The sudden suspension of the Kodaco delisting procedure has sent shockwaves through the market, leaving Kodaco investors grappling with a mix of fragile hope and profound uncertainty. While the halt of liquidation trading offers a temporary reprieve, it fails to address the deep-seated financial crisis plaguing Kodaco Co., Ltd. Is this a genuine turning point, or merely a delay of the inevitable? This comprehensive analysis will dissect the situation, explore the severe underlying risks, and provide a clear strategy for investors navigating this volatile landscape.

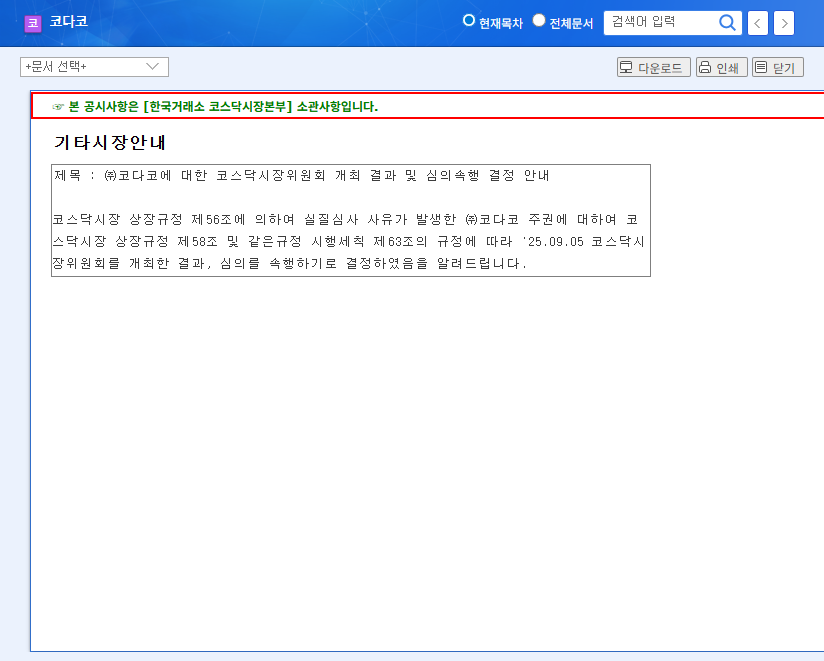

The Official Announcement: Kodaco Delisting Procedure Halted

On October 1, 2025, Kodaco Co., Ltd. confirmed the suspension of its scheduled delisting and liquidation trading. This decision was triggered by a ‘request for an injunction to suspend the effect of the delisting decision’ filed with the courts. As detailed in the company’s Official Disclosure to the Financial Supervisory Service, all procedures are on hold pending a final court ruling. This legal maneuver has bought the company time, but it simultaneously magnifies the uncertainty for all stakeholders.

Unpacking the Severe Kodaco Financial Crisis

Despite the legal pause, the fundamental financial health of Kodaco remains in critical condition. A close examination of its 2025 half-year report reveals a company on the brink.

Going Concern Uncertainty: The Core Risk

The most glaring red flag is the auditor’s warning of ‘events that raise significant doubt about the company’s ability to continue as a going concern.’ This is not a standard business challenge; it’s an existential threat. The primary driver for this is the delayed payment of rehabilitation claims from 2024. While the company is scrambling to raise funds by selling assets, any failure in this revised plan could trigger a complete collapse.

A Mountain of Debt and Anemic Profits

Kodaco’s financial structure is exceptionally fragile. Key indicators of this weakness include:

- •Astronomical Debt Ratio: The consolidated debt-to-equity ratio sits at a staggering 1,643.46%. This makes the company hyper-sensitive to any changes in interest rates or currency exchange rates.

- •Weak Profitability: While operating profit edged into the positive at 1.4 billion KRW, the net profit remains firmly in the red. This indicates that even with operations running, the company cannot cover its massive financial burdens.

- •Disclaimer of Audit Opinion: This is a critical blow to investor trust. When an auditor issues a disclaimer, it means they were unable to obtain sufficient evidence to form an opinion on the financial statements. This effectively renders the company’s financial reporting unreliable.

