The whispers surrounding a potential Hugel Inc. delisting have created a cloud of uncertainty for shareholders and market watchers alike. Sparked by earlier reports and reignited by a recent disclosure, this news has left many Hugel investors questioning the future of their holdings. However, beneath the noise of market speculation lies a company with demonstrably strong fundamentals and a clear growth trajectory. This comprehensive analysis will dissect the delisting situation, evaluate Hugel’s core business strength, and provide a clear Hugel investment strategy for navigating the path ahead.

Is the delisting concern a genuine threat or a fleeting distraction from a powerful growth story? For investors, the key is to separate the signal from the noise and make decisions based on a complete picture of risk and opportunity.

Unpacking the Hugel Inc. Delisting Saga

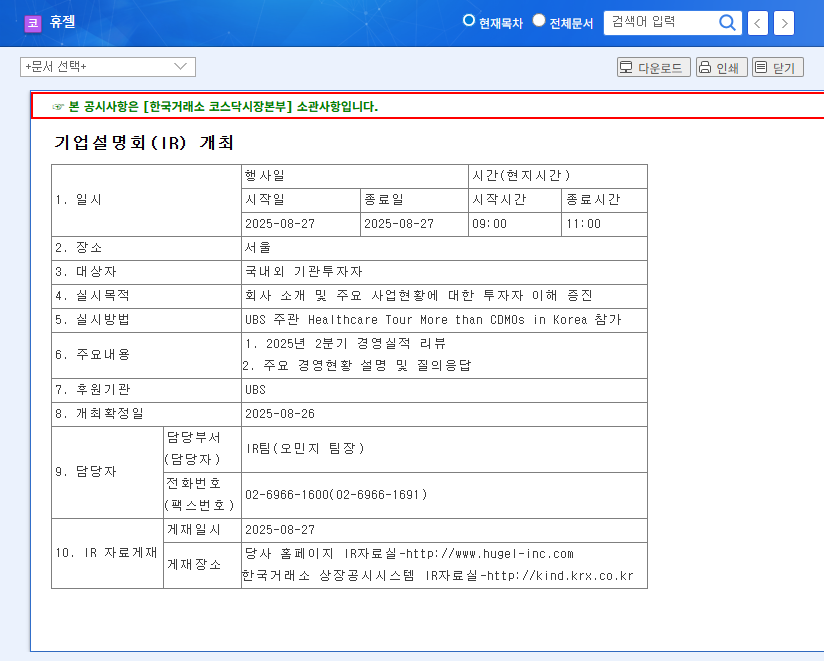

The story began on July 12, 2022, when a Bloomberg report first suggested that the CBC Group was exploring the possibility of delisting Hugel, Inc. Fast forward to November 7, 2025, when the company issued a reaffirmed disclosure regarding this matter. According to the filing, the largest shareholder, Aphrodite Acquisition Holdings LLC, is actively reviewing various strategic options concerning corporate governance. The crucial takeaway, however, is that no definitive decisions have been made. The market now awaits a follow-up disclosure, expected by February 6, 2026.

This official statement, while not entirely dismissing the possibility, serves to temper immediate fears. You can view the Official Disclosure on DART for complete transparency.

Beyond the Headlines: A Deep Dive into Hugel’s Fundamentals

While market sentiment can be swayed by headlines, a company’s true value is anchored in its performance. For potential Hugel investors, understanding the company’s core financial health is non-negotiable. The latest data from H1 2025 paints a picture of a robust and growing enterprise, providing a strong counter-narrative to the delisting uncertainty.

Key Pillars of Hugel’s Financial Strength

- •Explosive Revenue Growth: Hugel isn’t just growing; it’s accelerating. Sales revenue surged by an impressive 18.6% year-over-year in the first half of 2025, breaking the KRW 200 billion mark. This growth is powered by its flagship products, with the toxin (Botulax, 50.46%) and HA filler (The Chaeum, 34.24%) segments being the primary revenue drivers.

- •Aggressive Global Expansion: The company is successfully breaking new ground internationally. Landmark FDA approval in the United States and the initiation of sales in Europe have significantly broadened its market reach. This global footprint is a testament to its product quality and strategic vision, with massive potential still untapped in markets like China.

- •A Fortress-Like Balance Sheet: Financial stability is paramount. As of H1 2025, Hugel boasted a remarkably low debt-to-equity ratio of just 13.55%. This indicates minimal financial risk and a strong capacity to fund future growth, backed by substantial cash reserves.

- •Commitment to Innovation: Hugel continues to invest in R&D to secure future growth engines, exploring new product indications and venturing into adjacent business areas to maintain its competitive edge.

Weighing the Outcomes: Potential Scenarios for Hugel Stock

Investors must consider both sides of the coin. The ongoing strategic review creates a fork in the road, with distinct potential impacts on the Hugel stock price and investor sentiment.

The Bull Case (Positive Impacts)

If the review concludes with a decision to remain listed, investor sentiment could see a significant recovery. The removal of this overhang would allow the market to refocus on Hugel’s fundamentals. The company’s strong performance and growth prospects could then act as a powerful defense, preventing any lasting damage to its valuation and potentially driving the share price higher.

The Bear Case (Negative Impacts)

Conversely, the phrase “reviewing strategic options” keeps the possibility of delisting on the table. This lingering uncertainty can fuel volatility and put downward pressure on the stock in the short term. An actual decision to delist would likely trigger a significant price drop and create liquidity challenges for existing shareholders.

Crafting Your Hugel Investment Strategy

Given the current climate, a one-size-fits-all approach is unwise. Your Hugel investment strategy should align with your risk tolerance and investment horizon. For further reading, you can explore our guide to analyzing biotech stocks.

- •For the Cautious Investor (Short-Term): The most prudent approach is to observe from the sidelines. Monitor share price volatility and market reactions leading up to the February 2026 disclosure. Waiting for the uncertainty to resolve before committing capital is a sound defensive strategy.

- •For the Value Investor (Long-Term): If you have strong conviction in Hugel’s business model, global growth, and R&D pipeline, the current market anxiety could present a value buying opportunity. This strategy requires acknowledging and accepting the delisting risk while betting on the long-term fundamental strength of the company.

- •For All Investors: Diligent information monitoring is crucial. Keep a close watch on all official company disclosures and news related to the major shareholder’s review. Being informed will allow you to adjust your strategy flexibly as the situation evolves.

Frequently Asked Questions (FAQ)

Q1: Is the Hugel Inc. delisting confirmed?

No. While a review of strategic options is underway by its major shareholder, Hugel’s official disclosure on November 7, 2025, clarified that no definitive decisions have been made. The situation remains unconfirmed.

Q2: How strong are Hugel’s current business fundamentals?

Hugel’s fundamentals are very strong. As of the first half of 2025, the company shows significant revenue growth from its core toxin and filler businesses, successful global market expansion (including US FDA approval), and a very solid, low-debt financial structure.

Q3: When can we expect more information?

Hugel has stated it will provide a re-disclosure on the matter within three months of its last announcement, which sets the deadline at February 6, 2026.