The latest GS Holdings Q3 2025 earnings report has sent a clear signal to the market, delivering a significant ‘earnings surprise’ that comfortably surpassed analyst consensus. For investors tracking GS Holdings (078930), this performance is a critical data point in a volatile economic climate. But what are the fundamental drivers behind this impressive beat? More importantly, what does this signal for the company’s future stock trajectory and investment outlook?

This comprehensive analysis provides an in-depth look at the GS Holdings Q3 2025 earnings, moving beyond the headline numbers to explore the core strengths, potential risks, and strategic initiatives shaping the company’s path forward. We will dissect the performance of its key subsidiaries and outline a clear investor action plan.

Unpacking the GS Holdings Q3 2025 Earnings Surprise

GS Holdings announced preliminary Q3 2025 results that demonstrated robust health and operational excellence, beating market forecasts across all key metrics. This strong showing builds on the recovery momentum seen in the first half of the year, cementing a positive growth trend.

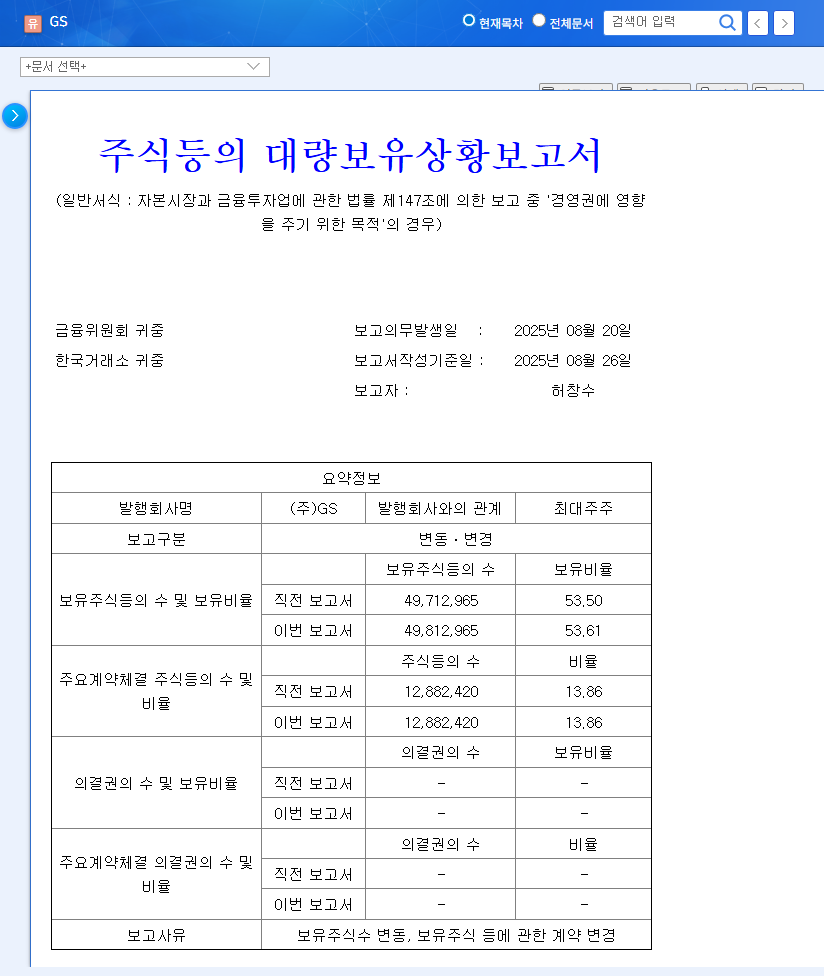

The official figures, as reported, showcase significant outperformance, particularly in profitability. Investors can view the complete filing for full transparency. Source: Official DART Disclosure

Key Financial Highlights vs. Estimates:

- •Revenue: KRW 6.5359 trillion, a 2.5% beat over the KRW 6.3767 trillion estimate.

