1. What Happened? GnC Energy Announces Convertible Bond Issuance

On September 11, 2025, GnC Energy announced the issuance of 14.7 billion KRW in convertible bonds. The issuance method is private placement, with a conversion price of 34,450 KRW, significantly higher than the current market price of 1,485 KRW. The payment date is September 19th, and the conversion period is from October 19, 2025, to August 19, 2028.

2. Why the Issuance? Funding Objectives and Underlying Implications

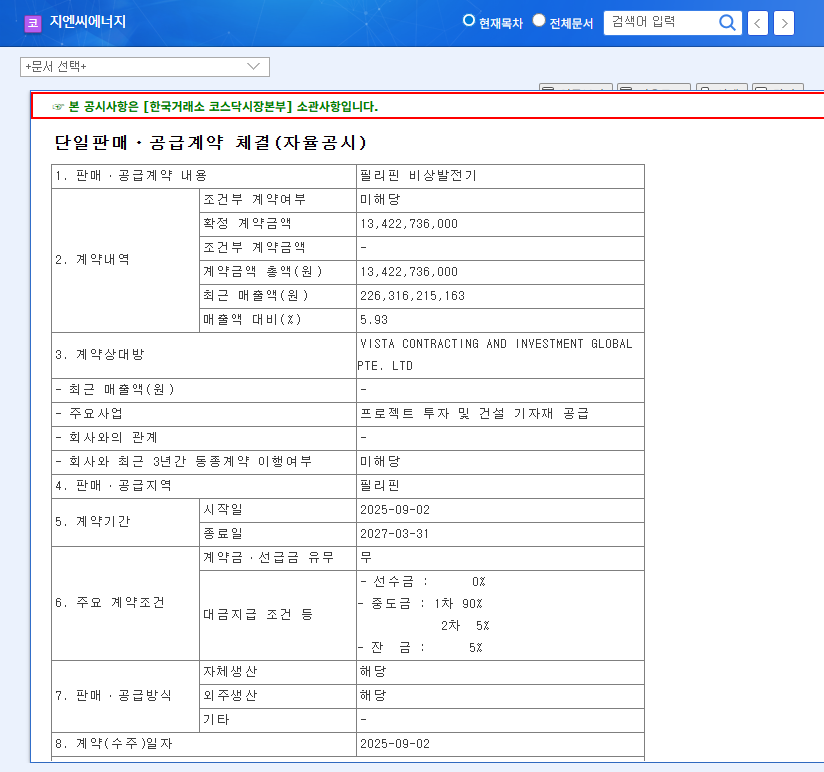

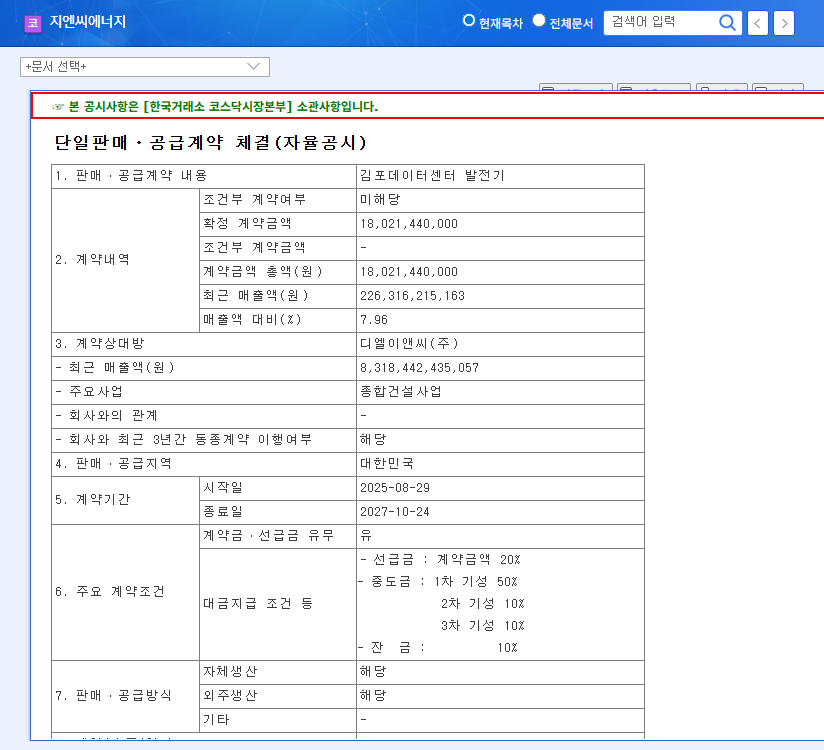

GnC Energy has been actively pursuing business diversification and overseas expansion through the incorporation of new subsidiaries. This bond issuance is likely aimed at securing the necessary funding to support these growth strategies. Specifically, the company is focused on securing investments for future growth engines such as hydrogen fuel cell power plants and edge data centers.

3. What’s the Impact? Analyzing the Positive and Negative Effects

- Positive Aspects: Secure funding for new business investments, potential capital increase upon stock price appreciation.

- Potential Negative Aspects: Large gap between conversion price and current market price, repayment burden at maturity, potential stock dilution.

Due to the possibility of conversion to stock, convertible bonds have a complex impact on stock prices. The high conversion price relative to the current market price could exert upward pressure on the stock in the short term. However, if the stock price fails to reach the conversion price, the bonds may not be converted, leading to a repayment burden.

4. What Should Investors Do? Key Checkpoints and Investment Strategies

Investors should carefully consider the following factors:

- Monitor stock price trends.

- Understand the investment strategy of the mezzanine fund investor.

- Verify the fund utilization plan and business performance.

- Analyze GnC Energy’s fundamentals and external environment changes.

Frequently Asked Questions

What are convertible bonds?

Convertible bonds are bonds that can be converted into shares of the issuing company’s stock.

Will this bond issuance positively impact the stock price?

It’s uncertain in the short term. Long-term positive impact can be expected depending on the company’s growth, but caution is needed due to the significant difference between the conversion price and the current market price.

What are the key points to consider when investing?

Comprehensive consideration of stock price trends, investor strategy, fund usage plans, and fundamentals is necessary.