The situation surrounding I-ROBOTICS,Co.,Ltd. (066430) has devolved into a critical state, creating a perfect storm for investors. The core of the issue is a deeply entrenched I-ROBOTICS,Co.,Ltd. management dispute that has now reached the nation’s highest court, all while the company navigates a catastrophic 066430 financial crisis. This analysis provides a comprehensive breakdown of the escalating legal battles, the shocking financial deterioration, and a strategic guide for current and potential investors. This is a clear investor warning that should not be ignored.

The Epicenter: Management Dispute Reaches the Supreme Court

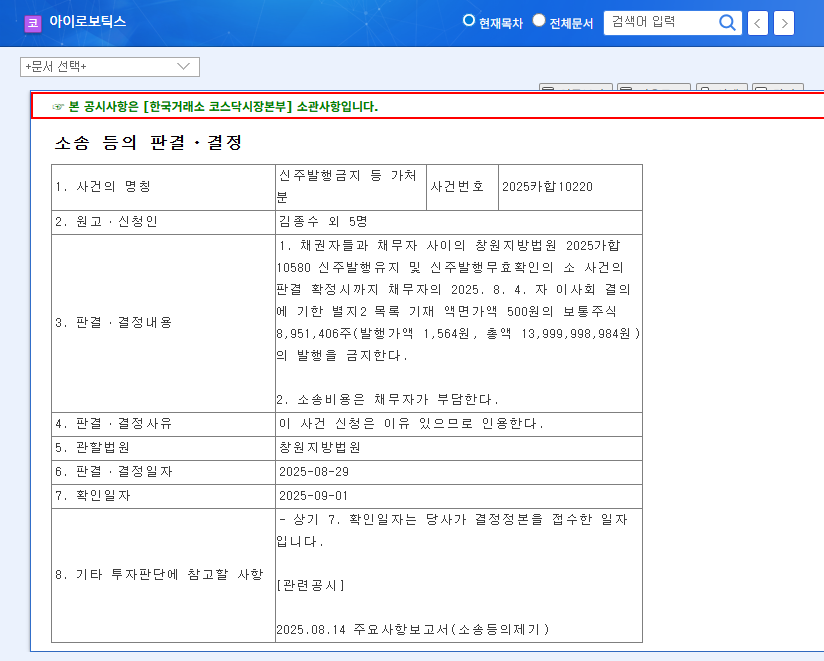

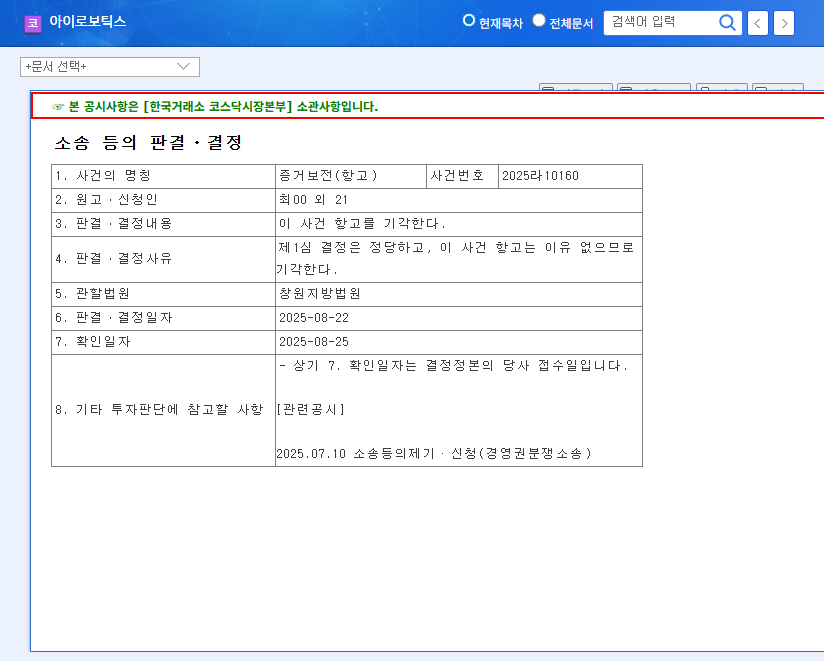

On November 12, 2025, I-ROBOTICS,Co.,Ltd. formally announced that its internal power struggle had escalated significantly. According to an Official Disclosure, a re-appeal was filed with the Supreme Court concerning a ‘provisional disposition for inspection and copying of the shareholder register’. This legal action, initiated by Yoo Hyung-seok and 19 others, is a clear move to gain leverage and information in the ongoing battle for control.

This isn’t merely a procedural step; it signifies that the I-ROBOTICS,Co.,Ltd. management dispute has become a protracted, high-stakes conflict. For a company already reeling from financial instability and corrections to its 2024 business report, this development paralyzes key decision-making and shrouds its future in profound uncertainty.

Financial Meltdown: A Look at the Alarming Numbers

The management turmoil is unfolding against the backdrop of a complete financial collapse. The 2024 business report paints a picture of a company whose core operations are failing. Understanding the numbers is crucial to grasping the severity of the 066430 financial crisis.

With an operating profit margin of -177.76%, I-ROBOTICS,Co.,Ltd. is effectively spending \177 to generate every \100 of revenue. This is an unsustainable model that signals a fundamental breakdown in its business operations.

Key Financial Deterioration Points:

- •Revenue Collapse: Sales plummeted to 33.4 billion KRW, a near 50% drop from 65.5 billion KRW in the previous year.

- •Exponentially Widening Losses: The operating loss exploded by 23 times to -59.4 billion KRW, while the net loss expanded 21 times to -55.5 billion KRW.

- •Profitability Erased: The aforementioned -177.76% operating profit margin shows a complete inability to operate profitably.

