In a landmark move signaling the surging demand in the electric vehicle sector, LG CHEM LTD has secured a monumental ₩3.76 trillion (approximately $2.8 billion) supply contract for its advanced LG Chem cathode material in the North American market. This deal is not just a figure on a balance sheet; it’s a strategic masterstroke that solidifies the company’s foothold in a critical region and underscores its technological prowess in the competitive EV battery space. As the global transition to electric mobility accelerates, this contract provides a clear window into LG Chem’s future trajectory and presents compelling questions for investors.

This analysis will dissect the profound implications of this agreement. We’ll explore how it enhances LG Chem’s fundamentals, accelerates its North American strategy—especially in light of the Inflation Reduction Act (IRA)—and what it means for the future of LG Chem stock. For investors, understanding the nuances of this deal is key to navigating the opportunities and risks ahead.

Breaking Down the $2.8 Billion Agreement

On November 13, 2025, LG Chem officially announced a mid-to-long-term supply contract for its high-performance EV cathode materials with a major U.S.-based customer. According to the Official Disclosure, the contract is valued at ₩3.76 trillion ($2.8 billion) and will run from November 15, 2025, to July 31, 2029. The sheer scale of this deal is impressive, representing 7.69% of the company’s revenue from the first half of 2025, guaranteeing a stable and substantial revenue stream for its Advanced Materials division for nearly four years.

This isn’t just a sale; it’s a strategic partnership. By locking in a long-term deal in North America, LG Chem de-risks its future revenue while perfectly aligning with geopolitical tailwinds like the IRA, which incentivizes localized supply chains.

Strategic Importance: Why This Deal Matters

The significance of this contract extends far beyond its monetary value. It touches upon market positioning, technological validation, and long-term growth for the entire company.

Dominating the North American EV Market

The North American EV market is one of the fastest-growing in the world, a trend massively amplified by government incentives. This contract firmly plants LG Chem’s flag in this lucrative territory. It not only secures a key customer but also serves as a powerful validation of its LG Chem cathode material technology, paving the way for further expansion and potentially new local production facilities. This move is critical for building a resilient supply chain, a topic further explored in our deep dive into the EV battery supply chain.

Technological Leadership in Cathode Materials

Cathodes are the most critical and expensive component of an EV battery, directly determining its performance, range, and cost. LG Chem has been heavily investing in its proprietary precursor process, which reportedly enhances performance while being more cost-effective and environmentally friendly. This deal confirms that their R&D efforts are paying off, giving them a competitive edge in a market where innovation is paramount. According to a recent International Energy Agency report, continuous improvements in battery chemistry are essential for meeting global EV adoption targets.

Investor Outlook: Opportunities & Risks

For those holding or considering LG Chem stock, this development warrants a fresh look at the company’s valuation and long-term potential.

The Bull Case: A Re-rating on the Horizon?

- •Revenue Stability: A guaranteed $2.8 billion pipeline reduces earnings volatility and provides a solid foundation for the Advanced Materials division.

- •Improved Profitability: Long-term contracts and economies of scale can lead to higher production efficiency and more stable margins, shielding the company from some raw material price fluctuations.

- •Positive Market Sentiment: Such a significant win is likely to trigger upward revisions in earnings forecasts from brokerage firms, potentially boosting the stock price in the short to medium term.

Key Risks to Monitor

Despite the overwhelmingly positive news, prudent investors must remain aware of potential headwinds.

