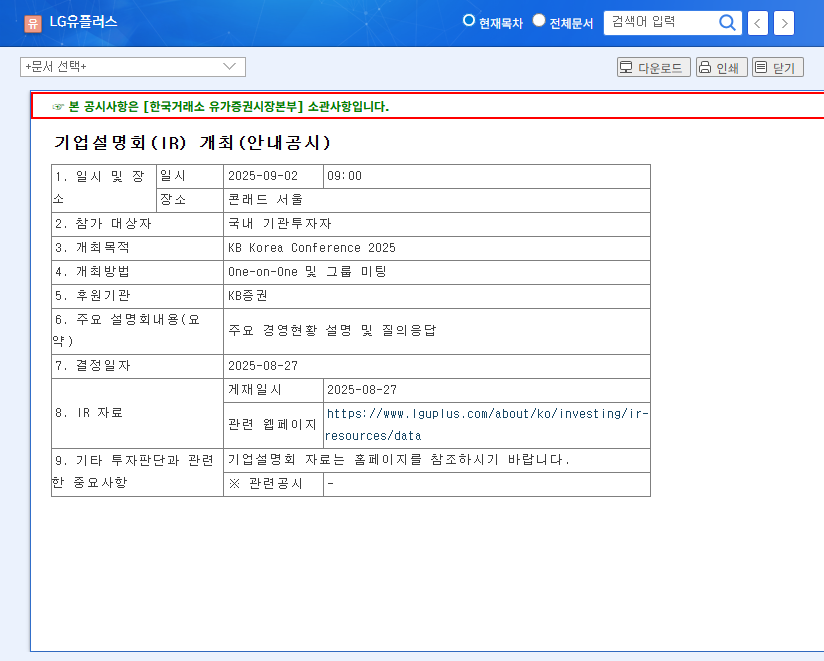

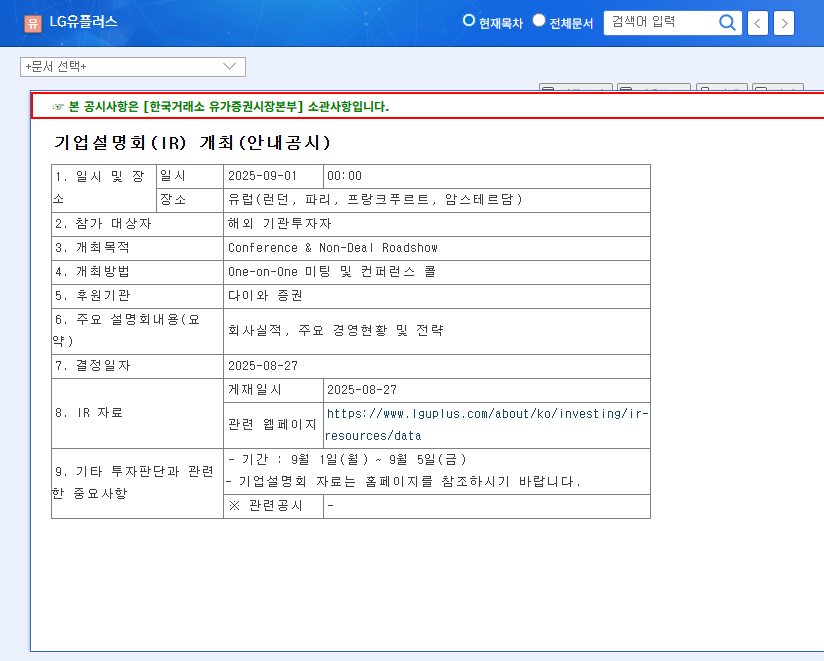

The upcoming LG Uplus Corp Investor Relations (IR) event, a Non-Deal Roadshow scheduled for November 17, 2025, represents a pivotal moment for the company and its stakeholders. In a rapidly evolving telecommunications landscape, this event is far more than a routine update; it’s a strategic platform for LG Uplus (LG유플러스) to articulate its vision, showcase its new growth engines, and address the pressing concerns of the investment community. This comprehensive analysis will serve as a guide for investors looking to understand the opportunities and challenges ahead, making it an essential read before the event. The official announcement for this roadshow can be found in the company’s public filings (Official Disclosure).

