1. What Happened? : Divestiture of CW Parent LLC

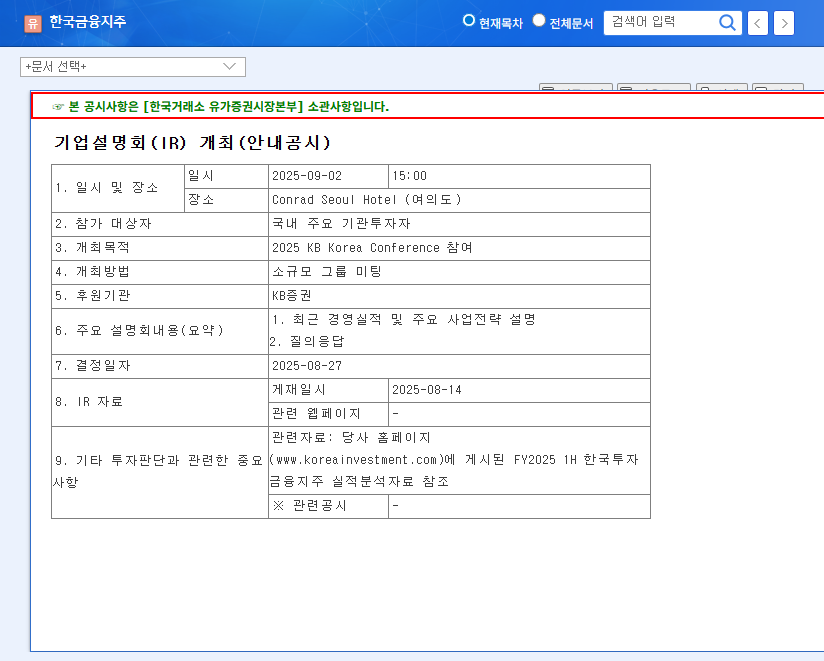

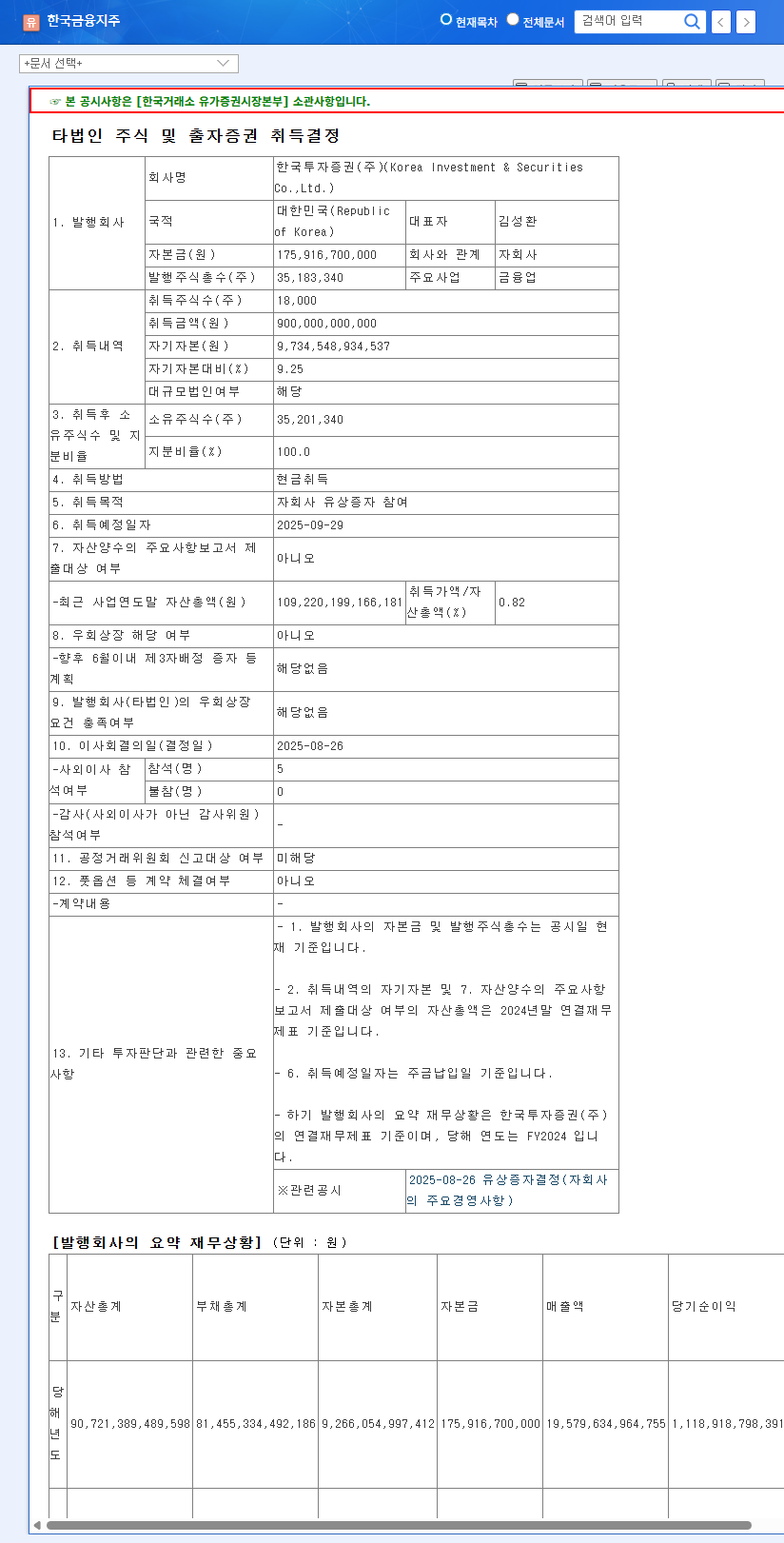

Korea Financial Group has decided to sell its 100% stake in its US subsidiary, CW Parent LLC, for $2.76 billion. The expected date of the sale is September 29, 2025. This represents 2.98% of Korea Financial Group’s capital.

