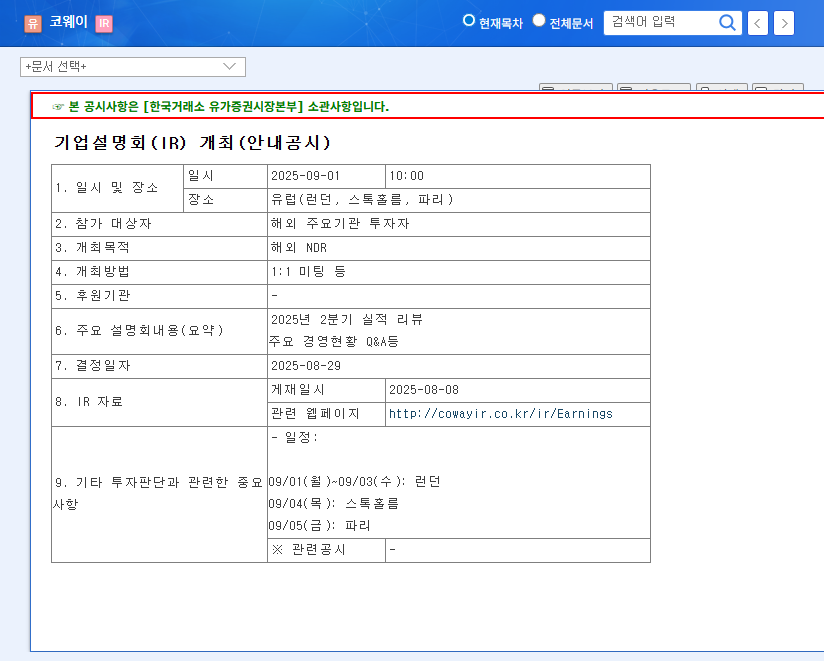

The upcoming COWAY Q3 2025 earnings announcement and subsequent investor relations (IR) call represent a pivotal moment for shareholders and market watchers. Scheduled for November 11, 2025, at 10 AM KST, this event offers more than just a financial snapshot; it provides a crucial window into the strategic direction of COWAY Co., Ltd., a leader in the environmental home appliance market. Investors are keen to understand the company’s performance amidst a complex global economic landscape. The official details of the event can be found in the Official Disclosure. This analysis will delve into COWAY’s fundamental strengths, pressing risks, and what to expect from the highly anticipated COWAY investor relations conference.

