In a significant development for the electric vehicle (EV) supply chain, FINO INC. has announced a major NCM precursor supply contract with L&F, a premier South Korean cathode material manufacturer. This ₩9.9 billion deal marks a pivotal moment for FINO’s burgeoning new energy business, solidifying its position in a fiercely competitive market. But beyond the headline figure, what does this agreement truly signify for FINO’s long-term strategy, financial stability, and investors? This comprehensive analysis explores the contract’s nuances, the underlying challenges, and the potential trajectory for FINO INC. moving forward.

Unpacking the FINO INC. & L&F Contract Details

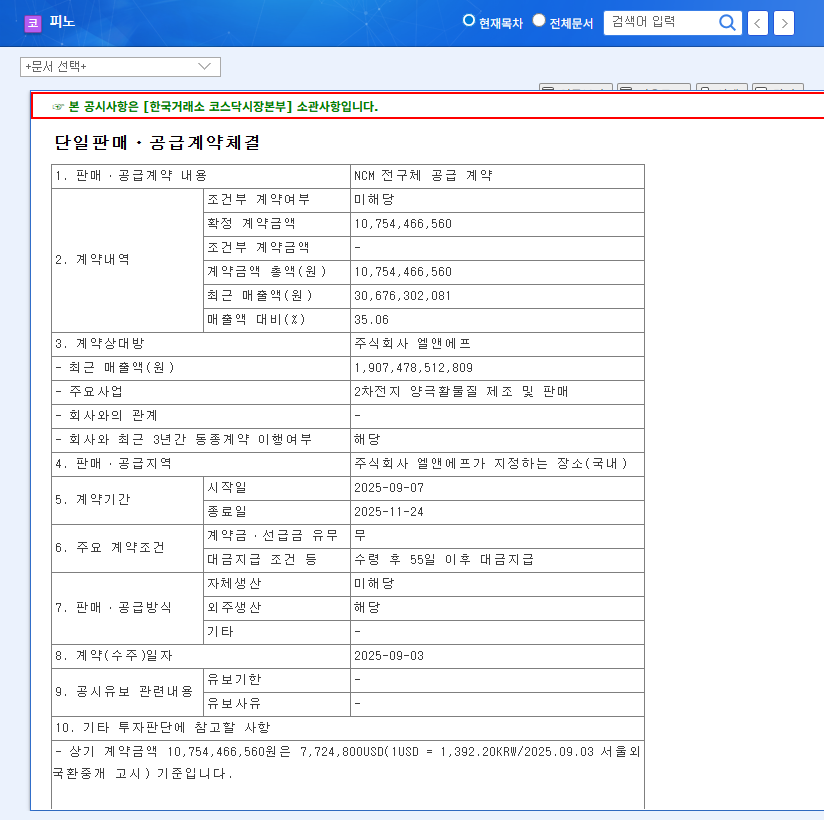

On November 6, 2025, FINO INC. formalized an agreement to supply NCM precursors to L&F. This deal, while short-term, is substantial, representing 32.33% of FINO’s recent revenue and underscoring the company’s growing production capabilities. The core details of the L&F contract provide critical context for its strategic importance. (Source: Official DART Disclosure)

- •Contract Value: 9.9 billion KRW (approx. $7.5 million USD)

- •Product Supplied: High-purity NCM (Nickel-Cobalt-Manganese) Precursors

- •Contract Period: October 25, 2025, to January 2, 2026

- •Counterparty: L&F, a leading domestic producer of cathode active materials.

Securing a contract with an industry heavyweight like L&F is a powerful validation of FINO INC.’s product quality and a critical step in diversifying its customer base beyond a single primary partner. This move signals to the market that FINO is a credible supplier in the highly demanding cathode material ecosystem.

Strategic Pivot: Growth Drivers & Hidden Risks

This deal is a cornerstone of FINO’s strategic shift toward its new energy business. The company’s legacy segments in telecommunications equipment and gaming have faced declining revenues, making the success of its energy materials division paramount. However, this aggressive expansion comes with both powerful tailwinds and significant financial headwinds.

