On November 17, 2025, all eyes in the tech and investment communities will be on South Korean IT giant Kakao. The company is set to host a pivotal Kakao Corp. IR event, a corporate presentation that promises to be far more than a standard earnings call. This event is a critical moment for Kakao to articulate its vision for navigating a challenging global economy and a rapidly evolving AI landscape. Investors are keenly awaiting detailed updates on the company’s Kakao AI strategy, H1 2025 performance, and future commitments to Kakao shareholder returns.

This comprehensive analysis offers an expert look into what’s at stake. We’ll dissect the company’s fundamentals, explore the potential market impact of the presentation, and provide a clear investment outlook. Will Kakao’s strategy inspire confidence? Let’s delve into the data and future projections.

A Deep Dive into Kakao’s H1 2025 Performance

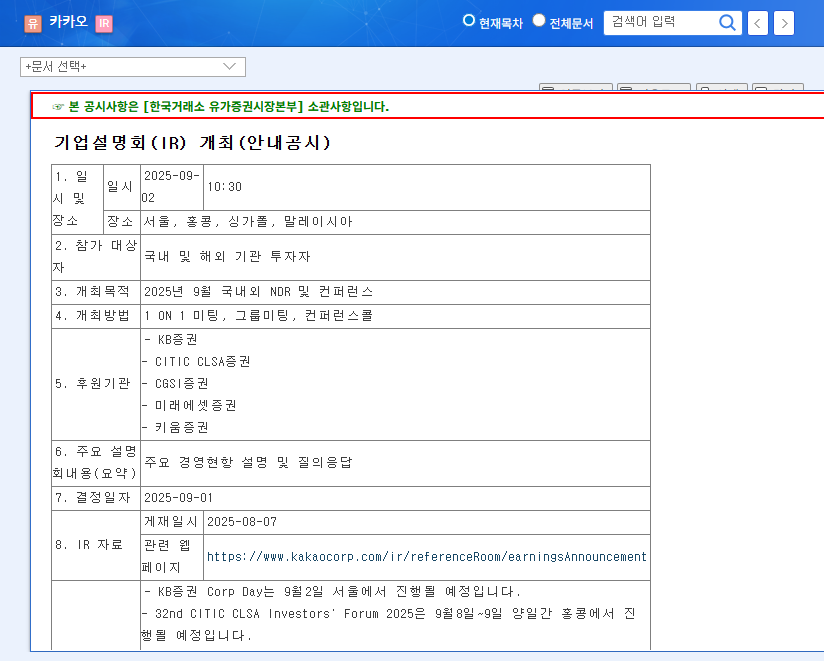

To understand the future, we must first analyze the present. The Kakao H1 2025 performance report reveals a mixed but fascinating picture of a company in transition. While headline revenue saw a slight dip, the underlying segments tell a more nuanced story. This performance data, as detailed in the company’s public filings (Official Disclosure), highlights both solid foundations and areas requiring strategic focus.

The Engine Room: Platform Division Growth

The platform division remains Kakao’s bedrock, showing impressive resilience with a 52.6% revenue increase. This growth is powered by key services:

- •Talk Biz: The advertising and commerce arm built on KakaoTalk continues its steady climb, fueled by a growing advertiser base and higher transaction values in its gifting service.

- •Kakao Pay: The fintech platform is successfully expanding beyond simple payments into loan comparisons, insurance, and investment products, solidifying its market position.

- •Kakao Mobility: By broadening its MaaS (Mobility as a Service) offerings, the division is creating more touchpoints with users and diversifying its revenue streams.

The Creative Front: Content Division Challenges

In contrast, the content division faced headwinds, leading to a decline in profitability that impacted the company’s overall operating profit. This was influenced by intensified competition, macroeconomic pressures on consumer spending, and the high costs associated with global expansion for its gaming, music, and story IP businesses. Addressing the performance of this division will be a key point of interest during the Kakao Corp. IR event.

The Future Blueprint: Kakao’s AI Strategy & Shareholder Returns

Beyond historical performance, this IR event will be defined by its forward-looking statements. Two areas are paramount: the company’s ambitious artificial intelligence plans and its commitment to delivering shareholder value.

Doubling Down on AI: “Kanana” and OpenAI Synergy

The Kakao AI strategy is the company’s primary bet on future growth. Significant investments are being channeled into R&D, infrastructure, and strategic partnerships. A key development is the collaboration with OpenAI to develop advanced AI agents. This is complemented by the launch of Kakao’s own data center, which became operational in early 2024. This infrastructure is crucial for the upcoming launch of its new AI service platform, codenamed "Kanana". Investors will be listening for a concrete timeline and monetization strategy for these AI initiatives, as the tech industry races to capitalize on generative AI, a trend reshaping global markets.

Kakao’s challenge isn’t just to develop innovative AI, but to seamlessly integrate it into its vast ecosystem of services in a way that creates tangible value for its millions of users and, ultimately, its shareholders.

Rewarding Loyalty: A Closer Look at Shareholder Returns

Amidst heavy investment in future tech, maintaining investor confidence is crucial. Kakao’s shareholder return policy is a key tool in this effort. The company has pledged to use 20-35% of its free cash flow for returns between 2024 and 2026, including cash dividends and consistent treasury stock cancellations. Any announcement of an enhanced Kakao shareholder returns policy during the IR event could significantly bolster investor sentiment.

Investment Thesis: A Neutral Stance with Cautious Optimism

Our overall investment opinion on Kakao remains "Neutral" heading into the IR event. The company’s stable platform business and immense potential in AI represent significant upside. However, these are balanced by the profitability challenges in the content division, the high costs of AI investment, and persistent regulatory risks within the tech sector. This Kakao stock analysis suggests that long-term success hinges on execution.

Investors should watch for clarity on three fronts: a clear path to profitability for AI services, a turnaround strategy for the content business, and management’s plan for navigating potential regulatory hurdles. For more on the competitive landscape, you can read our full analysis of the Korean tech market.

Frequently Asked Questions (FAQ)

What is the focus of the Kakao Corp. IR event?

The event will focus on Kakao’s H1 2025 performance, its strategic direction, detailed plans for its AI business including the “Kanana” platform, and its updated shareholder return policies.

What were the key takeaways from Kakao’s H1 2025 performance?

The platform division showed strong revenue growth of 52.6%, while the content division faced profitability challenges. Overall operating profit decreased due to content performance and increased investments in AI infrastructure.

What is Kakao’s vision for its AI business?

Kakao aims to become a leader in AI by developing advanced AI agents with partners like OpenAI, leveraging its new proprietary data center, and launching new AI-driven services to be integrated across its ecosystem.

What are the primary risks for Kakao investors?

Key risks include the high cost and uncertain timeline for AI monetization, declining profitability in the competitive content market, potential government regulations on platform businesses, and broader macroeconomic pressures.