Robust Fundamentals: The Pillars of COWAY’s Success

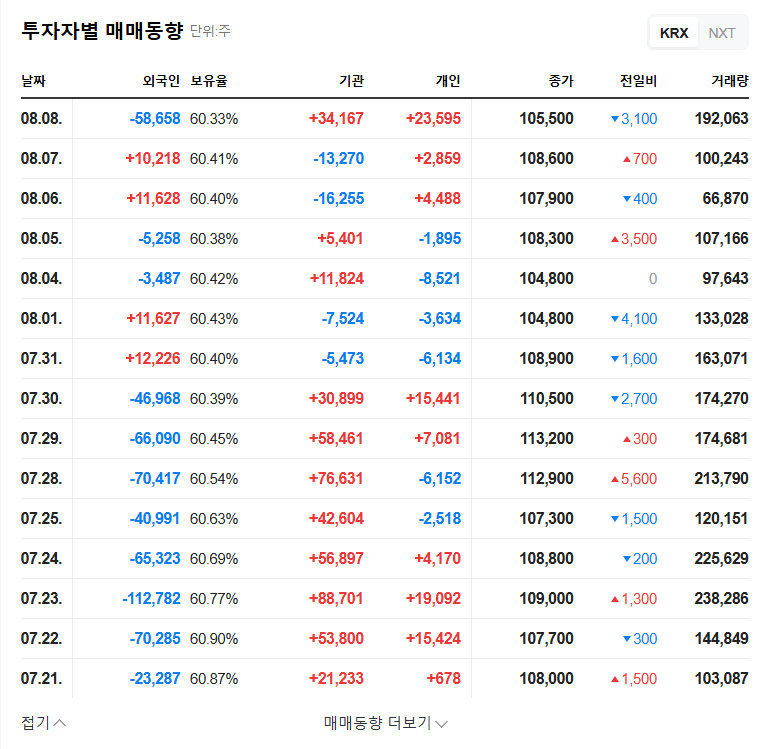

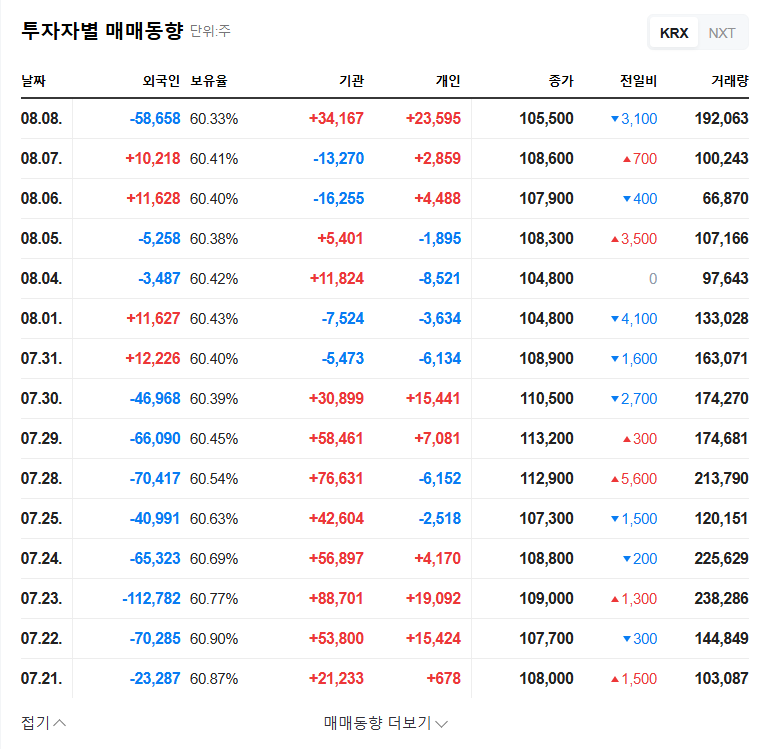

COWAY’s consistent performance is built on a foundation of several key strategic advantages. While the H1 2025 results were strong—showing a 17.0% year-on-year revenue increase to KRW 2.4338 trillion—understanding the underlying drivers is essential for any long-term COWAY stock analysis.

The Power of a Stable Rental Business Model

The cornerstone of COWAY’s financial stability is its massive rental and membership base, boasting over 7.36 million accounts. This subscription-like model, which accounts for over 90% of revenue, generates predictable, recurring cash flows. Unlike companies reliant on one-time sales, COWAY’s rental system creates a loyal customer ecosystem and a formidable barrier to entry for competitors, ensuring financial resilience even during economic downturns.

Strategic Diversification into New Growth Arenas

To secure future growth, COWAY has successfully expanded beyond its core offerings of water and air purifiers. The strategic push into new rental lineups, such as mattresses and massage chairs, has been well-received. This diversification not only opens up new revenue streams but also reduces the company’s dependence on a single market segment, positioning it to capture a larger share of the consumer’s home wellness budget.

Expanding Global Footprint

Consistent growth in key overseas markets, particularly Malaysia and the United States, is a critical component of COWAY’s long-term strategy. This international expansion mitigates risks associated with the highly competitive domestic South Korean market and strengthens overall business stability. Investors will be closely watching for updates on international account growth and profitability during the COWAY Q3 2025 earnings call.

Navigating Headwinds: Key Risks on the Horizon

Despite its strengths, COWAY is not immune to challenges. A thorough analysis requires acknowledging the potential risks that could impact future profitability and stock performance.

For investors, the key is not just to see the impressive growth but to understand how management plans to navigate the increasing macroeconomic and competitive pressures.

- •Macroeconomic Volatility: With a significant portion of its sales overseas, COWAY is exposed to exchange rate fluctuations. The rising KRW against the USD and EUR could negatively impact reported earnings. Furthermore, the global trend of rising interest rates, as tracked by sources like global central banks, will increase the company’s funding costs, especially with a debt-to-equity ratio of 94.3% as of H1 2025.

- •Intensified Competition: The environmental home appliance market is fiercely competitive. Both domestic and international players are vying for market share, necessitating continuous investment in R&D and marketing, which can pressure profit margins.

- •Non-Core Investment Scrutiny: The company’s investment in the MBX virtual asset (token) has been noted as a potential risk. During the COWAY investor relations Q&A, management will likely face tough questions on this topic. A lack of clear, convincing answers could heighten investor anxiety about the company’s capital allocation strategy.

Investor Action Plan for the IR Event

To make an informed decision, investors should actively engage with the information presented during the IR event. Focus on the following key areas:

- •Analyze the Presentation: Look beyond the headline numbers. Scrutinize the detailed performance of overseas operations, the growth trajectory of new business lines, and the specific strategies outlined for managing debt and currency risks.

- •Monitor the Q&A Session: The Q&A is often the most revealing part of an IR call. Pay close attention to the questions asked by analysts and the depth and confidence of management’s responses. This is where their grasp of the challenges will be tested.

- •Evaluate Future Guidance: Any forward-looking statements or changes in guidance will be critical. Management’s tone—whether optimistic, cautious, or defensive—can provide valuable clues about the company’s internal outlook for Q4 and beyond.

In conclusion, while COWAY’s strong market position and business model provide a solid foundation, the upcoming COWAY Q3 2025 earnings call will be a crucial test of management’s ability to navigate a challenging environment. A transparent and forward-thinking presentation could reinforce investor confidence, whereas ambiguity on key risks could lead to market disappointment.