2. Why the Divestiture? : Optimizing Investment Assets and Strengthening PEF Capabilities

Korea Financial Group plans to use the proceeds from this sale to optimize the management of its proprietary investment assets and strengthen its private equity fund (PEF) operation capabilities. This is a strategic move aimed at securing future growth drivers, not simply an asset disposal.

3. What’s the Impact? : Limited Short-Term Impact, Long-Term Growth Expected

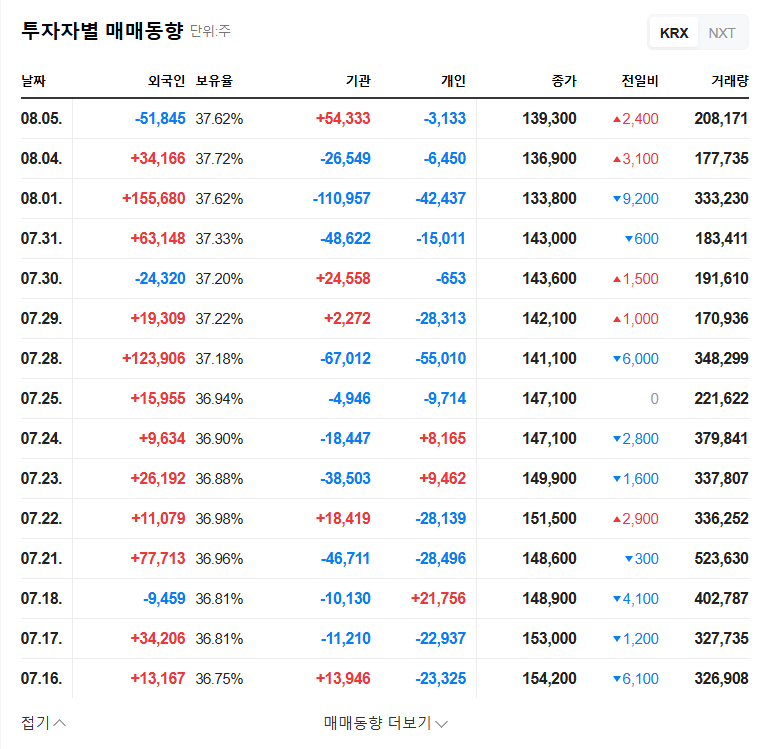

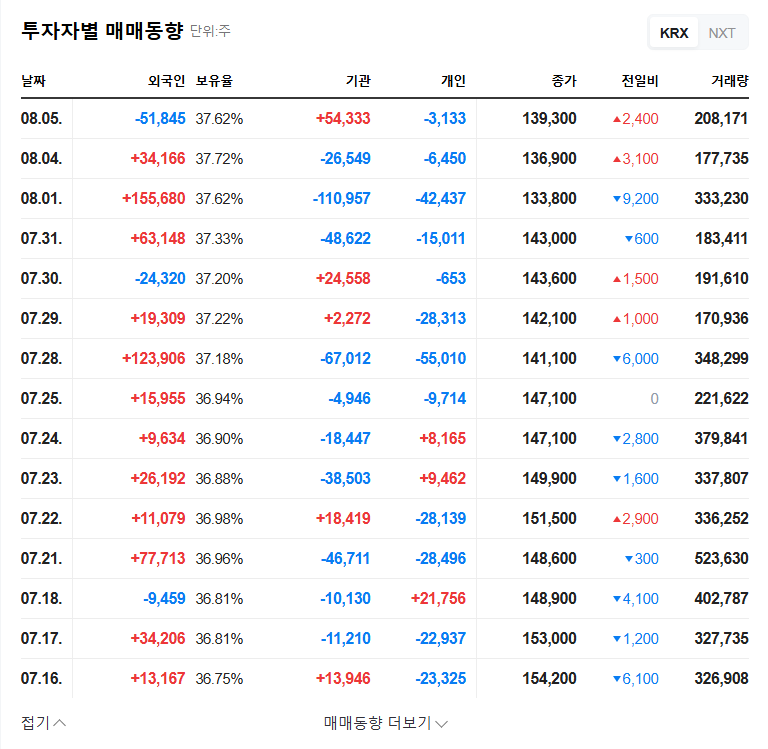

Experts predict a limited impact on Korea Financial Group’s short-term financial status. Instead, they anticipate increased long-term profits through enhanced PEF operational capabilities. The rebalancing of the asset portfolio is also expected to improve profitability.

- Positive Aspects: Streamlined business portfolio, strengthened PEF capabilities, increased financial flexibility

- Neutral/Limited Impact: Limited impact on stock price and short-term financials

- Considerations: Global economic volatility and changes in the interest rate environment

4. What Should Investors Do? : Maintain a Long-Term Investment Strategy

Korea Financial Group’s fundamentals remain strong. This divestiture should be interpreted with a focus on long-term growth potential rather than short-term stock fluctuations. Investors should carefully monitor Korea Financial Group’s future PEF performance and proprietary investment asset management strategy.

Q: How will this divestiture affect Korea Financial Group’s stock price?

A: Experts anticipate limited short-term impact and expect a positive long-term effect.

Q: How will the proceeds from the sale be used?

A: The funds will be used to optimize the management of proprietary investment assets and strengthen PEF operational capabilities.

Q: What is the outlook for Korea Financial Group?

A: Based on its solid fundamentals, long-term growth is expected.