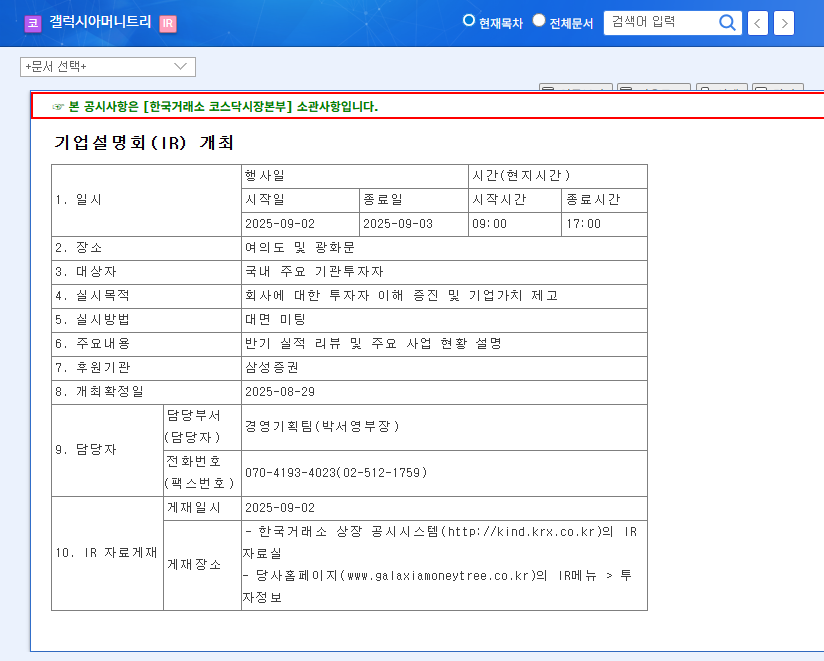

Galaxia Moneytree IR: Key Analysis

Galaxia Moneytree is focusing on new business expansion such as STO and overseas remittances based on its electronic payment and O2O businesses. This IR is expected to present a concrete roadmap for entering the STO business, along with a review of its half-year earnings.

H1 2025 Earnings: Light and Shadow

Galaxia Moneytree’s H1 2025 earnings showed improved operating profit despite a slight decrease in sales. However, the continued operating loss in the ‘Other Business’ segment is a concern for investors. A key point to watch will be the profitability improvement strategy following increased investment costs in the STO business.

STO Business: Can it Conquer the 367 Trillion Won Market?

Galaxia Moneytree aims to secure a new growth engine by entering the 367 trillion won STO market. Whether it receives designation as an innovative financial service by the Financial Services Commission will be a crucial variable for the business’s success. However, market value volatility and regulatory uncertainty remain risks.

Key Points for Investors

- Profitability Improvement Plan for ‘Other Businesses’: Presenting a concrete strategy to address the continuous losses is crucial.

- STO Business Roadmap and Monetization Strategy: They need to clearly state their plans for securing market competitiveness and generating profits.

- Macroeconomic Uncertainty Response Strategy: They should present countermeasures against external factors such as interest rate hikes.

Investment Strategy: A Cautious Approach is Necessary

Galaxia Moneytree has growth potential with the STO business, but high debt and the uncertainty of new businesses are risk factors. Therefore, it is advisable to make investment decisions after carefully analyzing the IR announcements and observing market reactions.

What are Galaxia Moneytree’s main businesses?

Galaxia Moneytree focuses on electronic payments and O2O services, while also pursuing new businesses like STO and overseas remittances.

What is the STO business?

STO (Security Token Offering) is a method of raising capital by issuing security tokens.

What are the precautions for investing in Galaxia Moneytree?

Consider factors such as high debt levels, uncertainty surrounding new businesses, and regulatory changes related to STOs.