What Happened? Jasco Holdings’ Convertible Bond Exercise

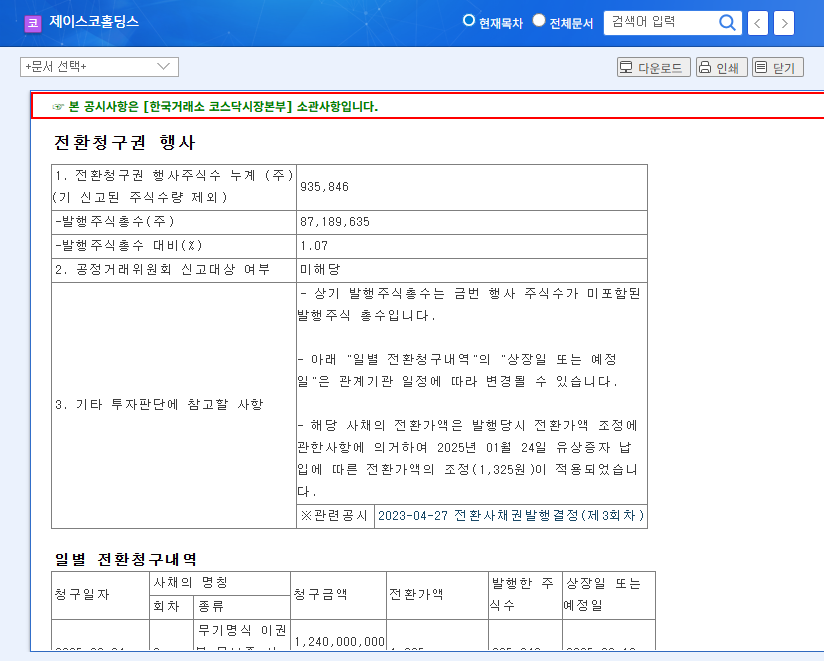

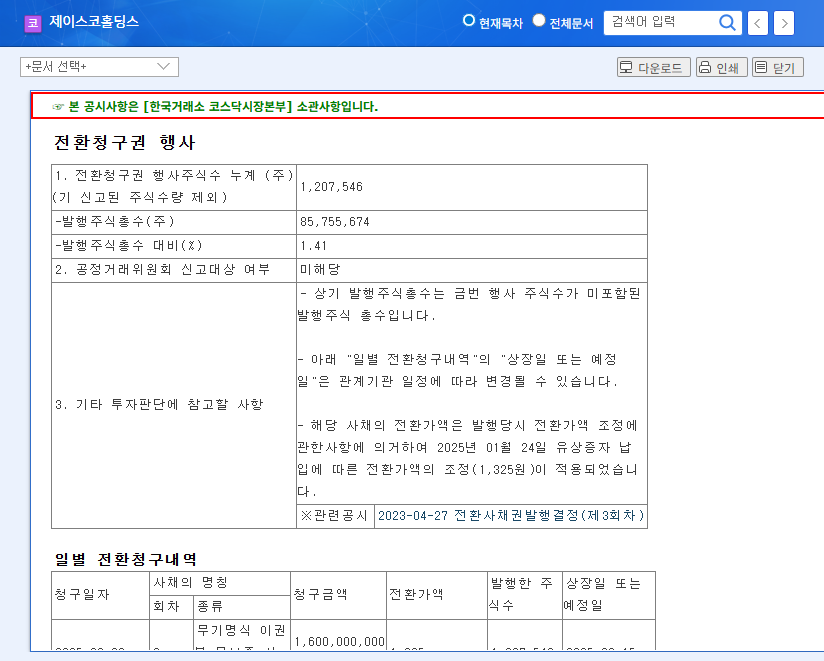

Jasco Holdings announced the exercise of its 3rd convertible bonds, amounting to 935,846 shares. The conversion price is ₩1,325, and the listing date is September 18, 2025. This represents approximately 1.07% of the current market capitalization (₩137 billion).

Why Does It Matter? Implications of the Exercise

The exercise of convertible bonds leads to the dilution of existing shareholders’ equity. In the short term, this can put downward pressure on the stock price. However, if the purpose of issuing convertible bonds was to secure operating funds, converting debt into equity can improve the financial structure. The listing of new shares also increases market liquidity.

What Should I Do? Investment Strategy

Currently, Jasco Holdings is facing challenges with continuous operating losses and low ROE. Despite the recovery in sales, improving profitability remains a task. The past amendment to the business report is positive in terms of enhancing corporate transparency, but it leaves questions about past relationships with shareholders. Therefore, we maintain a Neutral outlook from an investment perspective.

- Short-term perspective: Be mindful of potential downward pressure on the stock price due to dilution effects and increased share supply.

- Mid- to long-term perspective: Closely monitor improvements in profitability and financial structure stabilization.

- Risk factors: Frequent issuance of convertible bonds may indicate financial difficulties.

Investor Action Plan

Before making investment decisions, thoroughly review the background of the convertible bond exercise, the purpose of the funds, future business strategies, and past stock price volatility. Be prepared for high volatility.

Frequently Asked Questions

How does the exercise of convertible bonds affect the stock price?

In the short term, it can put downward pressure on the price due to the increased number of shares. However, in the long run, it can lead to improvements in the financial structure.

What is the financial status of Jasco Holdings?

Currently, the company is experiencing continuous operating and net losses and needs to improve its financial status.

What are the key considerations for investment?

Careful investment decisions are needed, considering the history of frequent convertible bond issuances and past stock price volatility.