Investors are closely watching SY CO., LTD. stock (109610) following a recently disclosed Major Shareholding Status Report. While changes in ownership can signal shifts in management stability, a truly informed investment decision requires a much deeper look. It’s critical to move beyond the headlines and conduct a thorough fundamental analysis of the company’s intrinsic value, financial health, and the broader macroeconomic landscape.

This comprehensive report breaks down the key details of the shareholding changes and provides a meticulous SY CO., LTD. fundamental analysis based on its 2025 half-year report. We will explore its profitability, growth drivers, and critical risk factors to offer a clear, actionable investment strategy for the future of the 109610 stock.

The Shareholding Report: What Really Changed?

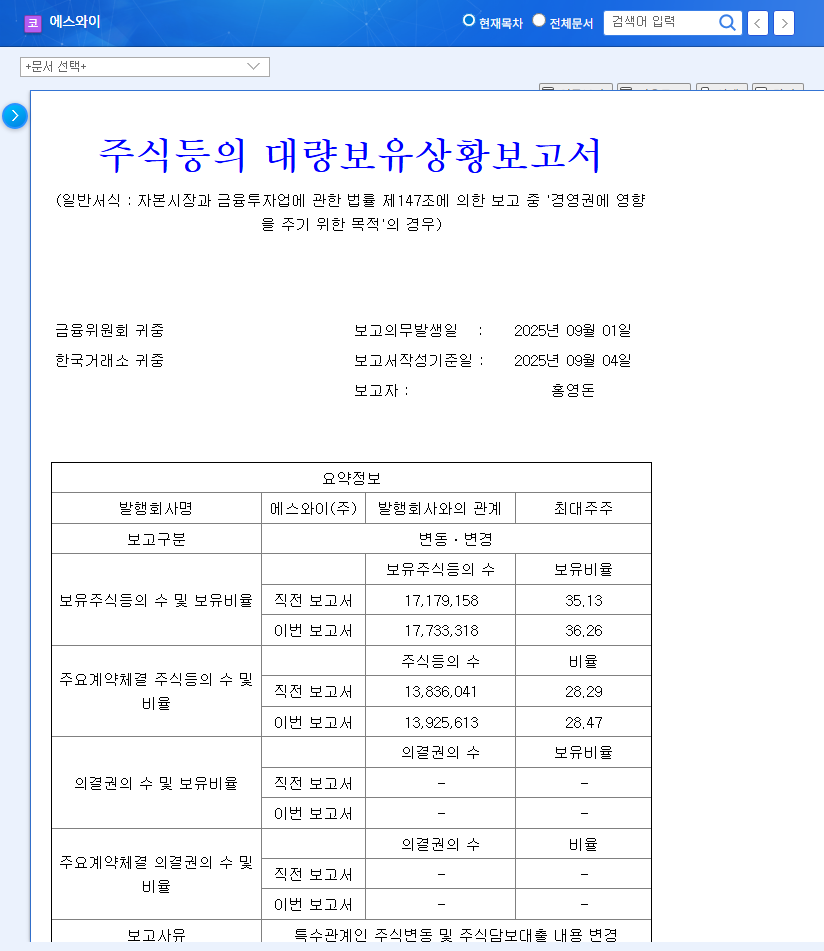

On November 5, 2024, SY CO., LTD. filed its Major Shareholding Status Report, an event that warrants careful consideration. The full details can be viewed in the Official Disclosure (DART). Here are the key takeaways:

- •Minor Stake Increase: The total shareholding of CEO Hong Young-don and related parties increased fractionally from 36.26% to 36.28%.

- •Purpose: The stated purpose for the holding is to influence management control, signaling a move to consolidate leadership and stabilize operations.

- •Transaction Details: The change resulted from SB Holdings Co., Ltd. purchasing 307,689 shares, while related party Kim Ok-ju sold 327,291 shares.

This subtle increase can be interpreted as a strategic move by the core leadership to reaffirm their commitment and tighten their grip on the company’s direction. While not a dramatic shift, it suggests a focus on long-term stability from the top.

SY CO., LTD. Fundamental Analysis: Beyond the Numbers

To understand the true value of SY CO., LTD. stock, we must look at its operational performance and financial health as detailed in the 2025 half-year report.

Profitability and Revenue Challenges

The company’s top-line performance shows signs of strain. Consolidated revenue for the first half of 2025 was KRW 252,238 million, a 12.6% decrease year-over-year. This slump is primarily attributed to a slowdown in the domestic construction market, affecting key products like sandwich panels and deck plates, compounded by a steep 46.3% decline in exports.

Interestingly, the company reported a net profit of KRW 16,231 million, a positive turnaround. However, this figure is heavily skewed by a one-time gain of KRW 15,740 million from the sale of investment shares in SY Steeltech. The core operating profit margin fell sharply from 12.11% to 5.22%, indicating that the underlying business profitability has weakened. This is a critical distinction for any stock analysis of 109610.

Financial Health and Risk Factors

The balance sheet reveals several areas that require monitoring:

- •High Debt Load: The debt-to-equity ratio remains elevated at 107.56%. While manageable, this level of debt can increase financial risk during periods of rising interest rates. For context, you can learn more about what constitutes a healthy debt-to-equity ratio on Investopedia.

- •Rising Inventory: Inventory assets have increased to KRW 68,551 million, suggesting a potential burden from sluggish sales that could lead to future write-downs.

- •External Volatility: The company is vulnerable to raw material price swings and currency fluctuations. A 5% change in the USD exchange rate could impact after-tax profit by approximately KRW 1.8 billion.

- •Litigation Risk: Seven ongoing lawsuits represent a potential, unquantified financial liability.

Growth Drivers and Future Outlook

Despite the challenges, SY CO., LTD. is actively pursuing several avenues for growth. Success in these areas is key to the long-term SY CO., LTD. stock forecast. Initiatives include overseas expansion in Vietnam and Nepal, R&D in eco-friendly and solar panels, and business diversification into new subsidiaries like SY Green Energy and SY Cosmetics. The performance of these new ventures will be crucial in offsetting the slowdown in its core construction materials business.

Investor Action Plan & Final Recommendation

Considering all factors, a cautious and patient approach is warranted. The management’s move to stabilize control is a modest positive, but it does not outweigh the fundamental headwinds the company is facing.

Key Watch Points for Investors:

- •Core Profitability: Look for a recovery in revenue and operating profit margin from the main business, independent of one-off gains.

- •New Venture Success: Monitor for tangible revenue and profit contributions from new businesses and overseas expansion.

- •Financial Deleveraging: Watch for progress in reducing the debt-to-equity ratio and managing inventory levels effectively. To learn more about financial health, see our Guide to Analyzing Financial Reports.

Overall Opinion: SY CO., LTD. is at a crossroads. While leadership appears stable, the company must prove it can restore profitability in its core operations and successfully execute its diversification strategy. At this time, a ‘Wait-and-See’ approach is the most prudent strategy. Investors should closely monitor upcoming earnings reports for signs of a fundamental turnaround before committing capital.

Disclaimer: This analysis is for informational purposes only. All investment decisions are the sole responsibility of the investor.