MKElectron recently announced the exercise of its ‘convertible bond conversion rights,’ a financial event that can send ripples through a company’s stock value. For investors, understanding the nuances of a convertible bond conversion is critical. Is it a sign of strength or a red flag for potential shareholder dilution? This comprehensive analysis will demystify MKElectron’s recent move, explore the direct impact on its stock price, and provide a clear action plan for making informed investment decisions.

First, What is a Convertible Bond Conversion?

Before diving into the MKElectron case, it’s essential to grasp the fundamentals. A convertible bond (CB) is a hybrid security that acts like a regular bond, paying interest to the holder. However, it comes with a unique feature: the option to convert the bond into a predetermined number of the issuing company’s common shares. The act of turning that bond into stock is the convertible bond conversion itself. Companies issue CBs as a flexible way to raise capital, often at a lower interest rate than traditional bonds because the conversion option offers investors potential upside.

MKElectron’s Conversion: The Key Details

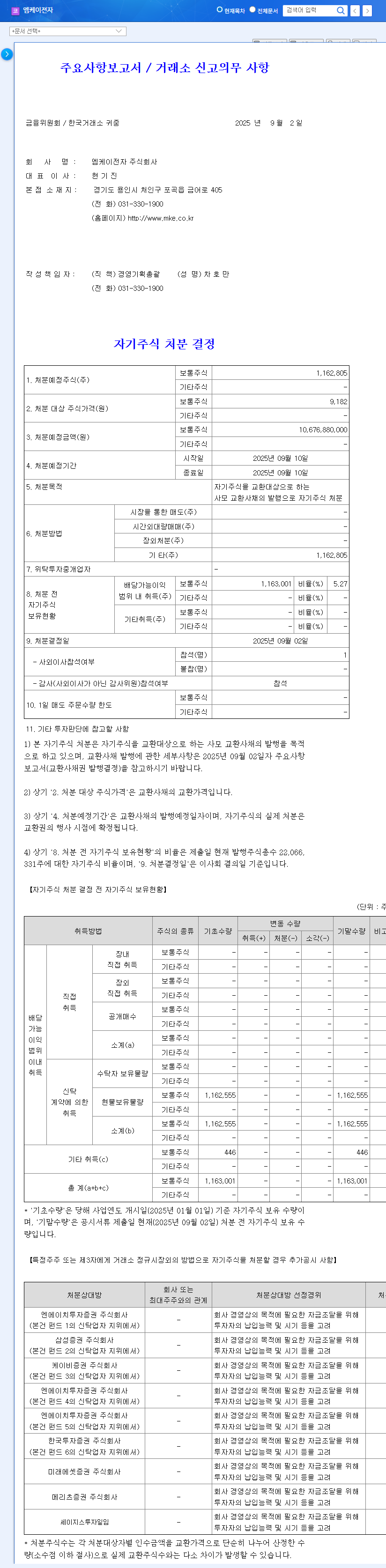

On October 15, 2025, MKElectron (Market Cap: KRW 239.6 billion) filed a disclosure announcing a significant CB conversion event. Understanding the numbers is the first step in a proper investment analysis. You can view the Official Disclosure for complete details. Here are the critical facts:

- •Number of New Shares: 393,455

- •Proportion of Market Cap: 1.78%

- •Conversion Price: KRW 7,988 per share

- •Stock Price at Announcement: KRW 10,232 per share

- •Expected Listing Date: October 31, 2025

The key takeaway here is the spread between the conversion price (KRW 7,988) and the market price (KRW 10,232). This creates a strong incentive for bondholders to convert and potentially sell for an immediate profit, a crucial factor in predicting short-term stock behavior.

Analyzing the Impact on MKElectron Stock

A CB conversion is a double-edged sword, presenting both potential risks and benefits for the company and its shareholders.

The Downside: Shareholder Dilution and Selling Pressure

The most immediate concern is shareholder dilution. With 393,455 new shares entering the market, the ownership percentage of existing shareholders decreases. While the 1.78% increase is relatively small, it can still impact earnings per share (EPS). Furthermore, the profitable spread for bondholders can lead to significant selling pressure as new shares become available, potentially driving the stock price down in the short term. This is a classic arbitrage scenario that investors should anticipate around the listing date.

The Upside: A Stronger Financial Foundation

On the other hand, the conversion has significant long-term benefits. By converting debt into equity, MKElectron effectively cleans up its balance sheet. This has two positive effects: it reduces the company’s debt burden and eliminates future interest payments associated with those bonds. This improved financial structure can make the company more attractive to long-term investors and credit rating agencies. It also signals that the capital raised via the bonds was likely put to good use, fueling growth that made the conversion attractive in the first place.

Investor Action Plan & Risk Assessment

Given the limited public information, a cautious and analytical approach is necessary. Before making any decisions regarding MKElectron stock, investors must conduct thorough due diligence.

Your Due Diligence Checklist

- •Fundamental Analysis: Go beyond the announcement. Scrutinize MKElectron’s recent financial statements, business reports, and strategic plans to evaluate its intrinsic value. You can learn more about analyzing company financial statements on our blog.

- •Market Sentiment: Seek out brokerage reports and professional investment analysis to understand how market experts view the company’s prospects post-conversion.

- •Monitor Price Action: Keep a close eye on the stock’s trading volume and price fluctuations around the October 31, 2025, listing date to see how the market absorbs the new shares.

- •Macro-Economic Factors: Consider the broader economic environment. Interest rates and industry trends can significantly influence a company’s performance, regardless of its capital structure. For a deeper dive into financial terminology, visit authoritative sources like Investopedia.

Frequently Asked Questions (FAQ)

What does MKElectron’s convertible bond conversion mean for investors?

It can lead to short-term stock price volatility and minor shareholder dilution. However, it also positively impacts the company by reducing debt and improving its financial health, which requires a comprehensive analysis from investors.

What are the direct impacts of this CB conversion on the stock price?

The primary impact is potential downward pressure on the stock price. This is driven by the issuance of new shares and the likelihood that converting bondholders will sell their new shares to realize a profit, given the gap between the conversion price (KRW 7,988) and the market price (KRW 10,232).

What are the positive aspects of this event for MKElectron?

When bonds are converted to stock, the company’s debt-to-equity ratio improves and interest expense decreases. This strengthens the balance sheet and enhances financial stability, which can be a very positive long-term signal.