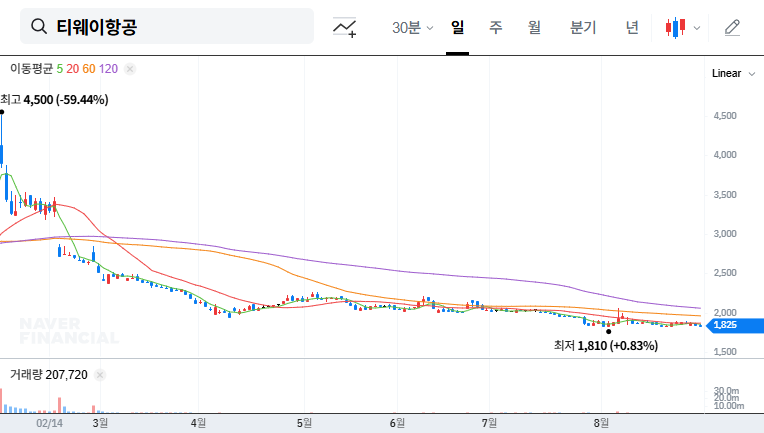

The latest financial report for T’way Air stock has sent shockwaves through the market, revealing a severe downturn that demands immediate attention from current and prospective investors. The preliminary Q3 2025 earnings are not merely a disappointment; they represent a significant financial crisis for the low-cost carrier, with massive operating and net losses that raise fundamental questions about its stability and future viability. This detailed T’way Air financial analysis will dissect the alarming figures, explore the underlying causes, and provide a clear-eyed investor outlook to help you navigate this turbulence and protect your assets.

The Alarming Numbers: T’way Air’s Q3 2025 Earnings Shock

T’way Air Co., Ltd. announced preliminary T’way Air earnings for Q3 2025 that dramatically underperformed all market expectations. The results paint a grim picture of the airline’s current operational state. The full details can be reviewed in the Official Disclosure (DART).

Key Financial Indicators (Preliminary)

- •Revenue: KRW 449.8 billion (5% below market expectation of KRW 471.0 billion)

- •Operating Profit: KRW -95.5 billion (A staggering 338% below market expectation of KRW -21.8 billion)

- •Net Profit: KRW -124.7 billion

The most alarming figure is the operating loss, which missed consensus estimates by a jaw-dropping 338%. This indicates that the company’s profitability issues are not minor but have reached a critical and accelerating point. This trend of continuous losses since Q3 2024 shows a deepening financial wound that cannot be ignored.

Why It Happened: A Deep Dive into the Causes

The sharp decline in the T’way Air Q3 2025 performance is not due to a single factor but a perfect storm of internal inefficiencies and external pressures. Understanding these root causes is crucial for any T’way Air stock analysis.

1. Soaring Costs & Weak Revenue

Revenue falling short suggests either a failure to attract passengers or a need to slash fares amid fierce competition. More critically, the massive operating loss points to an inability to control costs. Key culprits include:

- •Sustained High Fuel Prices: Jet fuel remains a primary expense for airlines. Global volatility, as tracked by authorities like IATA, continues to compress margins across the industry.

- •Rising Labor and Maintenance Costs: Inflationary pressures are increasing operational expenses across the board, from salaries to aircraft maintenance.

- •Inefficient Cost Management: The scale of the loss suggests that internal cost control measures have been insufficient to counter these external pressures.

2. Financial Burdens and Currency Woes

Beyond operational issues, T’way Air’s bottom line was further eroded by increased financial costs in a high-interest-rate environment and significant foreign exchange losses due to a volatile currency market. These factors turned a large operating loss into an even larger net loss, compounding the damage to the company’s balance sheet.

“This isn’t just a bad quarter; it’s a structural crisis. The widening losses point to a severe liquidity risk and raise serious concerns about the company’s ability to fund its operations and growth without immediate and substantial capital intervention.”

The Critical Impact on T’way Air’s Future

This earnings report will have profound and lasting negative impacts on T’way Air’s fundamentals and, consequently, its stock price.

- •Deepening Capital Impairment: The company was already facing a capital impairment of KRW -42.2 billion as of mid-2025. This quarter’s massive net loss will significantly worsen that position, threatening financial sustainability and risking credit rating downgrades.

- •Skyrocketing Debt-to-Equity Ratio: As capital erodes, the debt-to-equity ratio will climb sharply, signaling increased financial risk to creditors and investors.

- •Weakened Competitiveness: Financial distress makes it incredibly difficult to invest in new aircraft, expand routes, or compete on price. This could lead to a loss of market share in the hyper-competitive LCC sector.

Investor Outlook: A Cautious Flight Plan is Essential

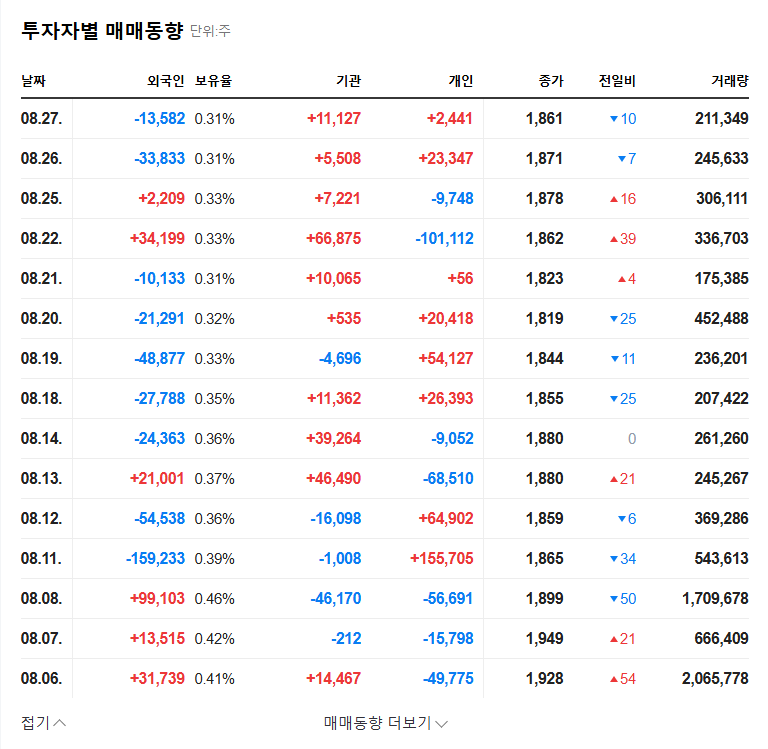

Given the severity of the T’way Air earnings report, an extremely cautious and defensive investment approach is paramount. The short-term outlook for T’way Air stock is overwhelmingly negative, with continued downward pressure highly likely. A recovery in investor confidence is improbable until the company demonstrates a clear and credible path out of its financial distress. For more general advice, you can review our guide to investing in airline stocks.

Key Variables to Monitor Closely:

- •Capital Injection Plans: The success or failure of planned capital injections (new shares, bonds) is the single most important factor. Any delay could be catastrophic.

- •Profitability Initiatives: Look for concrete evidence of effective cost-cutting, route optimization, and revenue diversification efforts.

- •Major Shareholder Impact: Monitor how the new largest shareholder, Sono International, influences management and financial stabilization efforts.

In conclusion, investors should remain on the sidelines, meticulously monitoring the upcoming Q4 results and the tangible progress of recovery plans before making any decisions regarding T’way Air stock.