The combination of a disclaimer of audit opinion and extreme debt creates a high-risk environment where the fundamental value of the Kodaco stock is nearly impossible to ascertain, making any investment highly speculative.

Impact on Kodaco Investors: Navigating the Uncertainty

The suspension of the Kodaco delisting process has distinct short-term and long-term consequences for investors. The immediate relief from delisting is overshadowed by prolonged ambiguity.

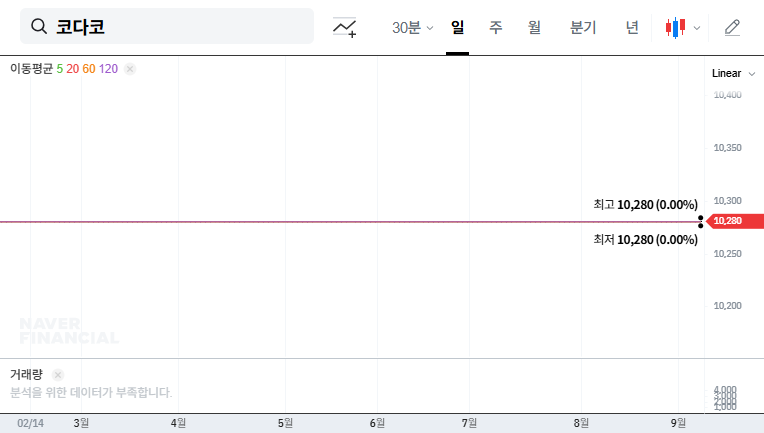

Short-Term: Heightened Volatility

In the short term, investors should brace for extreme price swings. The legal limbo creates a vacuum of information, where rumors can drive erratic trading. While the immediate threat of total loss is paused, the unresolved fundamentals mean that investor sentiment will remain overwhelmingly negative. This is not a stable environment for investment; it is a speculator’s arena where understanding risk management is paramount.

Mid-to-Long-Term: Eroding Trust and Fundraising Hurdles

Looking ahead, the path for Kodaco is fraught with challenges. The injunction prolongs the rehabilitation process, making it harder for the company to execute its turnaround plan. Securing new funding will be nearly impossible with the threat of delisting still looming, which in turn jeopardizes the very business operations needed for recovery. This cycle of uncertainty further erodes the trust of both investors and financial markets.

Macroeconomic Headwinds Adding to the Pressure

Kodaco’s internal problems are amplified by external economic pressures. As a company with a high debt load, it is extremely vulnerable to macroeconomic shifts. Global interest rate policies, such as those analyzed by sources like Bloomberg’s economic forecasts, could significantly increase Kodaco’s debt servicing costs. Furthermore, a slowdown in the global automotive parts industry, fluctuating raw material costs, and volatile exchange rates all add layers of risk that the company is ill-equipped to handle in its current state.

Investment Strategy: The Final Verdict on Kodaco Stock

Given the overwhelming evidence, the investment opinion on Kodaco Co., Ltd. remains ‘Highly Negative’ and ‘Unsuitable for Investment.’ The temporary halt in the delisting process does not change the fact that fundamental questions about the company’s survival are unresolved. The risk of a sudden resumption of the delisting procedure, which could lead to a total loss of investment, is exceptionally high.

Investors must vigilantly monitor the following key variables, as they will determine the company’s fate:

- •Court’s Injunction Decision: This is the most critical near-term catalyst. A rejection will likely mean an immediate resumption of delisting.

- •Rehabilitation Plan Progress: Watch for concrete news on asset sales and fundraising. Failure to meet targets is a major red flag.

- •Future Audit Opinions: A clean audit opinion is a non-negotiable prerequisite for restoring any semblance of trust.

- •Macroeconomic Changes: Keep an eye on interest rates and industry trends that directly impact Kodaco’s thin margins.

In conclusion, the Kodaco delisting saga is far from over. This suspension is a legal pause, not a financial rescue. For investors, the message is clear: the level of risk is extreme, and extreme caution is advised.