What Happened?

Several shareholders filed a request with the court for inspection and copying of the shareholder registry. While the company stated its willingness to provide the registry, it argued that the request for a preliminary injunction, bypassing standard procedures, was unnecessary.

Why Did This Happen?

The request for registry inspection can be interpreted as a precursor to a management dispute. Shareholders are likely attempting to secure the registry as a preparatory step for participating in management. Recent performance issues (net loss of ₩73 million) and issues such as amendments to the articles of incorporation may have fueled shareholder discontent.

What’s Next?

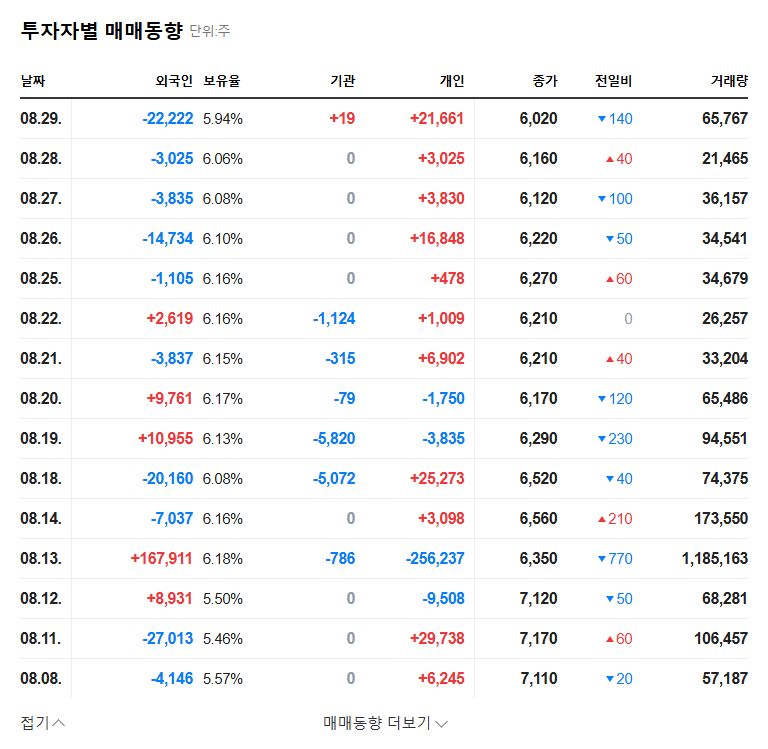

In the short term, increased stock volatility and a decline in investor sentiment are expected. In the long term, there are potential positives such as improved corporate governance and increased management transparency. However, if the dispute is prolonged, there are concerns about a decline in focus on core business and increased costs.

- Positive Aspects: Enhanced corporate governance transparency, protection of shareholder rights

- Negative Aspects: Increased management uncertainty, downward pressure on stock price, increased litigation costs

What Should Investors Do?

Investors should proceed with caution. Closely monitor the company’s disclosures and developments, and make investment decisions from a long-term perspective, unfazed by short-term stock fluctuations. While considering Infinitt Healthcare’s core business competitiveness and the growth potential of the healthcare market, it is crucial to adjust investment strategies based on the outcome of the management dispute.

Frequently Asked Questions

What is a request for inspection of the shareholder registry?

The shareholder registry is a document that records the status of a company’s shareholder composition. Shareholders can request to inspect and copy the registry for purposes such as participating in management.

What is a management dispute?

A management dispute refers to a conflict that arises between shareholders over the control of a company. Shareholders may attempt to replace management through the exercise of voting rights at the general meeting of shareholders.

What is the investment outlook for Infinitt Healthcare?

While the growth potential of the healthcare market is high, uncertainty exists due to the management dispute. Investors should carefully monitor the situation before making investment decisions.