The latest KEPCO KPS earnings report for Q3 2025 has sent a mixed signal to the market, leaving many investors wondering about the future of their KEPCO KPS stock. While KEPCO Plant Service & Engineering Co., Ltd. (KEPCO KPS) successfully surpassed revenue expectations, a surprising shortfall in operating profit has introduced a layer of uncertainty. This comprehensive KEPCO Plant Service analysis will dissect the numbers, explore the performance of key business segments, and outline a strategic outlook for potential and current investors.

We’ll go beyond the headlines to evaluate the company’s fundamental health, its position in a shifting energy landscape, and what these KEPCO Q3 2025 results truly mean for its long-term growth trajectory. Is this a temporary setback or a sign of underlying challenges? Let’s find out.

Deconstructing the KEPCO KPS Q3 2025 Earnings Report

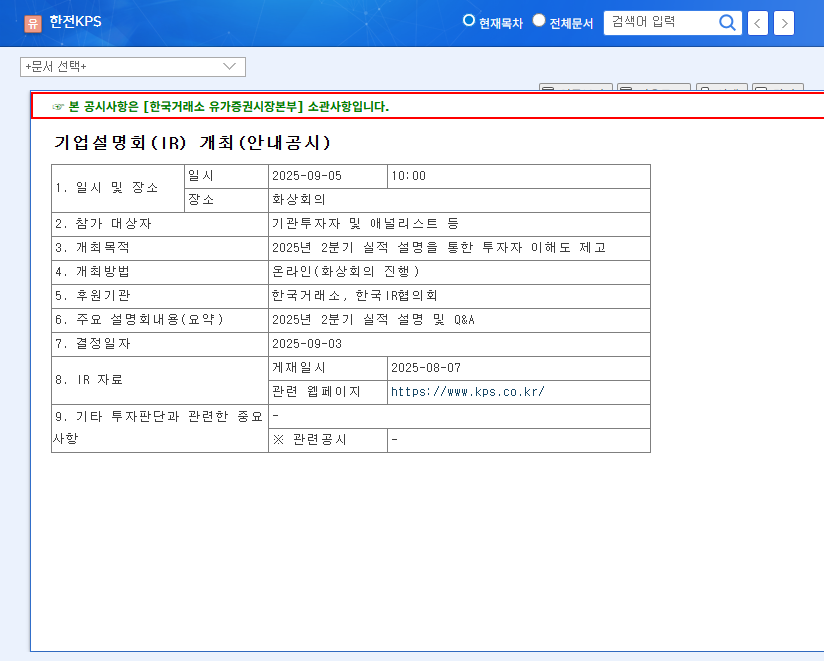

On November 10, KEPCO KPS released its provisional Q3 2025 financial results, which painted a complex picture. The top-line revenue growth was a clear positive, but profitability metrics told a different story. Here’s a closer look at the key figures from the Official Disclosure:

- •Revenue: KRW 393.7 billion, which was a healthy 4% above the market consensus of KRW 377.9 billion.

- •Operating Profit: KRW 47.4 billion, falling -5% short of the estimated KRW 50.1 billion.

- •Net Profit: KRW 42.7 billion, managing to come in 3% above the forecast of KRW 41.6 billion.

