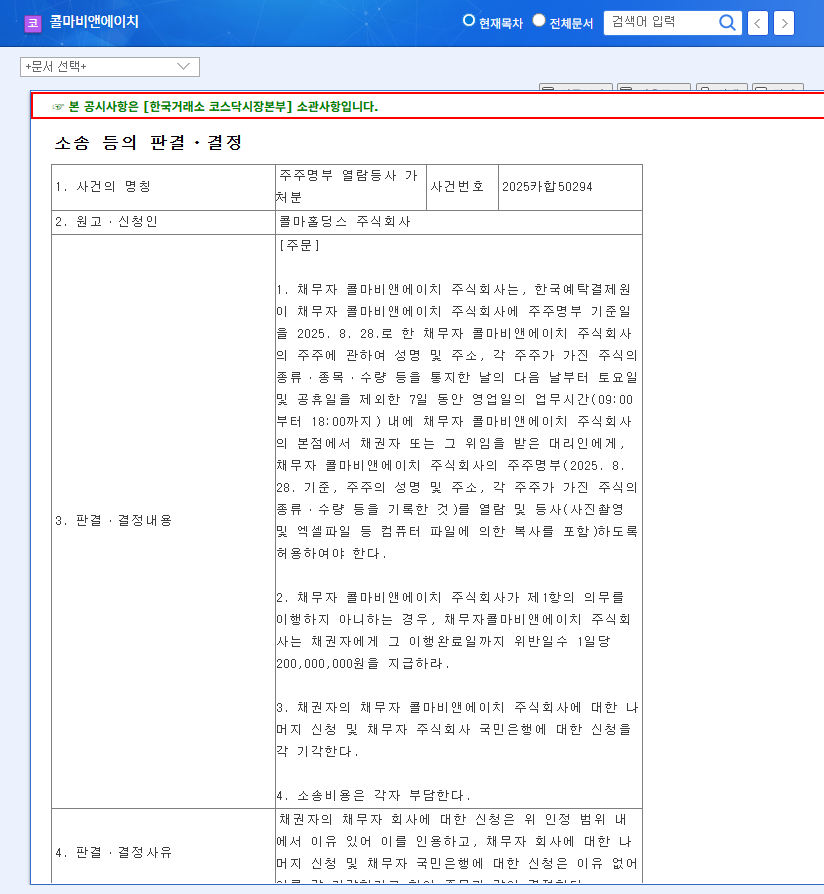

On September 25, 2025, the injunction filed by Mr. Yoon Dong-han was withdrawn. This suggests that the tension surrounding the management dispute may ease somewhat. However, this doesn’t signify the end of the dispute, and the possibility of further legal proceedings, such as immediate appeals, should be considered.

2. Why It Matters: Fundamental and Market Environment Analysis

Kolmar BNH operates in the growing health functional foods and cosmetics ODM/OEM market. However, it has recently shown signs of weakening fundamentals, including declining sales, a high debt ratio, and decreased R&D investment. The uncertain macroeconomic environment (exchange rate, interest rate, and oil price fluctuations) is also a factor that investors should carefully consider.

3. What’s Next?: Impact Analysis and Stock Outlook

- Positive Impact: Reduced management uncertainty and improved investor sentiment could lead to a short-term stock price increase.

- Negative Impact: Fundamental management issues and fundamental problems remain. Without continuous improvement efforts, long-term stock price growth is difficult to expect.

Analysis of past stock data shows that Kolmar BNH is sensitive to market conditions and internal corporate issues. Therefore, it’s important to be aware of the possibility of short-term stock price volatility.

4. What Investors Should Do: Action Plan

Investors should not be misled by the possibility of short-term stock price gains and should carefully consider the following:

- Future trajectory of the management dispute

- Whether fundamentals improve (sales growth, profitability improvement, strengthening financial soundness)

- The company’s ability to respond to changes in the market and macroeconomic environment

From a medium- to long-term perspective, it’s crucial to prioritize fundamental improvements and the establishment of a stable management environment when making investment decisions.

Will the withdrawal of the injunction positively impact Kolmar BNH’s stock price?

It may have a positive impact in the short term, but long-term stock price appreciation depends on whether the company’s fundamentals improve.

Is Kolmar BNH’s management dispute completely resolved?

The withdrawal of the injunction has resolved some uncertainty, but the dispute is not entirely over, and further legal proceedings are possible.

What should investors be cautious of when investing in Kolmar BNH?

Investors should carefully consider the direction of the management dispute, improvements in fundamentals, and the company’s ability to respond to changes in the market and macroeconomic environment.