The recent announcement of FOOSUNG’s self-stock disposal has captured the attention of the investment community. While the company cites ‘financial structure improvement’ as the motive, the unusually small scale of the transaction raises critical questions. Is this a routine financial maneuver, a signal of underlying liquidity issues, or a misunderstood opportunity? This comprehensive financial analysis will delve into FOOSUNG’s H1 2025 report to uncover the real story behind the numbers, providing investors with the clarity needed to navigate this event.

Decoding the FOOSUNG Self-Stock Disposal

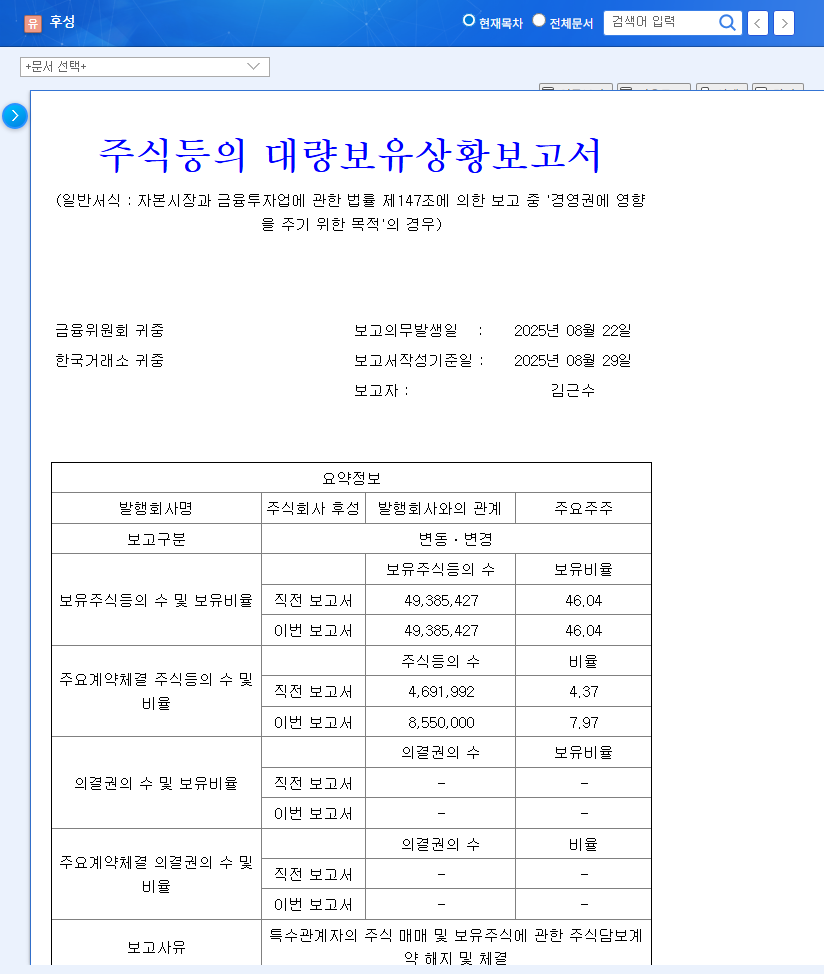

A self-stock disposal, often referred to as a sale of treasury shares, is when a company sells shares it had previously repurchased from the open market. This can be done for various reasons, such as funding operations, M&A activities, or employee stock plans. However, the context and scale are paramount. On October 30, 2025, FOOSUNG CO.,LTD filed a major disclosure detailing its decision.

Key Details of the Disposal

- •Event: Decision on Disposal of Treasury Shares

- •Shares for Disposal: A mere 94 common shares

- •Stated Purpose: Financial structure improvement

- •Official Disclosure: The company officially disclosed this action in a regulatory filing (Source)

The defining characteristic here is the minuscule volume. The sale of just 94 shares will have a negligible direct impact on FOOSUNG’s overall financial structure. Therefore, the market is likely to interpret this not as a major strategic shift, but as a minor, short-term administrative action, possibly to secure a small amount of cash for operational expenses or to settle minor obligations.

