What Happened? Park Systems Held an IR!

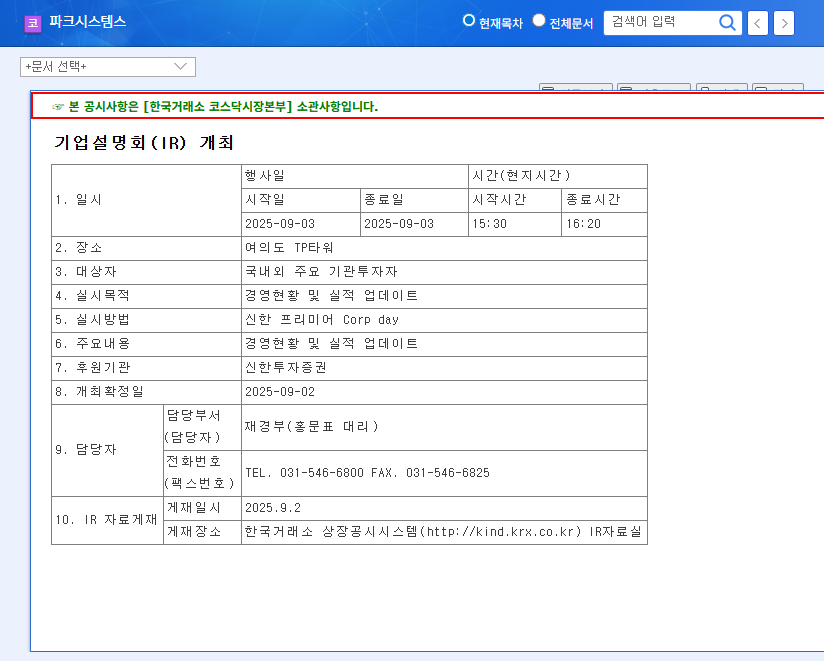

Park Systems, with a market capitalization of KRW 1.73 trillion, held an IR session on September 3, 2025, to update investors on its current business status and financial performance.

Why is this IR Important?

This IR serves as a crucial indicator for investors to assess Park Systems’ growth, profitability, and technological competitiveness, informing future investment decisions. Investors eagerly await details on the company’s growth strategy and market response following the acquisition of Lyncee Tec SA and its DHM technology.

Key Takeaways from the IR Analysis

- Positive Factors: Robust fundamentals, growth potential of DHM technology, and strengthened global market competitiveness are expected to improve investor sentiment and lead to a positive re-evaluation of the company’s value.

- Negative Factors: Potential for profit-taking if the IR fails to meet market expectations, sensitivity to global economic and interest rate volatility, and foreign exchange risk.

- Neutral Factors: Stable financial structure, high proportion of industrial equipment sales, and continuous R&D investment.

Action Plan for Investors

The long-term investment outlook for Park Systems is positive. However, investors should carefully monitor the IR details, market response to DHM technology, macroeconomic factors, and exchange rate fluctuations to inform their investment decisions.

FAQ

What is Park Systems’ main business?

Park Systems develops and manufactures atomic force microscopes (AFM). They recently acquired DHM technology, expanding their business portfolio.

What is DHM technology and how will it impact Park Systems?

DHM (Digital Holographic Microscope) is a 3D surface metrology technology. It’s expected to broaden Park Systems’ product portfolio and serve as a new growth engine.

What should investors consider when investing in Park Systems?

Investors should consider macroeconomic factors such as global economic conditions, interest rate volatility, and exchange rate fluctuations. It’s crucial to monitor IR details and the market reception of DHM technology.