KB Financial Group H1 2025 Earnings Analysis

KB Financial Group achieved KRW 3.45 trillion in net income for the first half of 2025, demonstrating robust growth. With solid fundamentals, including a BIS ratio of 16.36% and an ROE of 12.01%, the company maintains stable growth. The growth of its non-banking sector and proactive risk management are key competitive advantages.

Korea Capital Market Conference 2025: What to Expect

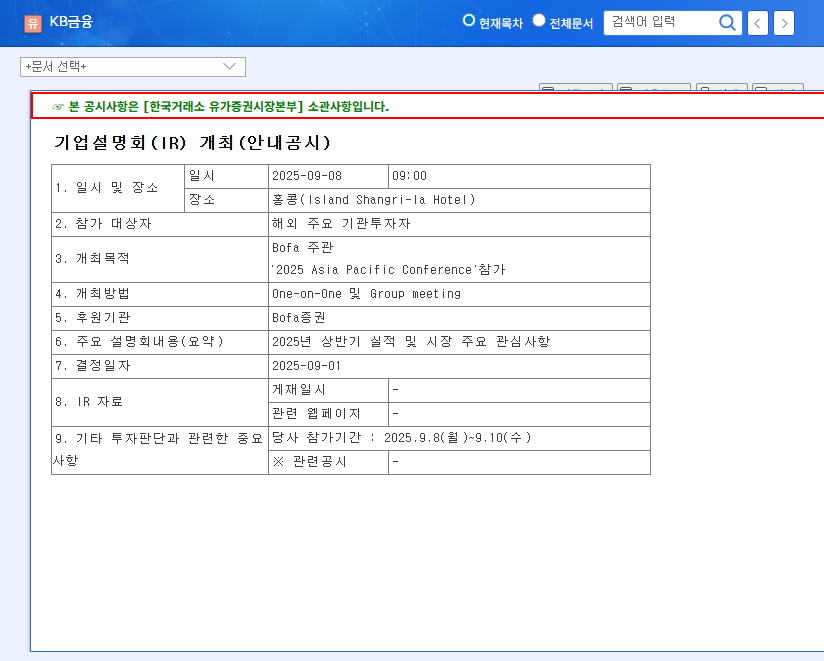

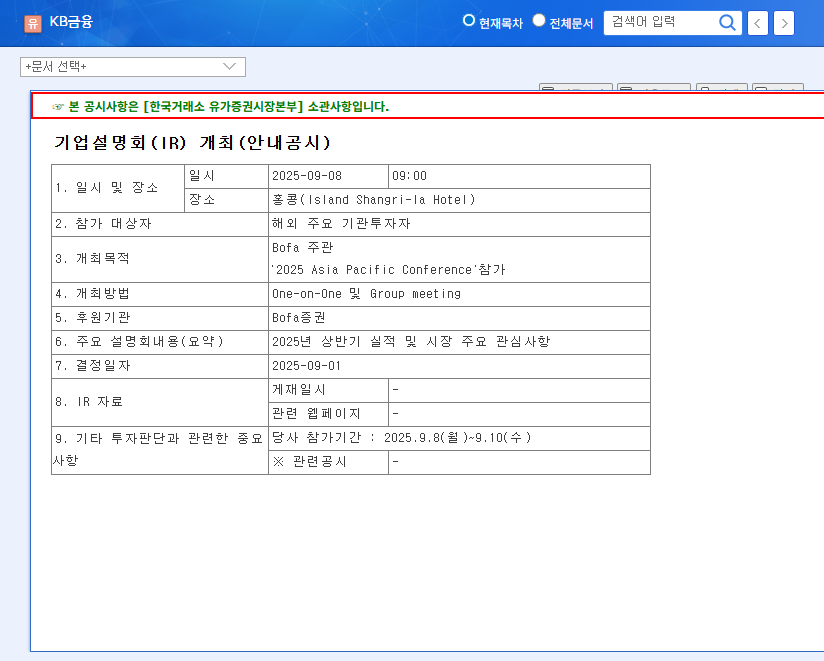

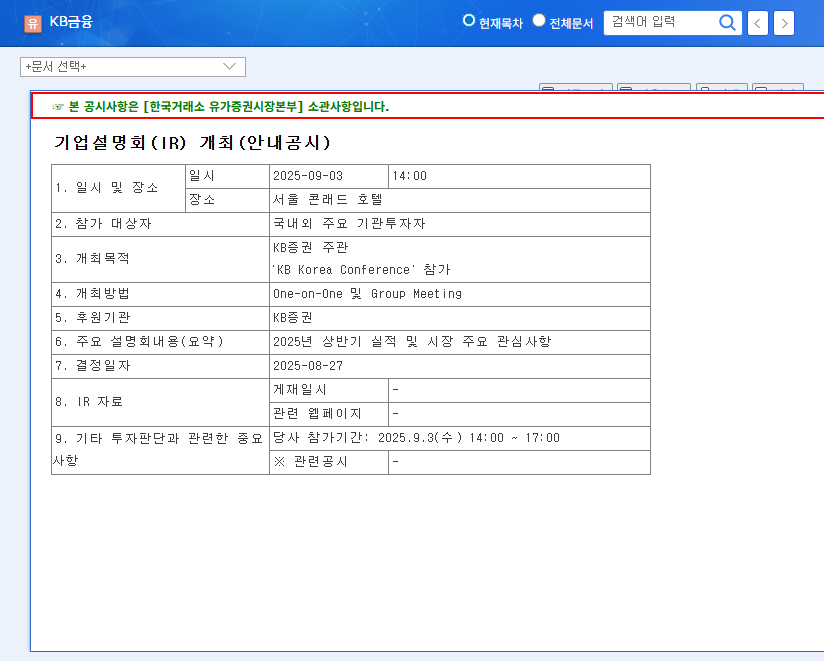

At the Korea Capital Market Conference 2025 on September 29th, KB Financial Group will share its future growth strategies along with its H1 2025 earnings results. This is a crucial opportunity to understand KB’s future vision, including digital innovation and ESG management. The IR event is expected to generate positive investor sentiment and potentially act as a catalyst for stock price appreciation.

Key Information for Investors

- Strengths: Strong fundamentals, solid earnings growth, diversified business portfolio

- Opportunities: Positive market environment, growth potential, proactive IR activities

- Risks: Macroeconomic uncertainty, intensifying competition in the financial market

- Action Plan: Review IR event details, analyze market conditions, re-evaluate investment strategy

Frequently Asked Questions

What are KB Financial Group’s key financial results for H1 2025?

KB Financial Group achieved KRW 3.45 trillion in net income for the first half of 2025, a 23.8% year-over-year increase.

When is the Korea Capital Market Conference 2025?

It will be held on September 29, 2025.

What should investors consider when investing in KB Financial Group?

Investors should consider risk factors such as macroeconomic uncertainty and intensifying competition in the financial market.