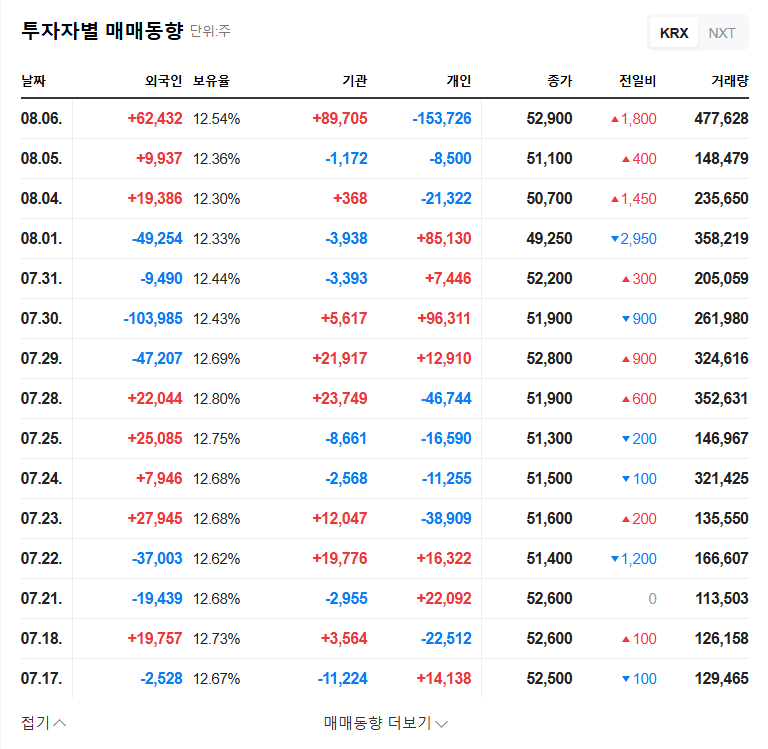

This divergence between robust sales and lagging operating profit suggests that while business is active, cost pressures or a shift in the revenue mix towards lower-margin activities could be impacting profitability. This is a critical point that the market will be scrutinizing closely.

Segment Performance: A Tale of Two Trajectories

To understand the latest KEPCO KPS earnings, we must analyze the performance of its individual business units. The results reveal a clear split between growth drivers and areas facing significant headwinds.

Growth Engine: Nuclear & Hydropower Maintenance

The star performer was the Nuclear and Hydro Power Plant Maintenance division. Revenue saw a significant boost, largely driven by the government’s renewed focus on nuclear power expansion. This segment is not just a current strength but also holds the key to future growth, with new ventures like nuclear plant decommissioning poised to become major long-term revenue streams. This aligns with global trends in extending the life of existing nuclear assets, a topic covered by authorities like the World Nuclear Association.

Challenging Areas: Thermal Power & Overseas Business

On the other end of the spectrum, the Thermal Power maintenance segment and the Overseas Business faced difficulties. Thermal power continues a structural decline as the world pivots to cleaner energy. The overseas division suffered a sharp revenue drop, attributed to the global economic slowdown and specific challenges with international clients. Revitalizing this segment through diversification and enhanced competitiveness is now a top priority for management.

While the operating profit miss creates short-term noise, KEPCO KPS’s long-term value hinges on its ability to capitalize on the nuclear energy tailwind and successfully pivot into new renewable ventures.

Investor Outlook & Strategic Considerations

Given the mixed KEPCO KPS earnings report, how should investors position themselves? A nuanced approach considering both short-term risks and long-term opportunities is essential.

Key Factors to Monitor for KEPCO KPS Stock

- •Profitability Improvement: Watch for management commentary on strategies to improve operating margins. Efficient cost controls and a focus on higher-value contracts will be critical.

- •New Business Execution: The market will be looking for tangible progress in new growth areas, particularly nuclear decommissioning and offshore wind power projects. Announcements of new contracts will be a powerful catalyst.

- •Overseas Recovery: Any signs of a turnaround in the international business segment could significantly improve sentiment. Monitoring regional economic indicators and company announcements is key.

- •Financial Stability: KEPCO KPS boasts a solid financial foundation with low debt. This stability provides a buffer against market volatility and allows for strategic investments, a crucial advantage you can learn more about in our guide to analyzing corporate balance sheets.

Conclusion: A Stable Core with Growth Questions

In summary, the Q3 2025 KEPCO KPS earnings present a compelling case study. The company’s core business in nuclear and hydro maintenance remains robust and is set to benefit from favorable government policies. However, the operating profit shortfall highlights immediate challenges in cost management and underperforming segments that cannot be ignored.

For long-term investors, the narrative remains positive, contingent on the company’s ability to translate its strategic initiatives in renewable energy and decommissioning into concrete financial results. The short-term stock performance may be choppy, but the underlying financial health and strategic positioning in growth sectors provide a solid foundation for future value creation.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. All investment decisions should be made based on your own research and judgment.