1. What’s Happening with Inji Controls’ Board?

Due to the passing of a director, Inji Controls’ board no longer meets the quorum requirements. The company has applied to the court for the appointment of a temporary director and plans to appoint a new director through a temporary shareholders’ meeting. Inji Controls stated that this matter will not affect management changes or major business activities.

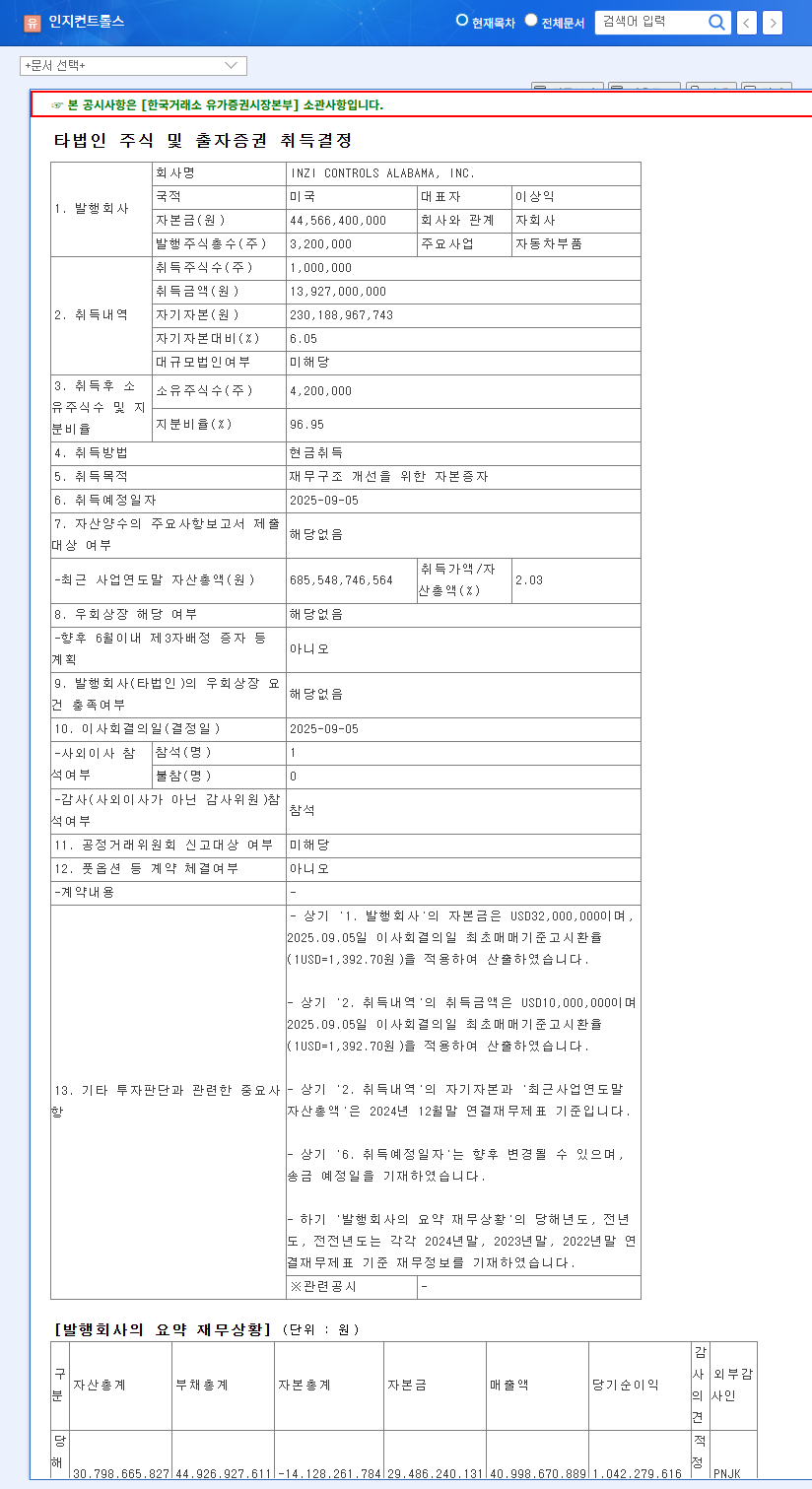

2. Why Are Board Changes Important?

The board of directors is responsible for making crucial decisions for a company. Changes to the board’s composition can impact management strategies, investment plans, and financial structure. Sudden changes like this can amplify investor anxiety and cause stock price volatility.

3. Impact on Stock Price and Investment Strategy

In the short term, concerns about the board vacancy could increase stock price volatility. However, the company’s proactive response and statement about limited impact on business activities can stabilize investor sentiment. In the long term, the new director’s expertise and synergy with management strategies will likely influence the stock price. While the growth potential of the eco-friendly vehicle parts business is promising, high debt ratios and exchange rate volatility remain ongoing risk factors.

4. Investor Action Plan

- Short-term investors: It is advisable to remain cautious and wait-and-see, noting the potential for increased stock price volatility.

- Long-term investors: Closely monitor the board normalization process, the new director’s capabilities, and the performance of the eco-friendly vehicle parts business.

Frequently Asked Questions (FAQ)

How will the board changes affect Inji Controls’ management?

While there are short-term concerns about management stability, the company has stated there will be no impact on major business activities. The new director’s expertise and management strategy will be key variables in the long term.

What should investors pay attention to?

Investors should monitor the appointment of the temporary and new director, the company’s financial health management, the performance of its eco-friendly vehicle parts business, and its strategies for dealing with exchange rate fluctuations.

Should I invest in Inji Controls stock now?

We currently maintain a ‘Hold’ rating and recommend observing the board normalization process and future business performance. Investment decisions should be made carefully based on individual judgment.