- •Operating Profit: KRW 870.6 billion, a staggering 29.4% beat over the KRW 672.6 billion estimate.

- •Net Profit: KRW 313.9 billion, a solid 17.5% beat over the KRW 267.2 billion estimate.

The double-digit outperformance in operating and net profit is particularly noteworthy, indicating powerful improvements in operational efficiency and margin expansion across the conglomerate’s diverse business units.

The ‘Why’: Core Drivers of Success

This robust performance is not an accident; it is the culmination of strategic execution within a stable business framework. The GS Holdings investment outlook is significantly bolstered by these underlying strengths.

1. Subsidiary Powerhouses Deliver

GS Holdings benefits from its structure as a holding company with strong, competitive subsidiaries. This diversification provides resilience and multiple avenues for growth. For a deeper understanding of this model, you can read our guide on analyzing Korean holding companies.

- •Energy Sector (GS Energy, GS Caltex): This division was a star performer, capitalizing on optimized portfolios and enhanced operational efficiency. Favorable, stable trends in international oil prices and refining margins provided a strong tailwind, directly boosting profitability.

- •Retail Sector (GS Retail): Despite macroeconomic concerns about weakening consumer sentiment, the retail arm demonstrated remarkable resilience and maintained a robust growth trajectory, proving its market leadership and contributing significantly to the group’s overall earnings.

2. Commitment to ESG and Shareholder Value

Modern investors increasingly value more than just profits. GS Holdings has actively strengthened its ESG (Environmental, Social, Governance) framework, aiming to build long-term corporate value and enhance investor confidence. This is complemented by a proactive shareholder return policy, including consistent dividends and strategic share buybacks, which directly increases shareholder value and makes the stock more attractive.

Market Analysis: Opportunities and Risks Ahead

While the 078930 earnings report was stellar, a prudent GS Holdings stock analysis requires a balanced look at the external environment.

Navigating Macroeconomic Headwinds

The third quarter of 2025 was defined by a complex global economic picture, with ongoing geopolitical risks and persistent inflation concerns. That GS Holdings delivered such strong results in this environment is a testament to its operational agility. However, risks from currency volatility (weaker Euro, stronger Dollar) and potential interest rate hikes remain. For a broader view, you can consult expert analysis on the global economic outlook from Reuters.

Potential Risks to Monitor

- •Sustained High Interest Rates: While its consolidated debt ratio of 89.8% is considered healthy, rising rates could increase interest expenses and pressure financials.

- •Subsidiary-Specific Risks: The energy sector is inherently exposed to volatile oil prices and the long-term energy transition. The retail sector must continuously monitor consumer spending habits.

- •Global Economic Slowdown: A broader slowdown could eventually impact even resilient companies by dampening demand across energy and retail segments.

Investor Action Plan & Future Outlook

The strong GS Holdings Q3 2025 earnings reaffirm the company’s solid fundamentals. The key question for investors is how to position themselves moving forward.

Overall Assessment: The results are overwhelmingly positive, validating the company’s strategy. The combination of a stable holding structure and high-performing subsidiaries makes a compelling case for its long-term investment appeal.

Investment Recommendations

- •Short-Term: Expect positive price momentum. A significant earnings beat like this often leads to upward revisions from analysts and attracts new investor interest, which can drive the stock price higher in the near term.

- •Mid-to-Long-Term: The outlook is constructive. The potential for long-term corporate value appreciation is high, provided management continues to effectively navigate macroeconomic shifts and invest in future growth engines.

- •Risk Management: A prudent approach is advised. Investors should continuously monitor the key risks outlined above, particularly shifts in interest rate policy and global energy markets.

In conclusion, GS Holdings has proven its resilience and operational strength. The future stock performance will likely hinge on the sustainability of this earnings power, its adaptability to a changing world, and successful execution of its long-term growth strategy.

Disclaimer: This report is for informational purposes only and is based on publicly available data. All investment decisions are the sole responsibility of the individual investor.