1. What Happened? Idea Bridge Asset Management Sells 1.98% Stake in Power Net

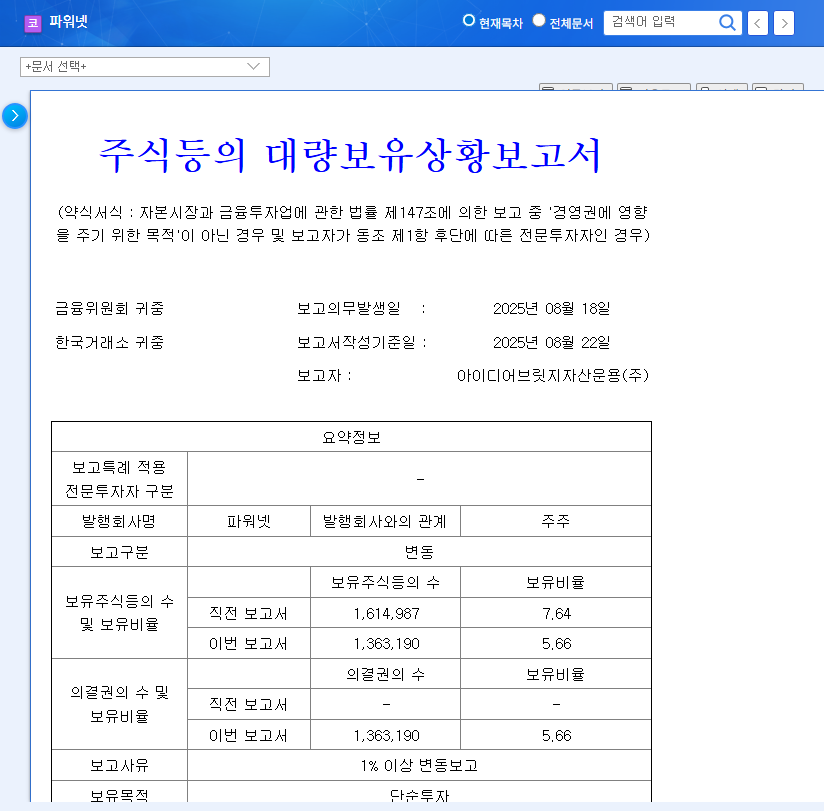

Idea Bridge Asset Management sold 708,179 shares of Power Net (including convertible bond call options) between August 18th and 22nd. This reduced their stake in Power Net from 7.64% to 5.66%.

2. Why the Divestment? Analyzing the Background

The exact reasons for the sale haven’t been disclosed, but common reasons include:

- Short-term profit-taking

- Portfolio adjustments

- Cashing out after exercising convertible bond call options

It’s likely that the sale is related to the asset manager’s fund operation strategy rather than Power Net’s new business performance.

3. Power Net’s Current Situation: Fundamental Analysis

Power Net is expanding beyond its existing component business into finished product manufacturing and the B2C market. They are also expanding their LFP battery pack business. While sales are increasing, profitability has slowed down. Investments in future technologies like next-generation power semiconductors and AI server products are positive. However, exchange rate volatility and the global economic slowdown pose risks.

4. What’s Next? Stock Forecast and Investment Strategy

The divestment by Idea Bridge Asset Management could negatively impact Power Net’s stock price in the short term. However, Power Net’s long-term growth potential depends on the success of its new businesses. Investors should consider the following:

- Understanding the reasons behind the divestment

- Monitoring the performance of new businesses

- Observing profitability improvement trends

- Checking information related to convertible bonds

- Keeping an eye on macroeconomic and industry trends

Frequently Asked Questions

Is Idea Bridge Asset Management’s sale a negative signal for Power Net’s future?

It could put downward pressure on the stock price in the short term, but the long-term growth potential hinges on the success of its new businesses.

Should I invest in Power Net?

Investment decisions should be based on individual judgment, but consider the performance of new businesses, profitability improvement trends, and macroeconomic conditions.

What is Power Net’s main business?

Power Net specializes in power conversion devices and is recently expanding into finished product manufacturing and the LFP battery pack business.