1. What Happened?

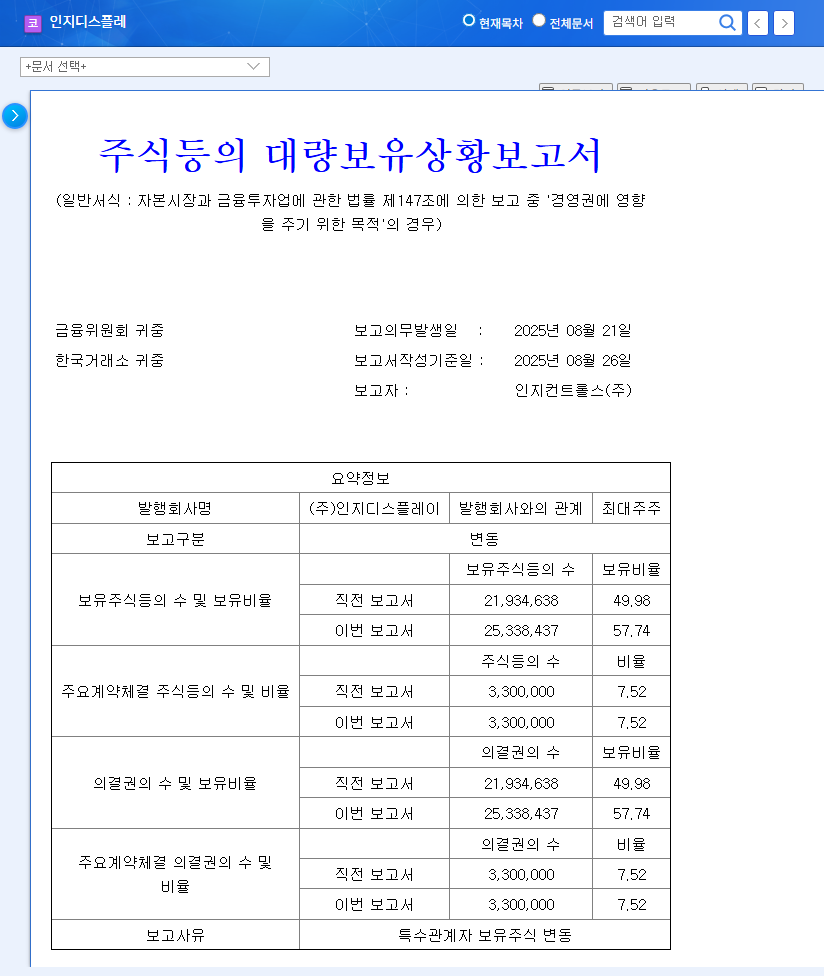

Inji Controls acquired additional shares of Inji Display through after-hours trading, increasing its stake from 49.98% to 57.74%. This is interpreted as a strategic move to strengthen management control and create business synergy.

2. Why is it Important?

The increase in the major shareholder’s stake suggests stable management and long-term investment commitment. This can be a positive signal for the company’s stable growth and shareholder value enhancement. In particular, the synergy effect can be expected in conjunction with the fact that Inji Display recently showed improvement in both sales and operating profit on a consolidated basis in Q1 2025 and announced a treasury stock disposal plan.

3. So What Will Happen?

- Short-term Impact: The stake increase is likely to have a positive impact on the stock price. Increased investor interest may create momentum for stock price appreciation.

- Mid- to Long-term Impact: Based on management stability, business synergy and fundamental improvement are expected. The possibility of entering new businesses and strengthening competitiveness through cooperation with Inji Controls should also be noted.

4. What Should Investors Do?

While this stake increase is interpreted as a positive signal, investors should consider several factors before making investment decisions. It is crucial to carefully review potential risk factors, such as the details of the treasury stock disposal plan, the trend of separate financial statements, and exchange rate volatility, and to establish a prudent investment strategy.

Frequently Asked Questions

What is the purpose of Inji Controls’ stake increase?

It is interpreted as a strategic move to strengthen management control and create business synergy between the two companies.

How will the treasury stock disposal plan affect the stock price?

The impact on the stock price will vary depending on the timing, size, and price of the disposal. Details should be checked through public disclosures.

What is the outlook for Inji Display?

While there are positive factors such as the increase in the major shareholder’s stake and improved earnings, the outlook may vary depending on changes in the external environment and the implementation of management strategies.