A recent development concerning S&S TECH CORPORATION, a pivotal player in the advanced semiconductor materials sector, has captured the attention of investors. A minor adjustment in shareholding by institutional giant Mirae Asset Management raises important questions. While the change itself is small, it serves as a catalyst to re-evaluate the company’s trajectory, especially given its critical role in the burgeoning EUV blank mask and pellicle market. This analysis will dissect the shareholding report, examine the fundamentals of the S&S TECH stock, and consider macroeconomic headwinds to provide a comprehensive outlook for informed investment decisions.

The Mirae Asset Management Shareholding Adjustment

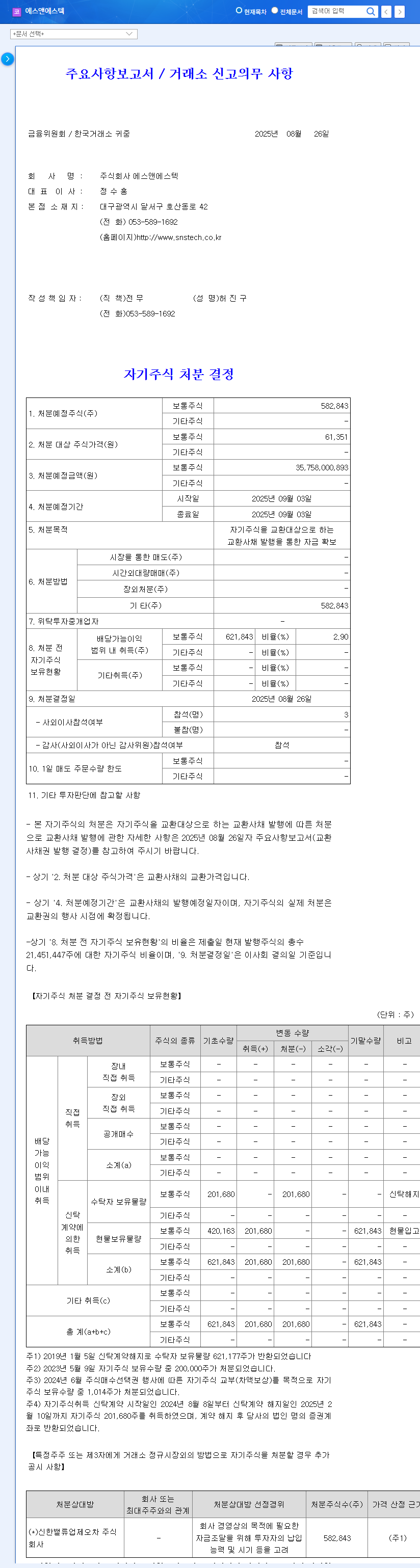

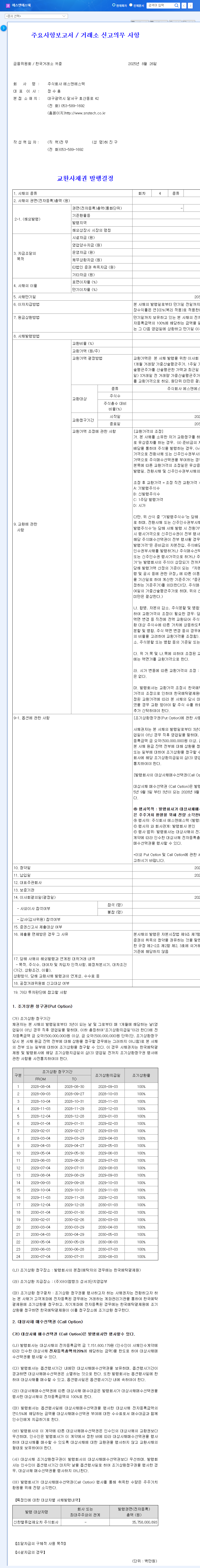

On November 5, 2025, an official disclosure revealed a change in Mirae Asset Management’s stake in S&S TECH CORPORATION. The filing, accessible via the official DART report (Official Disclosure), detailed a minor decrease in ownership.

- •Previous Stake: 5.00%

- •New Stake: 4.96%

- •Net Change: A reduction of 0.04 percentage points.

This adjustment resulted from open market transactions, including a sale of 34,574 shares, between October 15 and October 28, 2025. While seemingly insignificant, any move by a major institutional investor warrants a closer look at the company’s underlying health and future prospects.

The Critical Role of S&S TECH in the EUV Revolution

To understand the long-term value of S&S TECH CORPORATION, one must first appreciate its position in the semiconductor manufacturing process. The company specializes in materials for Extreme Ultraviolet (EUV) lithography, the cutting-edge technology used to produce the world’s most advanced microchips for AI, high-performance computing, and mobile devices.

What are EUV Blank Masks and Pellicles?

An EUV blank mask is the master template for a chip’s design. It is an incredibly complex, multi-layered substrate onto which a circuit pattern is etched. An EUV pellicle is an ultra-thin protective membrane that shields the mask from contaminants during production. A single defect on either of these components can ruin millions of dollars’ worth of chips. As such, the quality and reliability provided by specialists like S&S TECH are non-negotiable for semiconductor giants.

Financial Health & Company Fundamentals (H1 2025)

Despite its technological leadership, S&S TECH is not immune to broader industry cycles. A recent slowdown in the semiconductor and display sectors has impacted its short-term performance.

- •Revenue: KRW 118.6 billion (a decrease year-on-year).

- •Operating Profit: KRW 25.17 billion (a slight decrease, mitigated by cost management).

- •Total Assets: Increased to KRW 320.5 billion, reflecting strategic investments in new EUV production facilities.

- •Financial Stability: Remains robust with an A+ credit rating and 2.90% treasury shares.

The minor shift in shareholding by Mirae Asset Management is less a red flag and more a signal for investors to pay closer attention to the company’s long-term EUV strategy and its execution on new factory investments.

Investment Outlook: Catalysts and Risks

The future trajectory for the S&S TECH stock hinges on balancing short-term headwinds with significant long-term growth potential. Investors should consider the following factors.

Positive Catalysts

The company’s strategic investments in new EUV-related factories are the primary long-term growth driver. As the demand for AI chips accelerates and more fabs adopt EUV processes, S&S TECH’s market position is set to strengthen. This positions them to capture significant value in a high-growth, high-barrier-to-entry industry. For more on this, see our analysis of broader semiconductor industry trends.

Potential Risks to Consider

Macroeconomic uncertainty remains a primary concern. A high-interest-rate environment increases the cost of capital for expansion, while exchange rate volatility (KRW/USD) can impact the profitability of an export-heavy business. Furthermore, the recent decline in the R&D-to-revenue ratio (from 10.7% to 6.0% year-on-year) is a metric to monitor closely, as sustained innovation is key to maintaining a technological edge.

Disclaimer: This analysis is for informational purposes only and is based on publicly available data. It does not constitute investment advice. All investment decisions should be made based on your own judgment and research.