The latest news surrounding LTC stock (170920) has sent ripples through the investment community. Soosung Asset Management, a significant institutional player, has officially reduced its holdings, a move that demands careful consideration from every current and prospective investor. This action can influence short-term market sentiment and raises critical questions about the company’s long-term trajectory. Is this a red flag signaling underlying issues, or a fleeting market event that creates a prime buying opportunity?

This comprehensive LTC investment analysis will dissect the situation, exploring the immediate impacts, the company’s core fundamentals, and what this means for your investment strategy. We’ll provide the clarity you need to navigate the uncertainty and make an informed decision about the future of your LTC stock position.

Understanding the News: Soosung’s Stake Reduction

The Official Disclosure: What Changed?

On October 2, 2025, a significant disclosure was made. Soosung Asset Management announced a decrease in its holdings of LTC shares from 6.80% down to 4.77%. This 2.03 percentage point reduction is not a trivial adjustment and represents a substantial transaction that the market is bound to notice. You can view the Official Disclosure (DART Source) for complete transparency.

Potential Reasons for the Sale

An institutional sell-off is rarely driven by a single factor. The analysis points to a combination of strategic financial maneuvers:

- •Convertible Bond (CB) Strategy: Soosung executed a multi-part strategy involving its privately placed Convertible Bonds. A portion was sold off-market, while another was converted into shares, directly impacting the overall holding percentage as part of a standard CB investment cycle.

- •Profit Realization & Rebalancing: Over 200,000 common shares were sold directly on the open market. This could be a classic case of realizing profits after a period of growth or a strategic rebalancing of their portfolio to manage risk and allocate capital to other opportunities.

It’s crucial to distinguish between a strategic portfolio adjustment by an institution and a flight from a company with failing fundamentals. Often, the former creates opportunity for retail investors.

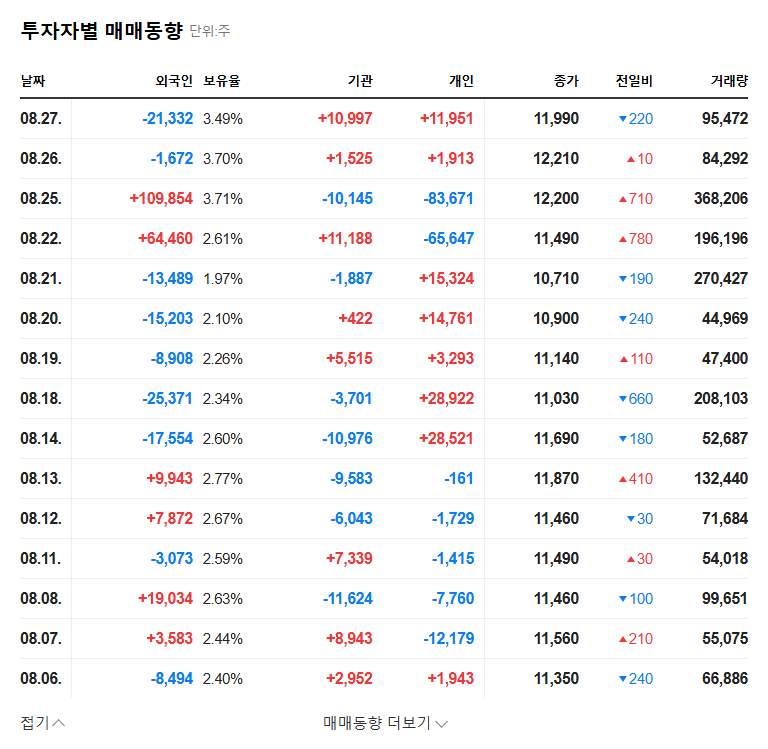

Analyzing the Impact on the LTC Share Price

Immediate Market Reaction: The Supply Pressure Effect

In the short term, news of a major investor reducing their stake can weaken investor sentiment. The on-market sale of over 200,000 shares introduces significant selling pressure. This sudden increase in supply, without an equivalent increase in demand, could lead to a temporary dip in the LTC share price. Traders should be prepared for heightened volatility.

The Bigger Picture: Is This a Fundamental Shift for LTC Stock?

While the short-term noise is important, long-term investors must look deeper. The 2% stake reduction is significant but may not signal a complete loss of faith in LTC’s core business. The crucial factor is whether the company’s fundamentals remain intact. While the converted CBs create a potential for future share supply (an ‘overhang’), this is a technical market factor, not necessarily a reflection of poor business performance. The real determinants of long-term value will be LTC’s operational results and broader market trends, such as those covered by financial authorities like Bloomberg’s market analysis.

A Deep Dive into LTC’s Core Fundamentals (H1 2025)

To truly gauge the LTC stock forecast, we must look past this single event and examine the company’s health. The H1 2025 report provides a solid foundation:

- •Resilient Revenue: Consolidated revenue reached 137.2 billion KRW, maintaining year-on-year growth. While the pace has slowed, indicating potential headwinds in the semiconductor and display sectors, the top line remains robust.

- •Improved Profitability: Operating profit showed positive improvement. This suggests strong cost management and a successful focus on higher-margin products, a sign of operational efficiency.

- •Future-Focused Investment: LTC maintains a stable capital structure while actively investing in R&D and new business ventures to secure future growth engines.

These fundamentals suggest that the company’s intrinsic value proposition has not been fundamentally altered by Soosung’s recent sale. For more on evaluating company health, you can read our guide to fundamental analysis.

Strategic LTC Investment Analysis: Your Action Plan

So, how should you position yourself? Your approach to this LTC stock news depends heavily on your investment horizon.

For the Short-Term Trader

Caution is the word of the day. The selling pressure from Soosung could lead to price drops and volatility. Consider a wait-and-see approach or be prepared to implement strict stop-loss orders to manage downside risk if you decide to enter a position.

For the Mid-to-Long-Term Investor

This is where the opportunity may lie. If you believe in LTC’s solid fundamentals and its long-term strategy, a temporary price dip caused by this market event could be an attractive entry point. A patient investor who is not swayed by short-term noise may find this an ideal moment to initiate or add to a position, focusing on the recovery of the semiconductor industry and the performance of LTC’s new business ventures.