Macroeconomic Headwinds and Tailwinds

LG Uplus operates within a complex global economic environment. The second half of 2025 presents a mixed bag of challenges and opportunities. On one hand, rising won/dollar and won/euro exchange rates could inflate import costs for network equipment, while increasing raw material and freight prices add further cost pressure. On the other hand, a potential downward trend in U.S. benchmark interest rates, as discussed by sources like leading financial analysts, could provide significant relief. Lower rates would reduce the interest burden on corporate debt and make future investments more financially attractive. How management plans to navigate this volatility will be a key focus of the IR event.

Analyzing LG Uplus’s Current Financial Health

Based on its 2025 semi-annual report, LG Uplus has demonstrated robust financial discipline and promising growth. The company is not only strengthening its core business but also laying a solid foundation for future expansion through prudent financial management. This financial stability is crucial for funding its ambitious growth projects.

Key Performance Indicators (H1 2025)

- •Strong Revenue Growth: Service revenue saw a healthy 2.5% year-on-year increase in Q2, primarily driven by a 4.3% rise in mobile service revenue. This indicates a strong core business performance.

- •Improved Profitability: Operating profit surged by 17.7% and net profit by an impressive 28.6% year-on-year for Q2 2025. This points to effective cost controls and operational efficiency.

- •Strengthened Balance Sheet: A reduction in total liabilities outpaced the decrease in total assets, leading to an increase in total equity and an improved debt-to-equity ratio. This enhances financial stability and reduces risk.

- •Commitment to Shareholders: The company is maintaining a dividend payout ratio of over 40% and has announced plans for share buybacks, signaling a strong commitment to enhancing shareholder value.

Securing New Engines for Future Growth

A core topic of the LG Uplus Corp Investor Relations event will be the strategic pivot towards new, high-growth business areas. While the 5G-based mobile and smart home sectors remain foundational cash cows, the company is aggressively investing in sectors poised for exponential growth to secure its long-term relevance and profitability.

AI and IDC (Internet Data Centers)

The global demand for data processing and AI capabilities is exploding. LG Uplus is positioning itself to capture this demand by expanding its IDC footprint. These data centers are the backbone of the digital economy, and by integrating advanced AI services, the company can offer high-value solutions to enterprise clients, moving beyond simple connectivity. Learn more about how 5G fuels this growth in our deep dive into the 5G market.

Electric Vehicle (EV) Charging Infrastructure

The transition to electric mobility is another megatrend LG Uplus is tapping into. By building out a network of EV charging stations, the company leverages its expertise in network management and infrastructure to enter a burgeoning market. This diversification not only creates a new revenue stream but also aligns the company with global sustainability goals.

“LG Uplus’s strategic investments in AI, data centers, and EV charging are not just about diversification; they represent a fundamental shift from a traditional telco to a future-proofed digital platform company. The success of these ventures will define their next decade of growth.”

Key Questions Investors Must Ask

While the outlook is promising, savvy investors will need to probe deeper during the Q&A session. The clarity of the company’s responses will be crucial for building confidence. Here are the critical areas to focus on:

- •New Business Monetization: What are the specific revenue models for the AI/IDC and EV charging businesses? What is the projected timeline to profitability and the expected return on investment?

- •5G ARPU Strategy: With 5G subscriber growth maturing, what is the concrete plan to defend and increase Average Revenue Per User (ARPU) amidst intense competition?

- •Capital Expenditure & Funding: How will the significant investments in new infrastructure be funded? What measures are in place to ensure these expenditures do not compromise the company’s strong financial standing?

- •Competitive Differentiation: How will LG Uplus differentiate its AI and B2B services from formidable competitors like SK Telecom and KT? What is its unique value proposition?

Conclusion: A Turning Point for LG Uplus Stock

The 2025 Non-Deal Roadshow is a crucial inflection point. LG Uplus has a compelling story to tell, backed by solid financials and a forward-looking strategy. However, the company must effectively communicate how it will execute this vision while navigating a challenging economic and competitive environment. The details provided during this LG Uplus Corp Investor Relations event will heavily influence market sentiment and could set the trajectory for the company’s valuation for years to come. Investors should listen closely, as the answers provided will be a clear indicator of the company’s potential to deliver long-term value.