- •Deceptive Liquidity: While the current ratio (220.61%) and improved debt ratio (38.67%) may seem positive, they are overshadowed by the catastrophic operational losses and cannot be seen as signs of genuine financial health.

The Ripple Effect: How the Dispute Amplifies Risk

A company’s internal stability is paramount. The I-ROBOTICS,Co.,Ltd. management dispute creates cascading failures that touch every aspect of the business, especially when combined with a volatile macroeconomic environment. For more information on this, you can read about how corporate governance impacts stock prices in our related article.

Direct and Indirect Consequences

- •Governance Paralysis: The leadership vacuum prevents strategic planning, crucial investments, and effective risk management.

- •Destroyed Investor Confidence: Uncertainty is toxic for stocks. The dispute and financial woes have already pushed the I-ROBOTICS,Co.,Ltd. stock to historic lows, and confidence is unlikely to return until there is a clear resolution.

- •Financial Drain: High legal costs associated with a Supreme Court case will further deplete the company’s already strained financial resources.

- •Heightened Macroeconomic Sensitivity: An unstable company is more vulnerable to external shocks like raw material price hikes and currency fluctuations, a concept well-documented by sources like Bloomberg.

Investor Action Plan: Navigating the Uncertainty

Given the overwhelming negative factors, a highly cautious and defensive strategy is essential. The outlook for the I-ROBOTICS,Co.,Ltd. stock is deeply negative, and any potential upside is dwarfed by the immense risks.

Recommendations for Investors:

- •For Potential Investors: Avoid this stock. The combination of governance failure and financial collapse presents an unacceptable level of risk. Wait for definitive signs of a turnaround, which may be months or years away, if ever.

- •For Current Shareholders: Re-evaluate your risk tolerance. This is no longer an investment but a high-risk speculation. Consider reducing your position to protect capital, as further downside is highly probable.

Moving forward, all eyes should be on the Supreme Court’s decision, any announcements regarding management stabilization, and the company’s subsequent quarterly financial reports. Until these critical uncertainties are resolved, a prudent, risk-averse approach is the only logical course of action.