The recent news about the LegoChem Biosciences treasury stock disposal has sparked questions among investors. On the surface, a multi-billion KRW transaction seems significant. But is this event a routine corporate procedure to reward employees, or does it signal underlying issues that shareholders should be concerned about? This comprehensive analysis dives deep into the context, impact, and future outlook for investing in LegoChem, providing the clarity you need to make informed decisions.

The Announcement: A Breakdown of the Disposal

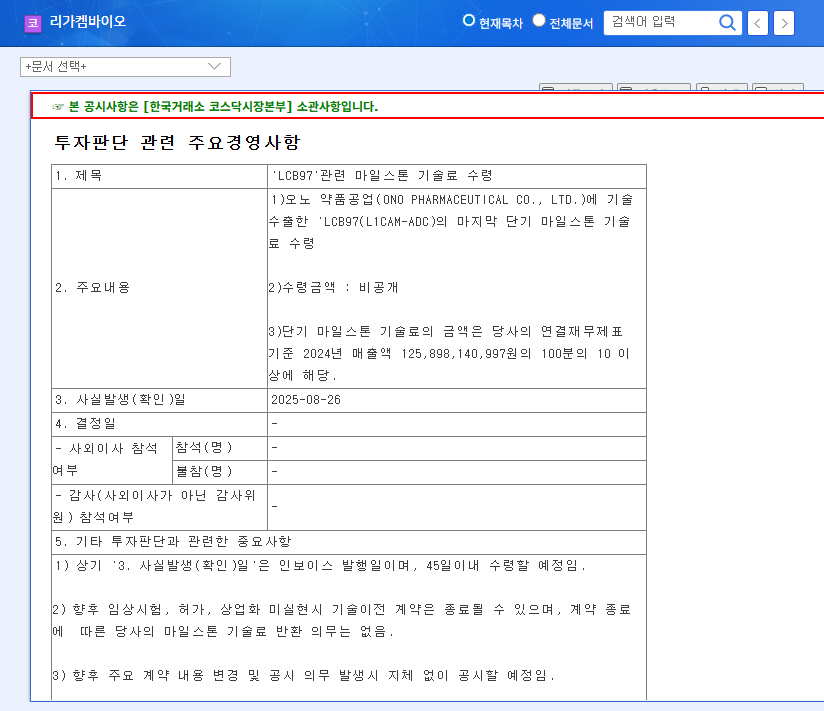

On October 1, 2025, LegoChem Biosciences Inc., a prominent R&D specialist in novel drug development, formally disclosed its decision to dispose of 36,218 of its common treasury shares. This block of shares holds an approximate market value of KRW 5.1 billion. The announcement, detailed in the ‘Report on Major Matters (Decision to Dispose of Treasury Shares),’ clarifies the transaction’s singular and specific purpose: to fulfill obligations arising from a stock option exercise by employees. You can view the complete filing here: Official Disclosure: View DART Report.

Behind the Decision: LegoChem’s Corporate DNA

To understand this decision, one must first understand LegoChem Biosciences. The company is a global leader in medicinal chemistry, with a primary focus on developing Antibody-Drug Conjugate (ADC) anticancer therapies. This move is deeply rooted in the company’s operational and financial structure.

Pioneering ADC Technology

LegoChem’s core value proposition is its proprietary next-generation ADC technology platform, ConjuALL. Think of ADCs as ‘smart bombs’ for fighting cancer; they combine a targeted antibody that seeks out cancer cells with a potent drug payload to destroy them, minimizing damage to healthy tissue. This innovative approach has attracted massive attention, leading to technology transfer agreements with leading global pharmaceutical companies like Janssen and AMGEN, totaling approximately KRW 9.4 trillion in potential value. This technological edge is the engine of the company’s long-term growth prospects.

Financial Health and R&D Investment

Like many clinical-stage biotechnology firms, LegoChem’s financials exhibit high revenue volatility tied to the timing of technology transfer milestones. The company experiences ongoing operating losses, a direct result of its heavy and necessary investment in research and development. In the first half of 2025, R&D expenses accounted for a staggering 91.80% of revenue. This high cash burn is not a sign of distress but rather a hallmark of a company committed to groundbreaking innovation. The stock option exercise, therefore, is a strategic tool to motivate and retain the elite scientific talent required for this intensive R&D work.

This treasury stock disposal is not a financial maneuver affecting market fundamentals, but an internal mechanism to reward and incentivize the brilliant minds driving LegoChem’s long-term value.

Impact on LegoChem Stock Analysis: Bull vs. Bear

The Positive Case: Employee Confidence and Motivation

The primary positive takeaway is the boost to employee morale and motivation. By facilitating the stock option exercise, the company rewards its team for past achievements and aligns their interests with those of shareholders. In the hyper-competitive biotech industry, retaining top-tier talent is paramount. This action signals that employees are confident in the company’s future, as they are choosing to exercise their options—an inherently bullish act. The clear and transparent purpose of the disposal also prevents market speculation and misunderstanding.

The Neutral Case: Limited Short-Term Impact

From a purely financial perspective, the event’s impact is minimal. Because this transaction uses existing treasury shares rather than issuing new ones, there is no dilution of shareholder equity. Furthermore, a KRW 5.1 billion transaction is negligible when compared to LegoChem’s multi-trillion KRW market capitalization and its KRW 9.4 trillion pipeline of technology transfer deals. Therefore, the event causes no material change to the company’s fundamentals and is unlikely to have a direct or lasting effect on the short-term stock price.

Investor Action Plan: Focus on the Fundamentals

A savvy LegoChem stock analysis must look past minor events like this and focus on the core drivers of the company’s value. The company’s destiny is tied to its scientific breakthroughs, not its treasury stock management. Investors should direct their attention to the following key catalysts:

- •ADC Pipeline Clinical Success: The single most important factor is the progress of clinical trials for its core ADC drug candidates. Positive data from Phase II and Phase III trials can be transformative, leading to major stock re-ratings.

- •Additional Technology Transfer Deals: Watch for announcements of new partnerships and licensing agreements. Each new deal validates the ConjuALL platform and provides non-dilutive funding in the form of upfront payments and future milestones.

- •Global Competitive Landscape: The ADC market is dynamic and increasingly competitive. Investors should monitor the progress of competitors and stay informed about broader technological trends in oncology.

In conclusion, the LegoChem Biosciences treasury stock disposal is a non-event for the long-term investment thesis. It is a standard operational procedure that reflects positively on internal company morale. True value for investors will be unlocked not by share transfers, but by scientific and clinical success. The focus should remain squarely on the company’s innovative ADC technology and pipeline, which holds the key to its future growth and market leadership.