FOOSUNG Financial Analysis: H1 2025 Performance

To truly understand the context of the stock disposal, a deeper FOOSUNG financial analysis is necessary. The H1 2025 report reveals a company with a strong core business facing significant external pressures.

Revenue Growth vs. Profitability Strain

FOOSUNG’s revenue grew to 231,324 million KRW, a respectable 4.91% year-over-year increase. This growth was fueled by strong global demand for its refrigerants and chemical equipment, showcasing its competitiveness in overseas markets. However, the bottom line tells a different story. On a consolidated basis, the company posted a net loss of -19,998 million KRW. This loss was not due to operational failure but was primarily driven by two factors: crippling financial costs of 31,546 million KRW and significant foreign exchange-related losses. Encouragingly, the standalone business (headquarters) turned a net profit, indicating the core operations remain robust.

Balance Sheet Strengths and Weaknesses

The company’s balance sheet presents a mixed picture. Total liabilities have decreased, suggesting some debt repayment. However, a substantial bond issuance of 133,768 million KRW remains, creating a high interest expense burden that directly impacts profitability. On the asset side, a notable 72,881 million KRW increase in inventory points to heightened business activity. While this can be positive, it also carries the risk of becoming a financial burden if sales slow down. This inventory level will be a key metric to watch in future reports, which you can learn more about in our guide to analyzing inventory on the balance sheet.

Despite consolidated losses due to external financial pressures, FOOSUNG’s core business remains profitable, and its continued investment in R&D signals a strong focus on future growth sectors like EV batteries and semiconductors.

Macro Environment & Strategic Outlook

No company operates in a vacuum. Several macroeconomic factors will significantly influence FOOSUNG’s performance going forward:

- •Interest Rates: Persistent high interest rates will continue to inflate financial costs, acting as a drag on net profit.

- •Exchange Rates: A weaker KRW can boost the value of overseas sales but also magnify foreign-denominated debt and expenses, creating volatility.

- •Industry Growth: The long-term tailwinds from the expanding EV battery and semiconductor industries are FOOSUNG’s greatest asset, as it is a key supplier in these high-growth sectors.

Strategically, FOOSUNG’s R&D investment of 4,067 million KRW (3.06% of revenue) is crucial. This commitment to innovation is essential for maintaining a competitive edge in fast-evolving markets. Success will depend on converting this R&D into commercially viable products that capture market share.

Investor Takeaways and Conclusion

The FOOSUNG self-stock disposal is a minor event with limited short-term impact. The real story for anyone considering investing in FOOSUNG lies in the balance between its strong core business and the significant macroeconomic headwinds it faces. A long-term perspective is essential.

Key Factors to Monitor:

- •Profitability Trends: Can the company reduce its financial costs and mitigate forex losses to allow its operational strength to shine through on the consolidated bottom line?

- •Core Business Growth: Watch for continued revenue growth in the EV battery and semiconductor material segments in upcoming quarterly reports.

- •Balance Sheet Health: Monitor inventory levels and any further reduction in high-interest debt.

In conclusion, while the stock disposal is trivial, the underlying FOOSUNG financial analysis reveals a company at a crossroads. Its future success, and the attractiveness of FOOSUNG stock, hinges on navigating the current high-interest rate environment and capitalizing on its strong position in secular growth industries.

Frequently Asked Questions

Q: Is FOOSUNG’s self-stock disposal a significant event for investors?

A: No. The disposal involves only 94 shares. Its direct financial and market impact is negligible. It should be viewed as a minor administrative action, not a major strategic signal.

Q: What is the main challenge for FOOSUNG’s profitability?

A: The primary challenges are external: high financial costs due to significant debt in a high-interest-rate environment, and volatility from foreign exchange rate fluctuations. These factors overshadowed the profitability of its core operations in H1 2025.

Q: What are the biggest long-term growth drivers for FOOSUNG?

A: The company’s strongest growth drivers are its established competitiveness in materials for the EV battery and semiconductor industries. The long-term expansion of these global markets provides a significant tailwind for FOOSUNG’s future revenue potential.