A sound KohYoung Technology investment strategy requires looking beyond headlines. Recently, the company (ticker: 098460) announced a change to its dividend record date, causing some investors to question its impact on stock value and future returns. While this procedural shift is noteworthy, it barely scratches the surface of the company’s true intrinsic value. This comprehensive KohYoung Technology analysis will dissect the meaning of this change, evaluate the company’s powerful core business, examine its financial stability, and outline a clear investment thesis based on its future growth engines.

Unpacking the Dividend Record Date Change

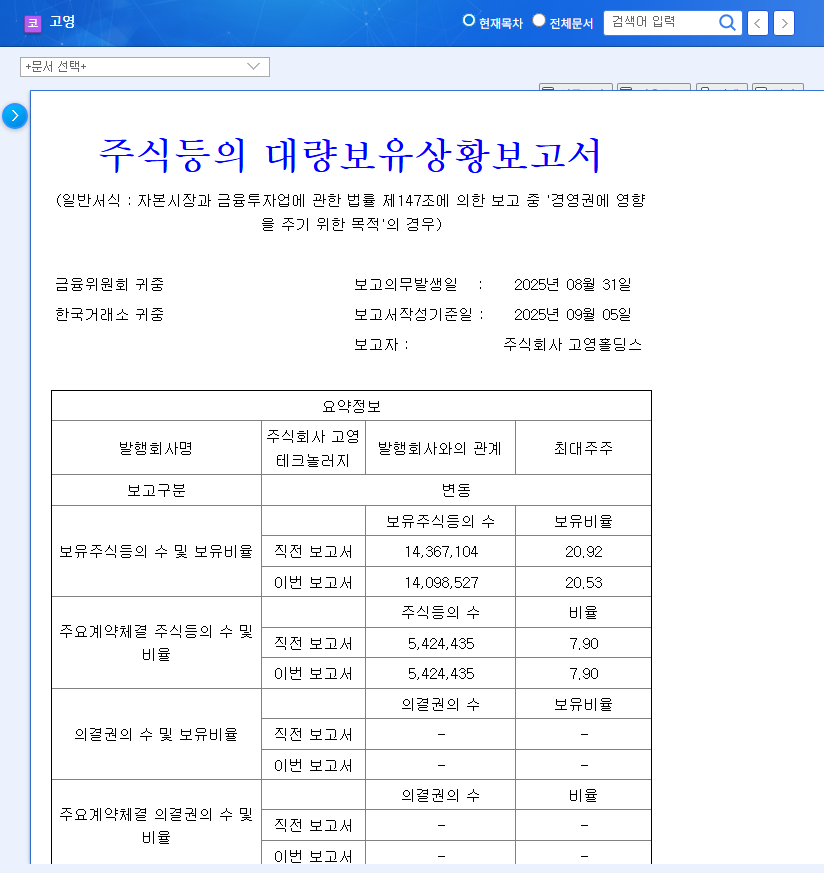

At its Annual General Meeting on March 28, 2024, KohYoung amended its Articles of Incorporation. The core change shifts the power to set the dividend record date from a fixed calendar day to a flexible decision made by the Board of Directors. This update was formally detailed in an Official Disclosure (Source) on the DART system.

Previously: Dividend eligibility was tied to holding shares on the last day of the fiscal year (December 31st).

After Change: Starting with the 2025 fiscal year-end dividend, eligibility requires holding shares on a specific date chosen and announced by the Board.

For investors, this means the old strategy of buying 098460 stock just before year-end no longer guarantees a dividend payout. While this introduces a slight reduction in predictability, it aligns the company with modern governance practices, granting it greater flexibility in capital management. Ultimately, this change is a procedural footnote and has a very limited direct impact on KohYoung’s fundamental business operations, revenue, or long-term profitability.

A Deep Dive into KohYoung’s Core Business Value

To truly assess a KohYoung Technology investment, we must focus on its powerful market position and technological leadership. The company’s value is built on a foundation of innovation in high-precision inspection and robotics.

The Global Leader: 3D Inspection Systems (SPI & AOI)

KohYoung is the undisputed global market leader in 3D Solder Paste Inspection (SPI) and Automated Optical Inspection (AOI) equipment. This technology is critical for electronics manufacturing, ensuring the quality of circuit boards used in everything from smartphones to electric vehicles. The company’s competitive edge is sharpened by its KSMART platform, which leverages AI to create a smart factory ecosystem, optimizing production lines and minimizing defects. This integration is key to their goal of capturing 70% of the market share.

The Next Frontier: ‘Geniant Cranial’ Medical Robot

A significant future growth engine is KohYoung’s expansion into the medical device sector. The company’s brain surgery medical robot, ‘Geniant Cranial,’ recently received US FDA 510(k) clearance. This is a monumental achievement that opens the door to the lucrative global healthcare market. This diversification not only provides a new revenue stream but also positions KohYoung at the forefront of the high-growth med-tech industry, a factor many KohYoung Technology stock analyses are watching closely.

Financial Health & R&D: A Stable Foundation for Growth

While revenue has seen fluctuations tied to the broader semiconductor cycle, KohYoung’s financial structure is remarkably robust. A deep dive into the numbers reveals a company built for the long haul. For context on industry financial health, investors can consult sources like Bloomberg’s market data.

- •Excellent Financial Stability: With a debt-to-equity ratio of just 38.67% and a current ratio of 220.61% (as of year-end 2024), the company has very low debt and ample liquidity to weather economic downturns and fund growth initiatives.

- •Commitment to Innovation: KohYoung consistently invests over 20% of its sales into Research & Development. This high R&D expenditure is a direct investment in maintaining its technological lead and developing future products like the Geniant Cranial robot.

- •Return to Profitability: After a challenging period, the company returned to profitability in the first half of 2025, signaling a positive operational turnaround. Investors should continue to monitor this trend.

Investment Thesis: Opportunities vs. Risks

A balanced KohYoung Technology investment outlook considers both the significant opportunities and the potential risks. For more on this, you can read our guide to investing in the semiconductor industry.

Positive Investment Points

- •Unrivaled technology and #1 market share in its core business.

- •Significant growth potential from the new medical robotics division.

- •Strengthening competitive edge through AI-powered KSMART solutions.

- •Extremely stable financial health and a strong commitment to R&D.

Risk Factors to Monitor

- •Exposure to the cyclical nature of the global IT and semiconductor industries.

- •Delayed profitability improvements could test investor patience.

- •Intensifying competition in the 3D inspection equipment market.

Conclusion: A ‘Neutral’ Stance with Long-Term Potential

In conclusion, the KohYoung Technology dividend record date change is a minor event that should not be the primary driver of your investment decision. The company’s fundamental strengths—market leadership, technological innovation, financial stability, and new growth ventures in med-tech—are far more significant. The overall investment opinion remains ‘Neutral’ for the short term, pending sustained evidence of profitability and market traction from new business segments. Prudent investors should monitor these key performance indicators closely, as KohYoung Technology possesses the core ingredients for significant long-term growth.