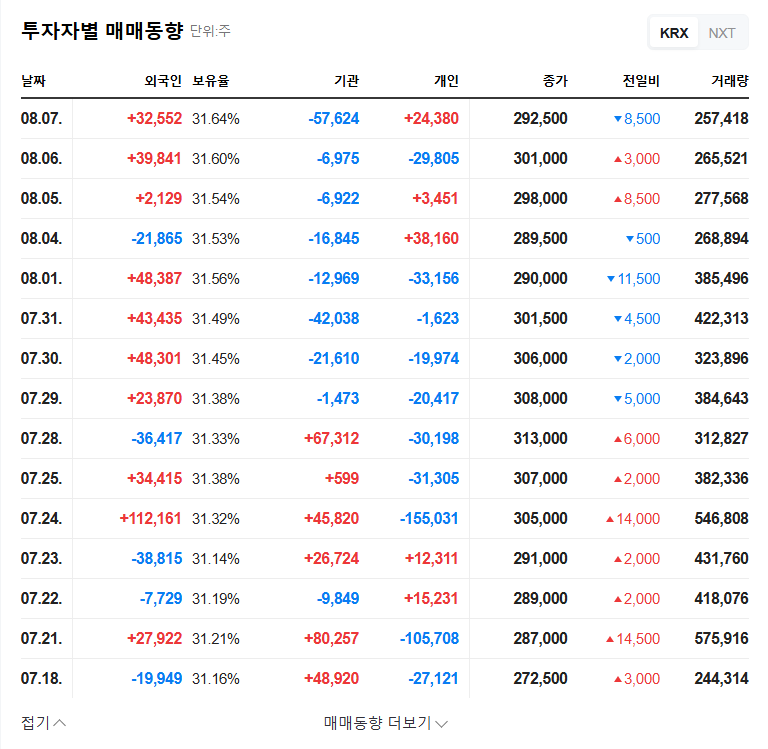

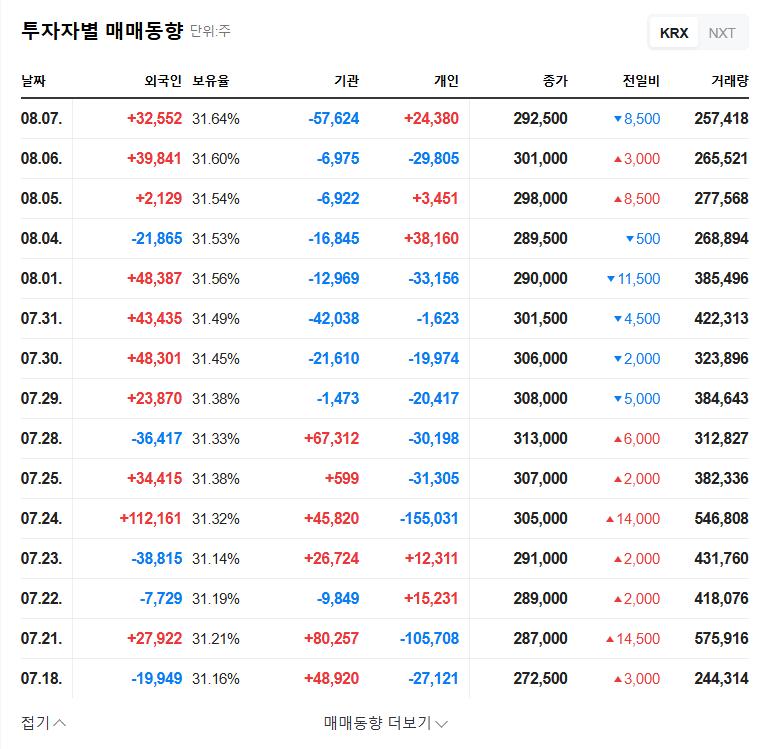

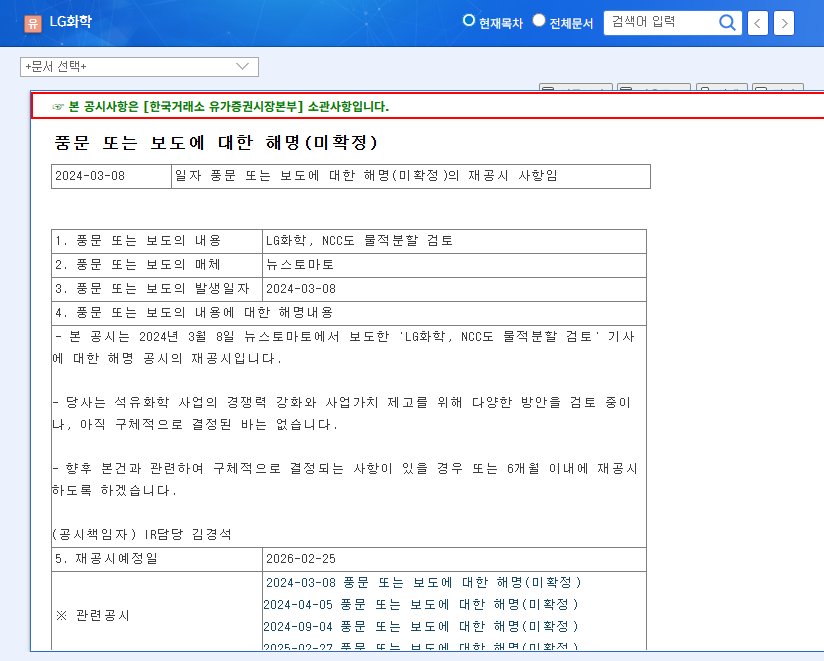

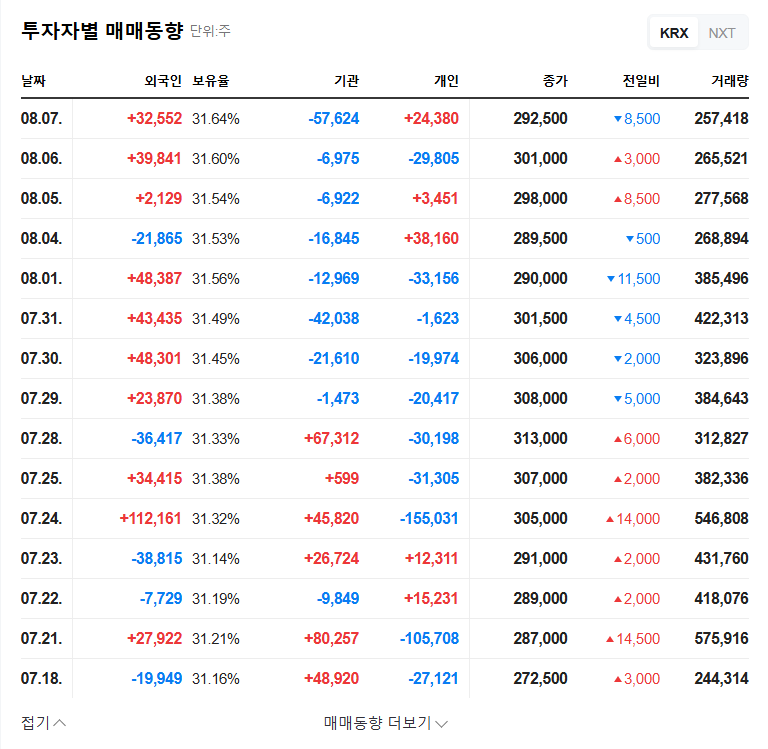

- •Petrochemical Drag: The company’s legacy petrochemical business has faced headwinds. Investors should watch if the growth in advanced materials is strong enough to offset weakness elsewhere.

- •Macroeconomic Factors: Fluctuations in raw material costs (like lithium and nickel), currency exchange rates, and global economic health can still impact profitability over the contract’s term.

- •Dependency on LG Energy Solution: While diversifying, LG Chem’s performance remains closely tied to its affiliate, LG Energy Solution. Continued success in securing third-party customers is vital for balanced growth.

Conclusion: A Catalyst for Growth

LG Chem’s $2.8 billion cathode material supply deal is a watershed moment, confirming its status as a premier player in the global EV battery supply chain. It provides a stable, long-term revenue stream, deepens its penetration into the vital North American market, and validates its technological leadership. While investors must keep an eye on broader market risks and the performance of other business segments, this contract is a powerful catalyst that significantly strengthens the investment thesis for LG Chem. It signals a clear acceleration of its growth trajectory, firmly powered by the electric vehicle revolution.