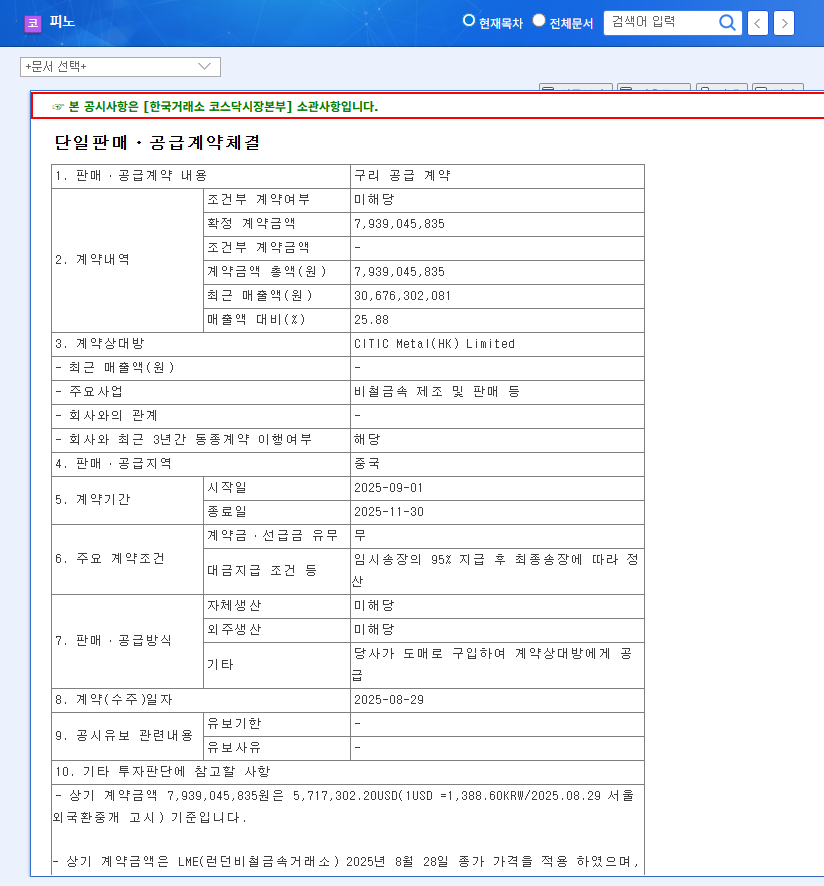

Growth Driver: Synergy with Global Leader CNGR

A key factor in FINO’s potential is its relationship with its largest shareholder, an affiliate of the global NCM precursor giant, CNGR. This partnership is not merely financial; it provides FINO with invaluable access to a global sales network, cutting-edge production technology, and a stable raw material supply chain. The L&F contract is an early sign that this synergy is beginning to bear fruit, enabling FINO to compete for and win deals with major domestic players.

While the revenue from this short-term contract is significant, its true value lies in establishing FINO INC. as a trusted supplier within the premier tier of the battery materials industry.

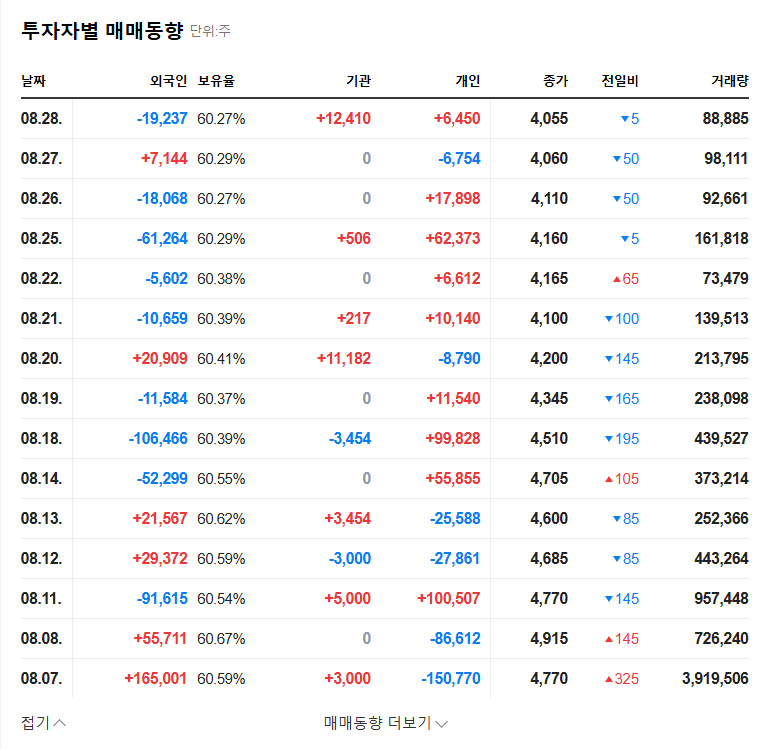

Challenge: Navigating Profitability and Financial Health

Despite explosive revenue growth in the new energy segment, FINO’s profitability remains a concern. The company is incurring substantial costs related to new business investments, R&D, and administrative expenses. Recent capital increases and convertible bond issuances have raised the debt ratio, placing its financial health under scrutiny. While the recent credit rating upgrade from B0 to BB0 is a positive sign of external confidence, the company must demonstrate a clear path to profitability. The cash injection from the L&F contract will aid short-term liquidity but doesn’t solve the underlying structural cost challenges. For more details on market dynamics, investors can review data on the global push for electrification from authoritative sources.

Investor Action Plan & Future Outlook

For investors, FINO INC. presents a classic high-growth, high-risk profile. The contract with L&F is a strong bullish signal for its operational capabilities, but the financial metrics require careful and continuous monitoring. A smart investment strategy should look beyond short-term stock price movements driven by news announcements.

Key areas to watch include:

- •Conversion to Long-Term Agreements: Can FINO convert this trial contract into a recurring, long-term supply agreement with L&F and other cathode makers?

- •Profit Margin Improvement: Watch for signs of improving operational efficiency, cost controls, and a clear strategy to manage the volatility of raw material prices like nickel and cobalt.

- •Financial Deleveraging: Monitor the company’s efforts to reduce its debt ratio and strengthen its balance sheet as the new energy business scales.

In conclusion, the L&F contract is a powerful catalyst for FINO INC., but it’s a milestone, not the finish line. The company’s ability to translate this operational success into sustainable profitability and financial stability will determine its long-term value. Investors should maintain a balanced perspective, acknowledging the immense growth potential while staying vigilant about the associated risks. To gain further context, it is helpful to start by understanding the EV battery supply chain in more detail.